When The Curve Speaks: What The (UK) Bond Market Is Telling Us

Authored by Ben Lord via BondVigilantes.com,

In 2020, the bond market awoke from a decade-long slumber and moved long-dated bonds higher, in what we call a curve steepening, even whilst short-end rates were (possibly) at paradigm lows.

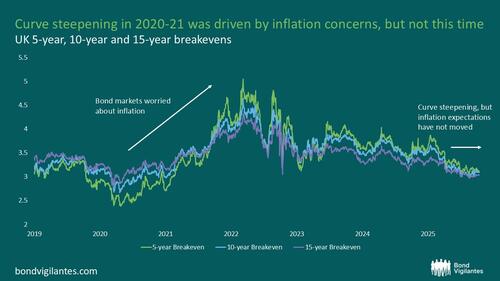

It was easy to look at this steepening move as being driven by the quite justified cutting of interest rates in response to the global pandemic and the seizure in the global economy that took place, and therefore to stop there and ignore any deeper or more subtle message. Looking back at this move, there was an important increase in inflation breakevens, which are simply bond market inflation expectations. You might say that the bond market was trying to tell central bankers that if you combine super-accommodative monetary policy rates with enormous fiscal stimulus that was (again, justifiably given the circumstances) occurring, then inflation will return.

Further, looking back at the moves in bond market inflation expectations, there was a difference in the move in expectations: 5y breakevens rose by a very significant 2.5% (so inflation was expected to be 2.5% higher each year on average for the next 5 years) between early 2020 and early 2022. 10y breakevens rose significantly too, but slightly less at 2% over the same period. These are, in bond market terms, significant repricings to say the least. The bond market was putting up its hand and saying that it was pricing large and long-term increases in inflation. Central bankers believed that this bond market move was ‘transitory’. 30yr breakevens were also up 1.5%, so the bond market clearly disagreed. The rest, as they say, is history. But the damage caused to inflation forecasting credibility may remain for a long time to come.

Source: Bloomberg (13 October 2025).

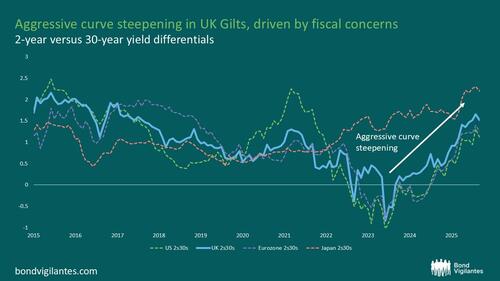

In the last 18 months or so there has been a renewed steepening in the yield curve, back to levels not that far from the bull steepening move of 2020 to 2021 in most western developed markets.

Importantly, in the UK specifically, we are at levels of steepness that are meaningfully greater than they were in 2020 and 2021.

We haven’t often seen such steepness when the starting point for short end rates is so high. Historically, steep curves tend to emerge when policy rates are low and markets are pricing in inflation. This time policy rates are restrictive, yet the long end is demanding more yield. The bond market is telling us something.

The bond market is, for some reason(s), requiring more yield for lending longer – in curve steepness terms – in the UK than many peers (US, Germany), although less than others (Japan).

The bond market is not by any means always right: predictions of recession since 2022 have clearly been misplaced (so far), for example. The second thing that needs to be said is that there are almost certainly many factors at play behind this move. But to me—and the one I want to focus on today—is the difference this time on the driver of the steepening, here in the UK and elsewhere. The recent significant steepening has not been driven by an increase in inflation expectations. At all.

What this means is that, for now at least, the bond market is not increasing term premia for lending to longer-dated government bonds because it is worried about rising inflation in the future.

Source: Bloomberg (30 September 2025).

Therefore, what we need to ask is: why the steepening and why the increase in term premia?

As I’ve said, the truth is that there are probably multiple factors at work.

However, in my opinion there is one factor that dominates all others: fiscal policy.

Indeed, it is a surprise to me that we all speak to our clients and to our colleagues every day at the moment about fiscal risks and issuance expectations in government bonds. We shouldn’t be worrying now when nominal GDP (real GDP and inflation) are running at solid levels that mean that the affordability of government borrowings are manageable. The time to worry about these risks is in a slowdown or a recession: tax receipts fall and expenditures rise, so government borrowing has to rise to plug the gap.

The Chancellor has been resolute in saying she will stick to the fiscal rules the UK government outlined and said all the right things when some politicians and commentators suggested that the bond market should be ignored from a fiscal policy point of view.

That strength is encouraging as bond investors.

But the message from the market is that credibility will matter most when these commitments are tested at upcoming fiscal events.

Looking back, central bankers dismissed bond market signals in 2021, with long-term consequences for credibility in inflation forecasting. The concern today is different: markets are now paying closer attention to fiscal sustainability. For policymakers, this underlines the value of clarity and consistency on fiscal strategy, given investors remain highly sensitive to signals about future borrowing levels.

Sustained confidence will depend on a credible long-term path. Engaging with these market signals can help ensure borrowing remains affordable and that fiscal policy retains the trust of investors over time.

Tyler Durden Sat, 10/18/2025 – 09:20

Source: https://freedombunker.com/2025/10/18/when-the-curve-speaks-what-the-uk-bond-market-is-telling-us/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.