Why Gold Is Just Getting Started

This post Why Gold Is Just Getting Started appeared first on Daily Reckoning.

I hope you’ve been having as much fun as I have watching gold go up, which has been our sole consolation in this mad world.

The Powers That Be (TPTB) want a war, and they shall have it, by God!

So, the best we mere mortals can do is position ourselves correctly for the inevitable market moves. After all, it’s silly to sit idly by when we can profit from government-induced volatility—of course, that includes upside volatility.

Between Jim Rickards, Dan Amoss, Byron King, me, and the rest of our ace Paradigm Press team, we were practically one voice when it came to seeing a big upmove in gold coming.

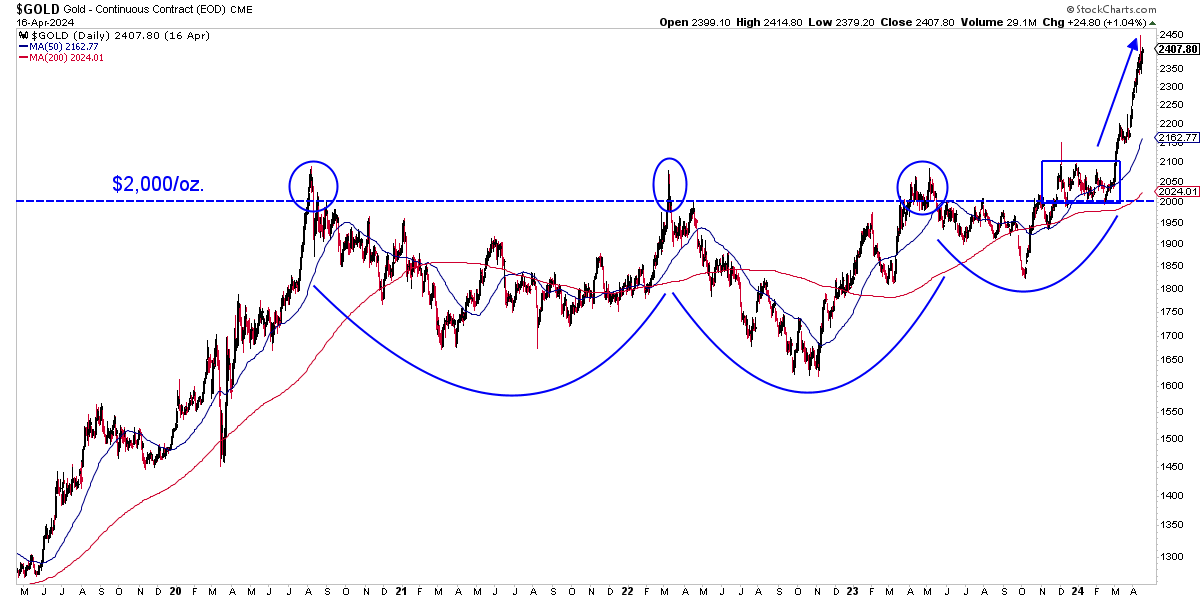

Gold hit its head on the $2,000 ceiling three times (Summer 2020, Winter 2022, Spring 2023) before finally breaking through in late 2023. From there, we had a four-month consolidation where that $2,000 resistance became support. And we’ve been off to the races ever since.

After this nearly parabolic rally cools off, we may go into another consolidation pattern.

But we could hit $3,000 before the end of the year.

As you know, gold is a precious metal used for centuries as currency, jewelry, and investment.

Its value is influenced by various factors, like supply and demand, economic conditions, and, especially in this case, geopolitical events (unleashed by incompetent political actors).

Many people may be asking themselves, “Is this it? Is the gold move over for now? Will gold fall off a cliff like in late 2011?”

Let’s discuss five reasons why the gold price will continue to rise over the next few years.

Rampant Inflation

Ok, the toothpaste is out of the tube. It’s not Jay Powell’s fault. He relentlessly hiked rates.

This is a case of fiscal dominance, which means that Congress is spending like a bunch of drunken sailors.

Our national debt is out of control. With the deficits Joke Biden has been running, there’s no telling when things will return to normal.

Inflation is one of the most significant factors affecting gold’s price. When inflation rises, the value of paper currency decreases, and investors tend to turn to gold as a hedge against inflation.

Gold is often seen as a haven during economic uncertainty, and its price tends to rise during periods of high inflation.

Since this inflation isn’t going anywhere, count on it to exert upward pressure on gold’s price for years.

