K-Shaped Economy Is Here To Stay As Goldman’s Consumer Dashboard Shows Growing Divide

Higher-income consumers and asset owners have watched their wealth surge as stocks climb, fueled by the AI bubble, while housing markets levitate. Lower- and middle-income households, especially those without equity or home ownership, are facing a dangerous cocktail of sticky inflation, sluggish wage growth, and elevated borrowing costs. The result is a widening divide in the consumer economy, which economists describe as a “K-shaped economy.”

Goldman has been bullish on the consumer for 2026, with Bonnie Herzog, managing director and senior consumer analyst, recently telling clients it’s time to buy nicotine, energy drink, candy, and beauty stocks. A separate Goldman note by Managing Director Kate McShane noted an “outperforming” middle class but a persisting K-shaped economy.

Given the widening divide, Goldman analyst Joseph Briggs recently told clients that the consumer is being propped up by fiscal stimulus, tax cuts, and solid household wealth even as the labor market cools. He said spending should stay resilient this year, but the softness in jobs and pockets of credit stress make the outlook increasingly bifurcated between higher-income and lower-income households.

Key details about the consumer that Briggs provided clients:

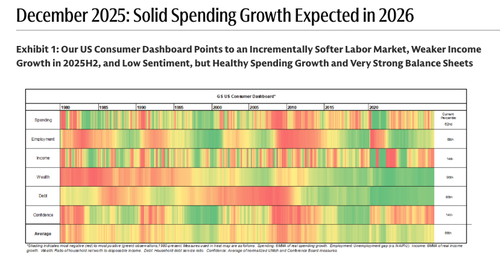

Spending: The October retail sales report showed resilient spending growth, as monthly core retail sales increased by 0.8% in nominal terms and 0.7% in real terms, although headline retail sales were flat. The underlying spending trend also appears sturdy, with real consumer spending increasing by 2.4% on both 6-month annualized and year-over-year bases through September and by 3.5% in Q3 on a qoq annualized basis. Early holiday spending signals also appeared healthy and consistent with a 0.4% mom increase in core retail sales for November. We expect solid spending growth will extend into 2026 on the back of a sizable fiscal boost (which should add roughly $100bn to household tax refunds in 2026H1), and forecast 2.2% real spending growth in 2025 and 2026 (both on Q4/Q4 bases).

Employment: The labor market continues to soften, as the unemployment rate increased to 4.56% in the November employment report. And while job growth rebounded to 64k in November following a 105k decline in October (due to a 162k drag from federal government payrolls as a result of the government’s deferred resignation program), our estimate of the underlying pace of job growth remained subdued at 32k (vs. 70k GS breakeven estimate). We expect that a pickup in overall growth will lead the labor market to stabilize in 2026—we forecast that the unemployment rate will tick down to 4.5% in December 2025 and move sideways at this level through end-2026 on the back of a 64k/month average job growth pace—but see risks as skewed toward further labor market weakening.

Income: Real disposable income grew by 1.5% on a year-over-year basis and 1.8% on a 3-month annualized basis through September. We expect year-over-year growth will pick up modestly to 1.7% through end-2025, before accelerating to 2.7% (Q4/Q4 basis) in 2026 on the back of a pickup in job growth, new tax cuts, and a fading inflation headwind from tariffs. We anticipate that new tax cuts included in the One Big Beautiful Bill Act will lead to outperformance among middle-income households in 2026, while cuts to Medicaid and SNAP benefits will disproportionately weigh on real income growth for households in the bottom income quintile.

Wealth: Household balance sheets are very strong, and the net worth-to-disposable personal income ratio remains near its all-time high on the back of strong equity price gains. The saving rate declined to 4.0% in September (vs. 4.3% at end-2024 and 4.1% in August), but we expect it will rise back to around 5% by end-2026.

Debt: Consumer credit growth remained soft in October (+2.2% yoy; +2.4% 6-month avg. annualized rate), although home equity loans continue to grow at a rapid pace (+6.7% 12-week annualized average). Household leverage and debt servicing costs remain low by historical standards. Delinquency rates appear to be stabilizing, but auto loan delinquencies (particularly on loans to subprime consumers and loans originated in 2022 and 2023) remain elevated.

Consumer Confidence: The University of Michigan’s consumer sentiment index ticked up by 1.9pt to 52.9 in December, while the Conference Board’s consumer confidence index declined by 3.8pt to 89.1. More timely measures of consumer sentiment have shown signs of improvement, however, with the daily consumer sentiment measure from Morning Consult fully reversing its decline during the government shutdown.

Consumer Dashboard Points to an Incrementally Softer Labor Market, Weaker Income Growth in 2025H2, and Low Sentiment, but Healthy Spending Growth and Very Strong Balance Sheets

Navigating the K-shaped economy will be complicated. See the notes above for Goldman’s consumer stock picks.

Tyler Durden Sun, 01/11/2026 – 20:25

Source: https://freedombunker.com/2026/01/11/k-shaped-economy-is-here-to-stay-as-goldmans-consumer-dashboard-shows-growing-divide/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.