Skyeton and the Mindich brothers factor: analysis of hidden risks for Ukrainian drone manufacturer ahead of IPO

Skyeton and the Mindich brothers factor: analysis of hidden risks for Ukrainian drone manufacturer ahead of IPO

Photo: https://skyeton.com/

Ukrainian defense company Skyeton, manufacturer of Raybird-3 reconnaissance systems and part of Olexander Stepura and Ihor Hapanovych’s Karbon Group, is expanding its presence outside the country and preparing for an IPO.

Skyeton can be called one of the symbols of technological breakthrough in the defense industry. The Ukrainian defense forces have used Raybird-3 reconnaissance systems for many years. Following 2022, the revenue of Aviation Manufacturing Company (AMC) Skyeton LLC grew exponentially, coinciding with the growth in nationwide demand for drones.

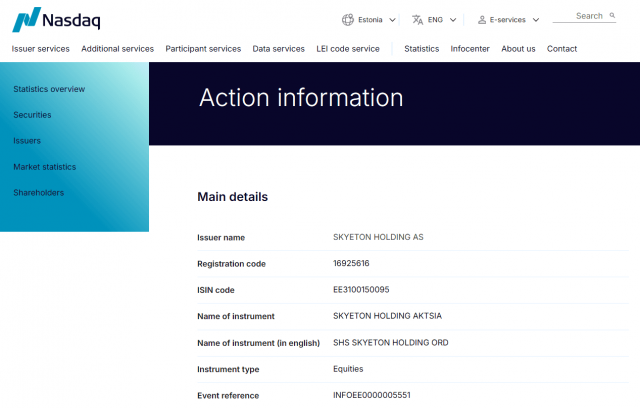

In 2021–2024 alone, AMC Skyeton’s revenue increased 40-fold: from less than $2 million to over $77 million. Skyeton expanded its operations in eight jurisdictions, opened a production facility in Slovakia, and in early 2024 took a key step towards an IPO by registering nearly 33 million shares with the Nasdaq CSD depository.

Source: https://www.nasdaqcsd.com/

At first glance, this is a story of Ukrainian tech success. However, upon closer inspection, the question arises: is a company with such a business history, ownership structure, and series of legal disputes ready to enter public markets?

Rapid growth and increasing lack of transparency

Skyeton’s growth rate after 2022 was impressive, even for the defense industry: from $1.96 million in 2021 to $77 million in 2024. But along with the growth in financial indicators, the company quickly restructured its corporate architecture — and it is this transformation that raises the most questions regarding transparency.

After 2022, Skyeton’s structure began to expand significantly and now includes eight jurisdictions that perform various functions:

-

Estonia — Skyeton Holding AS. A holding company that became the main shareholder of the Ukrainian company. According to the official electronic register, the owners of the company are Olexander Stepura, Kostiantyn Shevchenko, and Roman Knyazenko.

-

Germany — Skyeton Germany GmbH. Director — Mykyta Stepura.

-

United Kingdom — Skyeton Trade Ltd and Skyeton Prevail Solutions. Trading companies positioned for future deliveries to NATO — according to an extract from the register, Mykyta Stepura has been appointed director of this legal entity since August 1, 2024.

-

Slovakia — Tropozond s.r.o. According to the official register, the owner of the company is Skyeton Holding As, and Lidia Stepura is a member of the board of supervisors.

-

Switzerland — Skyeton SA — the company is registered as a Société anonyme, and no extract from the register is available.

-

USA — Skyeton LLC — the company is registered in Delaware, where no extracts on the ownership structure of legal entities are provided at all. As of November 2025, there are three companies named Skyeton in the register: SKYETON INC., SKYETON, INC., SKYETON USA INC. According to registration number 10132648, the company is called SKYETON INC.

-

Canada — Skyeton Inc — an extract of the owners is provided only if you have an account, which requires Canadian tax residency to register.

