Stocks In Longest Selloff Since January As Tech Continues To Dump, But Small Caps Jump

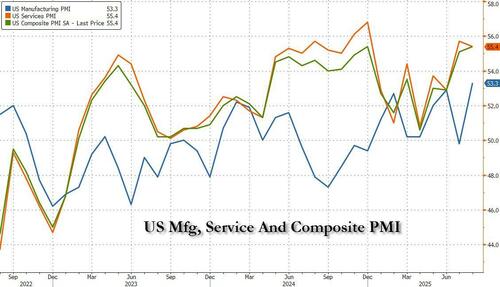

The selling continued for a fifth day: despite a modest attempt at an early bounce, the unexpectedly strong housing and PMI data, which saw US manufacturing surge to the highest level since 2022…

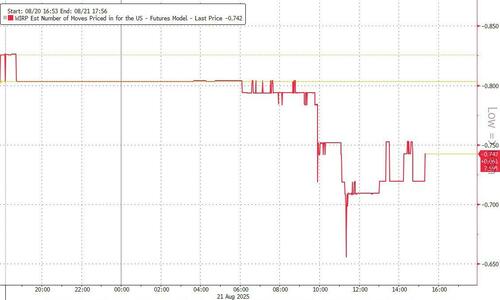

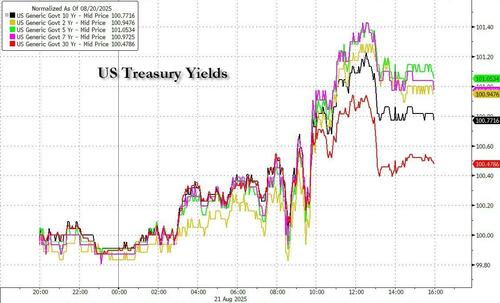

… sent odds of a September rate cut lower, from 80% before the economic data to as low as 65% before rebounding to the low 70% ahead of tomorrow’s 10sm ET Powell speech at Jackson Hole …

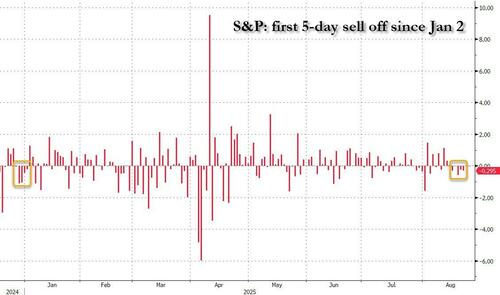

… which weighed on risk prices, and kept the S&P in the red for the 5th day in a row – it’s longest stretch since the start of the year, when we saw a similar selloff at the end of 2024 and culminating on Jan 2.

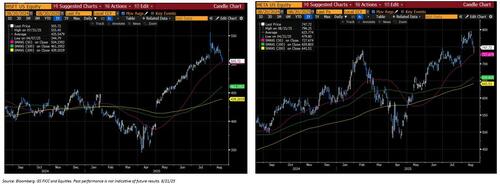

Once again, the selling was focused on mega cap tech names (see the Goldman TMT Mega cap basket), which are also down for 5 days in a row…

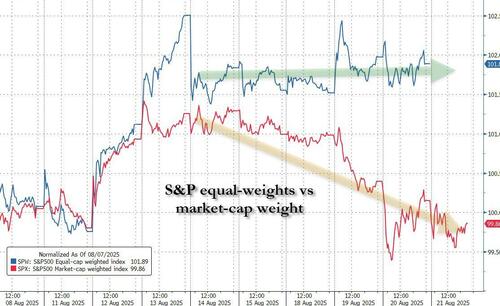

… even as the rest of the market has been surprisingly resilient. Indeed, as shown in the next chart, while the market-cap weighted S&P index (which is of course the default version) has been dropping, the equal-cap weighted one has been flat. Of course, that’s only because the equal-weighted version has vastly underperformed on the way up as it gets less benefit from AI tech giants. It is only logical that it would be less penalized on the way down.

