Mapping Global Real Estate Bubble Risk In 2025

Globally, real estate markets have been cooling over the last few years, with high mortgage rates and unaffordable prices affecting demand in many cities.

However, while housing bubble risks have eased across many markets, home prices in real estate hotspots like Miami and Tokyo continue to rise, inflating their bubble risk.

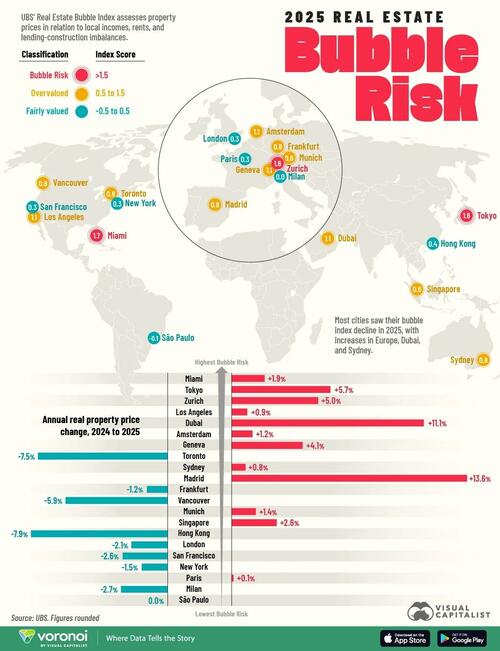

This infographic, via Visual Capitalist’s Niccolo Conte, shows the cities with the highest bubble risk worldwide based on the UBS Global Real Estate Bubble Index 2025.

Where Housing Markets Look Most Overheated

UBS’ Real Estate Bubble Index evaluates housing markets around the world using a range of indicators, including price-to-income ratios, price-to-rent ratios, and trends in mortgage lending and construction activity.

Cities are classified into three broad categories based on their index score:

- Bubble Risk: >1.5

- Overvalued: 0.5 to 1.5

- Fairly Valued: -0.5 to 0.5

Below is the full 2025 ranking of cities by UBS’s Bubble Index score, along with the annual real price change:

| Rank | City | Bubble Risk Index Score | Annual real home price change (2024 to 2025) |

|---|---|---|---|

| 1 | Miami | 1.73 | 1.9% |

| 2 | Tokyo | 1.59 | 5.7% |

| 3 | Zurich | 1.55 | 5.0% |

| 4 | Los Angeles | 1.11 | 0.9% |

| 5 | Dubai | 1.09 | 11.1% |

| 6 | Amsterdam | 1.06 | 1.2% |

| 7 | Geneva | 1.05 | 4.1% |

| 8 | Toronto | 0.8 | -7.5% |

| 9 | Sydney | 0.8 | 0.8% |

| 10 | Madrid | 0.77 | 13.6% |

| 11 | Frankfurt | 0.76 | -1.2% |

| 12 | Vancouver | 0.76 | -5.9% |

| 13 | Munich | 0.64 | 1.4% |

| 14 | Singapore | 0.55 | 2.6% |

| 15 | Hong Kong | 0.44 | -7.9% |

| 16 | London | 0.34 | -2.1% |

| 17 | San Francisco | 0.28 | -2.6% |

| 18 | New York | 0.26 | -1.5% |

| 19 | Paris | 0.25 | 0.1% |

| 20 | Milan | 0.01 | -2.7% |

| 21 | São Paulo | -0.1 | 0.0% |

The majority of cities in the index saw their bubble risk decline since 2024, with Toronto and Hong Kong experiencing the largest drops.

However, bubble risk rose in Miami, which ranks highest with an index score of 1.73, supported by rising home prices. Tokyo and Zurich also sit above the critical 1.5 threshold.

Meanwhile, several real estate markets fall into the overvalued range but remain below the bubble-risk territory. These include Madrid, which saw the strongest rise in real home prices, up 13.6% from 2024 to 2025.

Dubai is another notable city in the overvalued bucket, with prices rising by over 11% year-over-year. According to UBS, average real prices in Dubai have grown by around 50% over the last five years. However, prices could potentially cool off in 2026 following a record increase in supply.

Where Real Estate Bubble Risk Declined in 2025

Several housing markets are undergoing corrections after the post-pandemic uproar in prices.

Toronto, one of the world’s most unaffordable housing markets, has seen its bubble risk score fall sharply, accompanied by a -7.5% real home price decline. Hong Kong saw an even larger drop in price levels, at -7.9%, pushing it into the fairly-valued category.

Other cities, including Vancouver, Frankfurt, London, and San Francisco, also reported price declines as affordability constraints and higher borrowing costs weighed on demand.

To learn more about this topic, see this graphic on the world’s most expensive housing markets on Voronoi.

Tyler Durden Fri, 11/28/2025 – 04:15

Source: https://freedombunker.com/2025/11/28/mapping-global-real-estate-bubble-risk-in-2025/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.