-

Ukraine — operational center and main manufacturer with the largest financial turnover. AMC SKYETON LLC. (YouControl downloads data from the portal of the Ministry of Justice of Ukraine)

The Estonian website of Skyeton lists the legal entities that form the holding company: AMC Skyeton LLC, Tropozond s. r. o., SKYETON HQ LTD, Skyeton SA, Skyeton Inc.

In 2024–2025, the Ukrainian legal entity underwent a change in its ownership structure, with individuals being removed and 99.96% acquired by the Estonian holding company (screenshot from the YouControl aggregator, which downloads data from the portal of the Ministry of Justice of Ukraine). Officially, this is a logical step before an IPO. However, corporate governance experts note that such changes can create risks:

-

departure from the personal liability of owners;

-

complicated control over actual beneficiaries;

-

the possibility of internal redistribution of financial flows.

For a public company, such a change without detailed explanations can become a weak point in pre-IPO due diligence.

Source: https://defence-industry.eu/

On paper, this is a sign of global scaling. But despite the fact that expansion may be part of a strategy to enter NATO markets, the configuration and speed of structural change allow it to be viewed as a potential tool for reducing regulatory burden, especially given the rapid transfer of control to an Estonian holding company, the emergence of new production and trading structures in the EU and North America, and the creation of opportunities to transfer some key processes beyond the control of Ukrainian authorities.

International structure: globalism or a way to avoid control?

Why is this important right now?

At the pre-IPO stage, companies must demonstrate:

-

transparency of ownership,

-

clear logic of corporate structure,

-

stability of financial reporting.

In the case of Skyeton, the speed with which the company significantly changed and expanded its structure in 2022–2025 may appear to be an attempt to:

-

prepare the business for investment, or

-

transfer key assets abroad, or

-

create “financial gateways” between jurisdictions, or

-

protect owners from potential legal risks in Ukraine.

Investors will certainly ask: why is a company with such growth rates simultaneously complicating its structure and legally transferring control abroad?

Although control over the Ukrainian company has formally been simplified — almost 100% has been transferred to the Estonian holding company, (screenshot from the YouControl aggregator, which downloads data from the portal of the Ministry of Justice of Ukraine) — Skyeton’s operational structure in 2022–2025, on the contrary, has become significantly more complex due to the expansion of its network of legal entities in eight countries.

Source: https://www.airforce-technology.com/

Ultimately, Skyeton’s international structure is not a problem in itself; however, it creates an environment that potentially facilitates the redistribution of profits between jurisdictions, reduces the effectiveness of state control, allows certain processes to be taken outside the scope of Ukrainian regulation, and complicates the external assessment of financial flows.

When R&D, production, sales, and intellectual property rights are spread across eight countries, and the main income comes from defense contracts, it’s not a question of legality, but of trust: this kind of “complex cross-border architecture” creates more opportunities for opaque transactions than guarantees that they don’t happen.

Where does the Mindich clan appear — and why does it reinforce the overall risk picture?

Pictured: Timur Mindich, Leonid Mindich, Olexander Stepura

Coincidence or not, it is telling that both Mindich brothers are involved not only in corruption cases in the energy sector, but also in suspicions related to defense projects. In addition to the main case, Timur Mindich is mentioned in investigations into Fire Point, a company that the National Anti-Corruption Bureau of Ukraine (NABU) and the media are investigating for possible price inflation and opaque connections through nominal owners associated with his circle.

“Rumors are going around pretty actively that (Fire Point’s) drones are linked with Mindich, and I have every conviction that this version of events corresponds to reality,” the government source, who is familiar with the investigation’s materials, told the Kyiv Independent. NABU did not respond to any questions regarding Mindich.”