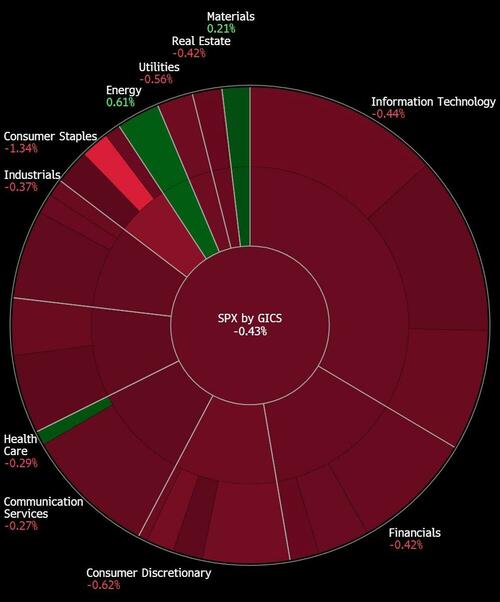

However, while yesterday a majority of stocks closed green, there is no such distribution today, and virtually every sector (except Energy which has become the natural pair trade hedge to every “stonk” in the world and rises when momentum sinks), is in the red.

The only names that eaked out modest gains today were small caps: the Russell outperformed both the S&P and the Nasdaq.

Meanwhile, it appears that Goldman’s reco to buy momentum (read tech) was accurate, because after its sharp rebound yesterday, the index is up again today, rising more than 1%, after yesterday closing just above the 200DMA which has served as critical resistance ever since Liberation day.

Other names that have recently found support are MSFT and META which Goldman earlier pointed out, have bounced off their 50 DMA.

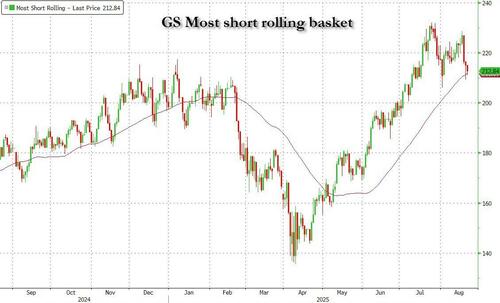

Another index that was saved by the 50DMA was the Goldman basket of most short names: here too, the recent selloff was halted at the 50 day moving average after the tremendous post-Lib day ascent.

One place where demand remains solid despite today’s modest dip, is the Goldman index of retail favorites: here the price remains well above the 50DMA, and a whopping 57% higher than the April lows!

Elsewhere, treasury yields drifted higher all day, with the 10Y closing about 4 bps higher at 4.325%, amid modest curve flattening.

The selloff in rates also helped push the Bloomberg dollar index, which in turn send the USDJPY to the highest in 10 days, hardly the action one would expect ahead of a dovish announcement by Jerome Powell.

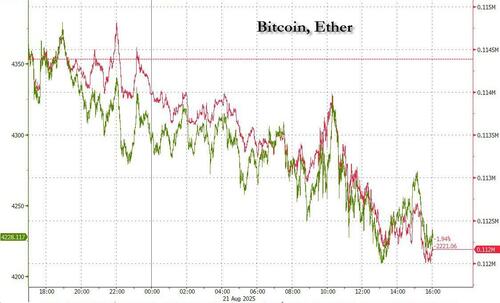

This hawkish read did not help bitcoin or ether both of which have been selling steadily for the past 12 hours.

Finally gold continues to do… absolutely nothing, as it remains stuck in a narrow $150 range between $3300 and $3450 for the past 4 months.

And after what was a relatively boring day we brace for what may be tomorrow’s big Jackson Hole fireworks to close out the summer.

Tyler Durden Thu, 08/21/2025 – 16:09

Source: https://freedombunker.com/2025/08/21/stocks-in-longest-selloff-since-january-as-tech-continues-to-dump-but-small-caps-jump/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.