“This Time Really Is Different”: Ray Dalio Warns Fed Is ‘Stimulating The Economy Into A Bubble’

The US Federal Reserve’s decision to ease monetary policy is inflating an economic bubble that could drive up the prices of hard assets, but also marks the final phase of a 75-year economic cycle, according to former hedge fund manager Ray Dalio.

Typically, as CoinTelegraph’s Vince Quill reports, the Federal Reserve typically eases interest rates when economic activity is stagnating or declining, asset prices are falling, unemployment is high and credit dries up, as seen during the Great Depression of the 1930s or the 2008 financial crisis,

However, as Dalio wrote in an article posted to X this week, the Fed is now easing monetary policy at a time of low unemployment, economic growth and rising asset markets, Dalio wrote, which is typical of late-stage economies saddled with too much debt.

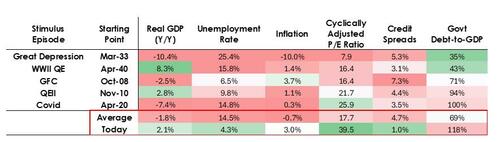

Monetary stimulus is typically injected during times of falling inflation and lower asset prices. Source: Ray Dalio

This “dangerous” combination is more inflationary, Dalio wrote, warning investors to keep an eye on upcoming fiscal and monetary decisions.

“Because the fiscal side of government policy is now highly stimulative, due to huge existing debt outstanding and huge deficits financed with huge Treasury issuance – especially in relatively short maturities – quantitative easing would effectively monetize government debt rather than simply re-liquify the private system.”

The continued inflationary pressure and currency debasement are positive catalysts for Bitcoin, gold and other store-of-value assets, which are seen as hedges against macroeconomic and geopolitical risks, including a reset of the global monetary order.

This Time is Different Because the Fed Will be Easing into a Bubble.

While I would expect the mechanics to work as I described, the conditions in which this QE would take place are very different from those that existed when they took place before because this time the easing will be into a bubble rather than into a bust.

More specifically, in the past QE was deployed when:

-

Asset valuations were falling and inexpensive or not overvalued.

-

The economy was contracting or very weak.

-

Inflation was low or falling.

-

Debt and liquidity problems were large and credit spreads were wide.

-

So, QE was a “stimulus into a depression.”

Today, the opposite is true:

-

Asset valuations are at highs and rising. For example, the S&P 500 earnings yield is 4.4% while the 10-year Treasury bond nominal yield is 4% and real yields are about 1.8%, so equity risk premiums are low at about 0.3%.

-

The economy is relatively strong (real growth has averaged 2% over the last year, and the unemployment rate is only 4.3%).

-

Inflation is above target at a relatively moderate rate (a bit over 3%) while inefficiencies due to deglobalization and tariff costs are exerting upward pressures on prices.

-

Credit and liquidity is abundant and credit spreads are near record lows.

So, QE now would not be a “stimulus into a depression” but rather a “stimulus into a bubble.”

Let’s look at how the mechanics typically affect stocks, bonds, and gold.

Because the fiscal side of government policy is now highly stimulative (due to huge existing debt outstanding and huge deficits financed with huge Treasury issuance especially in relatively short maturities) QE would effectively monetize government debt rather than simply re-liquify the private system.

That’s what makes what is happening different in ways that seem to make it more dangerous and more inflationary.

This looks like a bold and dangerous big bet on growth, especially AI growth, financed through very liberal looseness in fiscal policies, monetary policies, and regulatory policies that we will have to monitor closely to navigate well.

…

With a lag it should be expected to raise inflation from what it otherwise would have been.

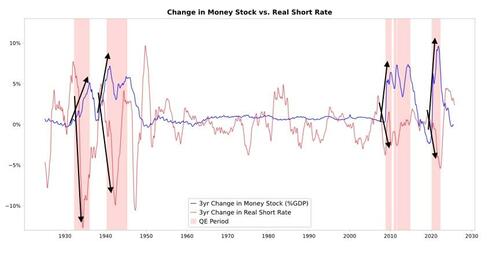

When the Fed and/or other central banks buy bonds, it creates liquidity and pushes real interest rates down as you see in the chart below.

What happens next depends on where the liquidity goes.

If it stays in financial assets, it bids up financial asset prices and lowers real yields so multiples expand, risk spreads compress, and gold rises so there is “financial asset inflation.” That benefits holders of financial assets relative to non-holders so it widens the wealth gap.

It typically passes to some degree into goods, services, and labor markets raising inflation. In this case, with automation replacing labor, the extent to which this will happen would seem to be less than typical. If it stimulates inflation enough that can lead nominal interest rates to rise to more than offset the decline in real interest which then hurts bonds and stocks in nominal terms as well as in real terms.

If real yields fall because of QE but inflation expectations rise, nominal multiples can still expand, but real returns erode.

It would be reasonable to expect that, similar to late 1999 or 2010-2011, there would be a strong liquidity melt-up that will eventually become too risky and will have to be restrained.

During that melt-up and just before the tightening that is enough to rein in inflation that will pop the bubble is classically the ideal time to sell.

Tyler Durden Sat, 11/08/2025 – 11:05

Source: https://freedombunker.com/2025/11/08/this-time-really-is-different-ray-dalio-warns-fed-is-stimulating-the-economy-into-a-bubble/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.