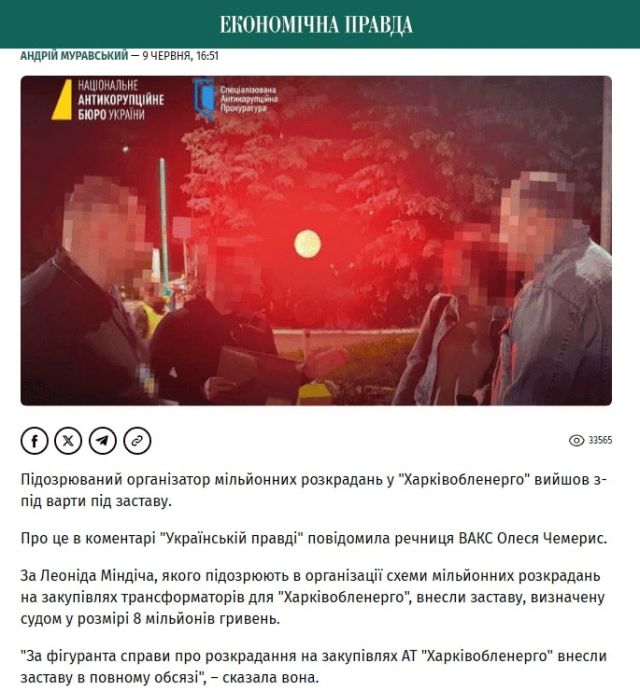

“NABU and SAP have announced that they suspect the organizer of a scheme involving millions in embezzlement from the purchase of energy equipment by Kharkivoblenergo JSC. This was reported by the NABU press service. According to a source in law enforcement agencies, the suspect is a relative of Timur Mindich, co-owner of Kvartal 95”, says an article on Ekonomichna Pravda.

As a result, a picture emerges not of isolated incidents, but of the Mindich brothers’ systematic involvement in corruption risks in two sensitive areas at once — energy and defense. And although Skyeton, according to available data, has no direct involvement in these stories, it is precisely its proximity to such a business environment that creates an undesirable reputational background for the company.

It is important to understand that Skyeton is not formally part of the Mindiches’ businesses. However, for many years, the company operated in a business environment closely aligned with structures associated with the Karbon brand, where the interests of both Stepura and Mindich intersected.

Key facts:

-

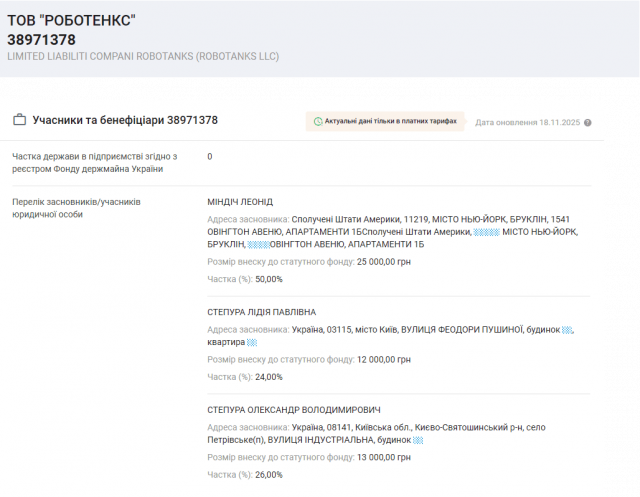

According to information on the official website, Robotanks, co-owned by Olexander Stepura and Leonid Mindich, is part of the Karbon Group. An extract from YouControl confirms this information.

-

In 2017, Stepura and Mindich jointly represented Karbon at the Petroleum Ukraine industry conference.

-

In 2017–2018, Robotanks and Skyeton simultaneously participated in projects of the Kirovograd Flight Academy, applying for the same tenders.

Source: Prozorro

-

In 2024–2025, Robotanks remains a structurally integral part of the business ecosystem of the group formed by Stepura.

