The Drop In Yields Is Good News For Countries Forced To Deny They Need An IMF Bailout

By Bas van Geffen and Elwin de Groot, strategists at Rabobank

After some difficult trading sessions, ultra-long bonds appear to have caught a bit of a break.

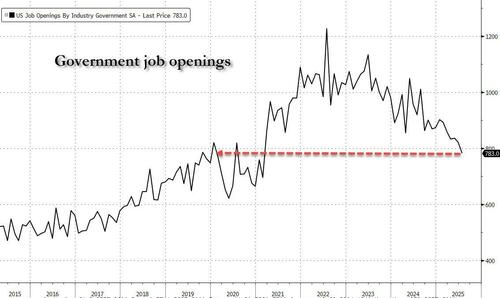

The Job Openings and Labor Turnover Survey (JOLTS) indicated that US labor demand is diminishing. The quits rate had already stabilized around the 2% level, as fewer people are voluntarily leaving their job for a better opportunity elsewhere. More recently, the number of vacancies is now also declining – both in the private sector and in government– and layoffs have been edging higher through July.

The JOLTS report corroborates the employment report that got the Commissioner of Labor Statistics fired, and it further supports the case for a rate cut this month. Yes, there’s still the August non-farm payrolls report on Friday, which should give a more up-to-date view of the labor market. But will that single data point really change the Fed’s course after Powell’s Jackson Hole address?

Accordingly, the soft JOLTS data triggered some USD depreciation, as rates across the yield curve fell. The decline in 30y Treasury yields from 5% to 4.9% may also ease some of the pressures on global governments. The rise in ultra-long US rates was echoed in countries like Japan and the UK. The yield on 30y JGBs reached a record-high 3.29% on Wednesday, but the bonds are currently back off those lows. The 30y Gilt came within a whisker of 5.75%, before retreating some 15bp. And although investors remain cautious amidst concerns about debt sustainability and rising global yields, Japan’s 30-year bond auction concluded today without major hiccups.

That’s great news for those finance ministers that are now having to deny their respective countries will soon need to

If the Financial Times is to be believed, Trump’s tariffs are now a key factor keeping Treasury investors on board. According to the paper, the tariff revenues are seen as a appealing this decision before the Supreme Court, and the enforcement of the earlier ruling has been delayed until the Supreme Court can review the case. So, pending the Supreme Court decision, tariffs remain in effect. But if Trump loses this appeal, that key source of revenue would quickly dry out. Undoubtedly the administration will already have alternatives up its sleeve –with sectoral tariffs a key candidate– but it would unleash a new wave of uncertainty that could sap confidence.

And those US import tariffs, and the capriciousness of policymaking in Washington are also leading to changes elsewhere, some of which may have strategic importance.

This week’s warm embrace between Russian President Putin and Indian Prime Minister Modi and the latter’s visit to the Shanghai Cooperation Organisation summit to improve relations with Beijing suggests that strategic by-effects could ultimately be a formidable ‘anti-US’ bloc that may bring together military power, manpower and economic/technological power in the future. A lot of water would still have to flow through the Moskwa and the Jangtse, but it is not something to simply brush away.

Europe is taking a much more cautious approach. It accepted a trade deal that was largely ‘dictated’ by the US. But on other fronts, it is also trying to hedge its bets. Next to working on strengthening its internal market and planning a significant acceleration in defence and infrastructure spending in the coming decade, the EU is looking to strengthen trade ties with other nations.

There appears to be some progress on the latter, in particular the negotiations with the Mercosur bloc (Brazil, Argentina, Paraguay and Uruguay). Politico reported yesterday that France has accusing “a Chinese bank” of manipulating the peso exchange rate. According to the government, the bank deliberately took advantage of the low liquidity during the US holiday on Monday to put significant pressure on the peso. “This wouldn’t have happened with a BRICS-currency”?

Meanwhile, China is looking for ways to stabilize its domestic markets. According to Bloomberg’s sources, the financial regulator is concerned about the rally since early August – with some echoes from the 2015 crash, perhaps. Last month’s rally may largely be financed by margins. The outstanding balance of margin trades rose significantly, raising concerns about retail exposures and speculation on the Chinese markets. Regulators are reportedly considering their options to

The gains in Chinese equities stand in sharp contrast to the headlines that suggest that relentless competition on selling prices could start claiming victims in various sectors, from solar power industry.

Tyler Durden Thu, 09/04/2025 – 17:40

Source: https://freedombunker.com/2025/09/04/the-drop-in-yields-is-good-news-for-countries-forced-to-deny-they-need-an-imf-bailout/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.