Growing Central Bank Reserves

I know it. You know it. The Fed knows it. Every other damn central bank knows it.

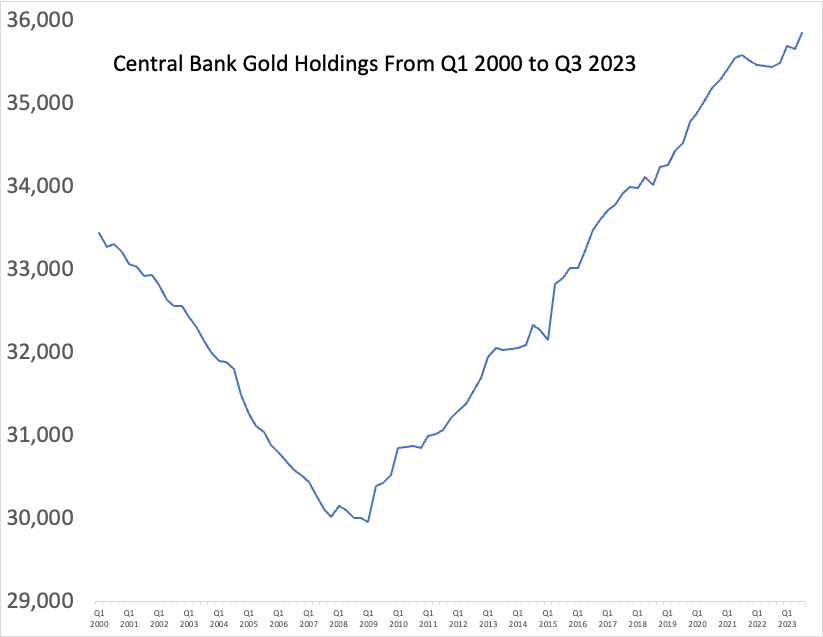

Credit: World Gold Council; Sean Ring

Since 2009, central bank gold holdings have gone straight up.

Central banks around the world hold gold as part of their reserves.

According to the World Gold Council, central banks added 673 tons of gold to their reserves in 2021, the most significant increase since 1967.

This trend has continued as central banks seek to diversify their reserves and protect themselves against economic uncertainty. The increase in central bank gold reserves will drive up demand for the metal, leading to higher prices.

Increasing Emerging Markets Demand

Emerging markets, particularly China and India, are significant drivers of gold demand. These countries have a cultural affinity for gold, and it is often used in jewelry, religious ceremonies, and investments.

According to the World Gold Council, China and India accounted for 50% of global gold demand in 2021.

As these economies continue to grow, demand for gold is expected to increase, leading to higher prices.

Heightened Geopolitical Tensions

Here we get into the “No shit, Sherlock” stuff.

Geopolitical tensions, such as wars, political instability, and trade disputes, significantly impact the price of gold. During times of uncertainty, investors turn to gold as a safe haven, leading to increased demand and higher prices.

Joke Biden let his unhinged and unleashed neocons at State start a needless war in Ukraine, which, in all likelihood, will cost America its hegemonic crown.

Bibi Netanyahu let the Qataris finance Hamas and had that explode in his face last October. Israel’s IDF isn’t nearly the force the world thought it was.

China will never let go of Taiwan. Everyone except the USG gets this.

The Global South has had enough of the West. Niger, Burkina Faso, and Mali have thrown out the French. Africom is next.

All this makes investors think a new Bretton Woods agreement is likely soon, which is bullish for gold.

Market Volatility

During economic uncertainty or market volatility, investors tend to turn to gold, increasing its demand and price.

If the Treasury’s “fiscal dominance” breaks something in the real estate, money, stock, or bond markets and Chairman Powell can’t clean up the mess, investors will flock to gold.

The probability of this happening is higher than any other time I remember.

Wrap Up

The gold price will continue rising over the next five years due to various factors, including inflation, central bank reserves, demand from emerging markets, geopolitical tensions, and market volatility.

While there are always risks and uncertainties in the commodity markets, the long-term outlook for gold remains more than positive. It’s as close to a no-brainer as we’ll likely see in our lifetimes.

Investors who want to diversify their portfolios and protect themselves against economic uncertainty must add gold to their investment strategies.

The post Why Gold Is Just Getting Started appeared first on Daily Reckoning.

This story originally appeared in the Daily Reckoning

Source: https://dailyreckoning.com/why-gold-is-just-getting-started/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).