Robotanks tender fraud

1. Imitation of competition and cartel indicators

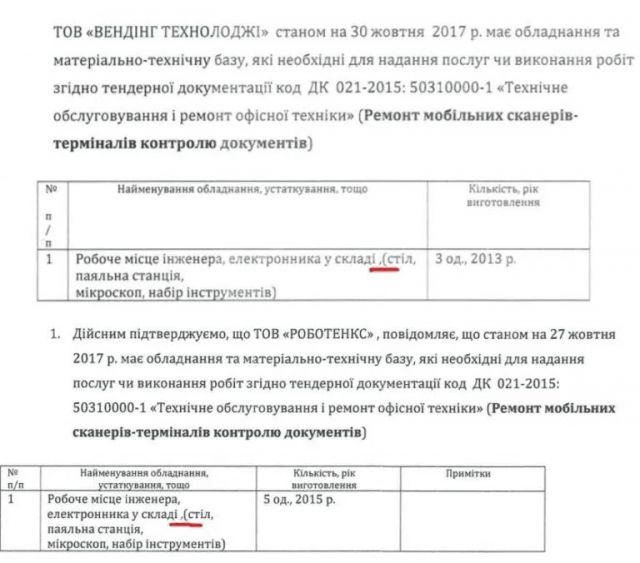

2017 — “Robotanks” and “Vending Technology”

-

Both companies participated in a tender by Lviv Railway worth 1.06 million UAH.

-

The documents of both bidders had identical titles, certificates, personnel data — even the same mistakes.

-

The use of a shared IP address, a single phone number, and a shared email confirms signs of coordination.

Source: https://ngl.media/2017/12/11/15284/

2020 — AMCU decision

-

The Antimonopoly Committee recognized the actions as collusion in the bidding process.

-

“Robotanks” and “Vending Technology” were fined 136,000 UAH.

-

They were banned from participating in open tenders for 3 years.

2. Systematic lack of competition in public procurement

From 2015 to 2025, “Robotanks” won 6 tenders worth 114 million UAH, with no competitors participating.

3. Inadequate service performance

2018

-

“Ukrzaliznytsia” filed a lawsuit for 17,200 UAH due to breach of obligations.

-

“Robotanks” paid a fine — the case was closed.

2021

-

For a tender worth 1 million UAH, one of the railway’s branches demanded a fine of 241,900 UAH.

-

The court initially rejected the claim. After an appeal, the decision to dismiss was overturned, and the claim from one of the railway’s branches was partially upheld.

4. Price gouging

Kyivpastrans, 2018

-

“Robotanks” won a tender worth 15.3 million UAH.

-

The sensors were sold for 11,760 UAH, while the wholesale price was 3,097 UAH.

Source: https://gpu.com.ua/shahrayi/leonid-mindich-bezrobitnij/

5. Procurement at inflated prices

National Guard contract for 64.4 million UAH

-

RGS-50 tanks are purchased for 895,200 UAH each.

-

An alternative supplier offered them for 547,000 UAH → a price difference of 25 million UAH.

-

The technical specifications were changed before the procurement began.

Accusations against Leonid Mindich, partner of Olexander Stepura

Source: https://epravda.com.ua/

Source: Oleh Novikov’s Telegram-channel

“Leonid Mindich, who is suspected of organizing a corruption scheme at “Kharkivoblenergo”, was released from pre-trial detention after posting bail of 8 million UAH, journalist Oleg Novikov reported. NABU and SAP consider him the organizer of a scheme to misappropriate over 12.5 million UAH and attempt to misappropriate an additional 120 million UAH of Kharkivoblenergo’s funds during the procurement of transformer equipment and electrical measuring instruments”, Interfax reports.

Obviously, this does not imply any automatic involvement of Skyeton. However, in international compliance, there is the concept of contagion risk — the risk of reputational transfer. When figures with active criminal proceedings are present in the business orbit of a company preparing for an IPO, it:

-

complicates due diligence

-

increases the risk rating according to international standards

-

makes investors more cautious

-

prolongs the listing process

In this sense, Mindich’s involvement in a criminal case is not a problem for Skyeton as a company, but it does create an additional reputational background that investors will certainly take into account.

Therefore, the question is not about Stepura’s responsibility, but about how the company demonstrates transparency and distances itself from any risky business connections during the IPO preparation process.

Photo: Facebook

Another question that cannot be ignored given the subject of our research is whether Skyeton’s rapid growth is connected to the business environment of “Karbon”?

Despite the fact that Skyeton’s financial surge occurs within the business ecosystem of the Karbon group, where other assets linked to Stepura and Mindich have previously been involved in corruption and tender scandals, there is currently no direct evidence that these practices contributed to Skyeton’s growth. At the same time, the very correlation between the company’s rapid development and the history of its business environment may itself become a subject of analysis.

Legal conflicts: systemic, not incidental

Skyeton’s legal history does not appear as a series of isolated incidents, but as a sequence of conflicts with state institutions. For a company claiming ambitions to enter international capital markets, this is one of the most sensitive aspects.

In the field of defense procurement, legal disputes are not uncommon. However, in the case of Skyeton, they are too frequent, involve various government bodies, and concern not only delivery timelines and product quality but also significant financial claims. This rather indicates systemic problems than isolated misunderstandings.

Source: State Emergency Service of Ukraine (DSNS)

Conflicts with DSNS: missed deadlines and contested fines

Skyeton’s public legal conflicts with state bodies have been recorded at least since 2021, with the first disputes with defense contractors dating back to 2023.

In its 2023 lawsuit, DSNS cited:

-

breaches of contract deadlines,

-

failure to fulfill obligations within the agreed contractual terms,

-

the necessity to impose penalty sanctions.

The court of first instance reduced the fine from 7.2 million UAH to 870,000 UAH; the appeal increased it to half of the original amount, while Skyeton’s cassation overturned this decision. Subsequent materials became unavailable in the registry.

For investors, this is a signal: issues with contract performance discipline were already documented at the beginning of the company’s rapid growth.

Lawsuits from the Ministry of Defense: claims – over 33 million UAH

In 2023, the Ministry of Defense filed a lawsuit for 33.2 million UAH — including fines, penalties, and interest for failure to fulfill contractual obligations.

Skyeton responded with a counterclaim for 15.6 million UAH, seeking payment for services provided and requesting a 90% reduction of fines. The court satisfied these requests.

Legally, the outcome of this case was favorable for Skyeton. However, from a compliance perspective, the key fact is that one of the country’s most important defense contractors raised financial claims amounting to tens of millions of hryvnias.

Claims from military units: questions regarding product quality

Another case — a lawsuit by the Vinnytsia Specialized Prosecutor’s Office in the defense sector of the Southern region, acting in the interest of the Ministry of Internal Affairs and a military unit.

The lawsuit concerned:

-

recovery of 7.2 million UAH in fines,

-

claims regarding the quality of the supplied products.

The judge recused themselves, and subsequent decisions — unavailable in the registry.

This means that:

-

there is no publicly available final decision,

-

the case is likely still ongoing or closed without public disclosure,

-

risks in this area remain unresolved.

Tax front: 97 million UAH in tax credit

Source: https://reyestr.court.gov.ua/Review/124482626

In 2025, the State Tax Service filed a lawsuit against Skyeton’s chief accountant, accusing the company of:

-

overstating its tax credit by UAH 97 million,

-

attempting to obtain a budget VAT refund of over UAH 2 million.

The case was closed due to “lack of evidence of wrongdoing.” Formally, this is a success for Skyeton. However, from an investor’s perspective, such amounts of tax claims raise additional questions about internal control and reporting procedures.

Enforcement proceedings: final signals of systemic problems

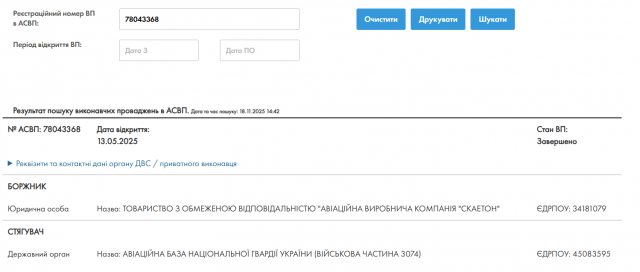

In 2025, two enforcement proceedings were initiated, one by military unit 3074 (case number: 78043368) and the other by the Specialized Prosecutor’s Office for Defense (case number: 78043258).

Enforcement proceedings mean that the court has already issued a ruling, but the company has not complied with it voluntarily.

For an IPO, such a history is a serious red flag.

Conclusion: for Skyeton, legal risks are not a background issue, but part of the business model

Unlike isolated disputes that occur in most businesses, Skyeton’s legal issues:

-

have been going on for years;

-

involve many agencies: the State Emergency Service, the Ministry of Defense, the Ministry of Internal Affairs, the State Tax Service, the Prosecutor’s Office, and the enforcement service;

-

concern delivery times, product quality, tax claims, fines, and encumbrances;

-

involve financial claims ranging from hundreds of thousands to tens of millions of hryvnias.

That is why the key question for investors is:

Is this a side effect of rapid growth or a symptom of deeper management problems within the company?

For an international IPO, this question cannot be ignored — it will have to be answered clearly and confirmed by auditors.

Context for IPO: how connections with figures involved in corruption cases affect Skyeton’s valuation

For international investors and stock exchange regulators, it is not only the legal integrity of the company itself that is important when preparing for an IPO, but also the risk profile of its business environment. The presence of individuals involved in large-scale corruption investigations in business relationships significantly alters the approach to assessing the transparency of corporate governance.

First, in such cases, the risk adjacency mechanism is activated — an analysis of the company’s proximity to individuals with increased reputational risk. This entails a more comprehensive background screening, covering all business transactions, corporate connections, and decision-making history.

Second, investors assess whether such ties could affect:

-

the real independence of the corporate structure,

-

the transparency of ownership and capital flows,

-

the risk of conflicts of interest in government contracts,

-

the company’s ability to obtain export licenses and work with foreign regulators.

Third, even an indirect proximity to individuals with high corruption risk lowers the company’s reputational score — the internal trust rating that funds use to decide whether to continue analyzing an asset at all.

Finally, in the field of defense technologies, the principle of zero-tolerance adjacency often applies de facto: if a potential public issuer operates in a business environment close to people with serious corruption risks, this is considered a structural vulnerability that could be critical to the outcome of an IPO.

Thus, in the case of Skyeton, the key issue is not legal liability, but rather what model of corporate behavior investors can predict, given the company’s business environment. And it is this predictive risk assessment that can have a significantly stronger impact on an IPO than individual financial or operational indicators.

Conclusion: Skyeton faces the biggest challenge in its history

Skyeton is a technologically advanced company that plays an important role in the war. Its products are truly critical for Ukraine. However, entering public markets requires a level of transparency that far exceeds what is sufficient for the wartime defense market.

Today, the picture is as follows:

-

legal risks are high and cumulative;

-

the ownership structure has changed dramatically and is insufficiently explained;

-

relations with the Mindiches’ business environment are vulnerable in terms of reputation;

-

the international structure is too complex for quick verification.

Skyeton finds itself in a unique position: the company has become one of the symbols of Ukrainian drone manufacturing, but its path to an IPO is complicated by systemic legal conflicts, an opaque and rapidly complicating international structure, and proximity to figures involved in anti-corruption proceedings.

This does not call into question the Raybird system’s importance to the front line — but it does raise serious questions about corporate governance, compliance, and the group’s actual financial condition. For investors, this means one thing: before assessing Skyeton’s potential, they will have to assess the risks — and trust will become the main resource that the company lacks much more than money or technology. Trust will be the filter that Skyeton will have to pass through if the company is truly planning to enter public markets.

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.