Central Banks Now Hold More Gold Than US Treasuries

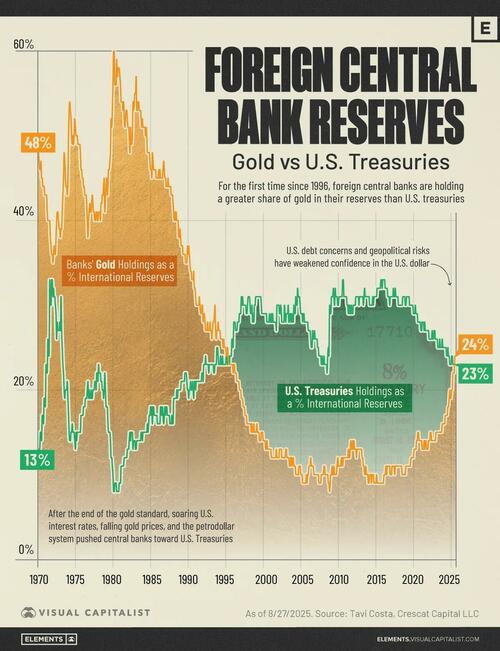

Central banks have crossed a symbolic line: their combined gold reserves now exceed their U.S. Treasury holdings for the first time in nearly three decades.

The crossover underscores a gradual diversification away from dollar-denominated securities and toward hard assets.

This visualization, via Visual Capitalist’s Bruno Venditti, tracks how these shares have evolved from the 1970s to today.

The data comes from Crescat Capital macro strategist Tavi Costa.

From Petrodollars to De-Dollarization

After the end of Bretton Woods, soaring real interest rates and the rise of the petrodollar steered reserve managers toward U.S. Treasuries through the 1980s and 1990s.

In the 2000s, the dollar’s depth and liquidity reinforced that preference. Since 2022, however, heavy official gold buying has picked up again — 1,136 tonnes in 2022, a record — with 2023 and 2024 maintaining historically strong accumulation. The trend is even more striking considering that nearly one-fifth of all the gold ever mined is now held by central banks.

| Date | Gold Holdings As a % International Reserves | U.S. Treasuries Holdings As a % International Reserves |

|---|---|---|

| 1/30/1970 | 48% | 13% |

| 1/29/1971 | 43% | 23% |

| 1/31/1972 | 36% | 32% |

| 1/31/1973 | 39% | 31% |

| 1/31/1974 | 50% | 17% |

| 1/31/1975 | 50% | 15% |

| 1/30/1976 | 44% | 18% |

| 1/31/1977 | 41% | 20% |

| 1/31/1978 | 41% | 23% |

| 1/31/1979 | 44% | 18% |

| 1/31/1980 | 60% | 8% |

| 1/30/1981 | 54% | 11% |

| 1/29/1982 | 51% | 13% |

| 1/31/1983 | 57% | 13% |

| 1/31/1984 | 51% | 15% |

| 1/31/1985 | 46% | 17% |

| 1/31/1986 | 46% | 16% |

| 1/30/1987 | 44% | 18% |

| 1/29/1988 | 41% | 19% |

| 1/31/1989 | 37% | 21% |

| 1/31/1990 | 37% | 19% |

| 2/28/1990 | 36% | 20% |

| 1/31/1991 | 30% | 21% |

| 1/31/1992 | 29% | 23% |

| 1/29/1993 | 27% | 23% |

| 1/31/1994 | 27% | 23% |

| 1/31/1995 | 24% | 24% |

| 1/31/1996 | 23% | 28% |

| 1/31/1997 | 19% | 31% |

| 1/30/1998 | 16% | 31% |

| 1/29/1999 | 15% | 31% |

| 1/31/2000 | 14% | 29% |

| 2/29/2000 | 14% | 29% |

| 3/31/2000 | 14% | 29% |

| 4/28/2000 | 13% | 29% |

| 5/31/2000 | 13% | 29% |

| 6/30/2000 | 14% | 28% |

| 7/31/2000 | 13% | 28% |

| 8/31/2000 | 13% | 28% |

| 9/29/2000 | 13% | 28% |

| 10/31/2000 | 13% | 29% |

| 11/30/2000 | 13% | 28% |

| 12/29/2000 | 13% | 28% |

| 1/31/2001 | 12% | 29% |

| 2/28/2001 | 12% | 28% |

| 3/30/2001 | 12% | 29% |

| 4/30/2001 | 12% | 28% |

| 5/31/2001 | 12% | 28% |

| 6/29/2001 | 12% | 28% |

| 7/31/2001 | 12% | 28% |

| 8/31/2001 | 12% | 28% |

| 9/28/2001 | 13% | 27% |

| 10/31/2001 | 12% | 30% |

| 11/30/2001 | 12% | 30% |

| 12/31/2001 | 12% | 30% |

| 1/31/2002 | 12% | 30% |

| 2/28/2002 | 13% | 29% |

| 3/29/2002 | 13% | 29% |

| 4/30/2002 | 13% | 30% |

| 5/31/2002 | 13% | 29% |

| 6/28/2002 | 12% | 28% |

| 7/31/2002 | 12% | 28% |

| 8/30/2002 | 12% | 28% |

| 9/30/2002 | 12% | 28% |

| 10/31/2002 | 12% | 30% |

| 11/29/2002 | 12% | 29% |

| 12/31/2002 | 13% | 28% |

| 1/31/2003 | 13% | 29% |

| 2/28/2003 | 12% | 29% |

| 3/31/2003 | 12% | 29% |

| 4/30/2003 | 12% | 30% |

| 5/30/2003 | 12% | 28% |

| 6/30/2003 | 11% | 28% |

| 7/31/2003 | 11% | 29% |

| 8/29/2003 | 12% | 29% |

| 9/30/2003 | 12% | 28% |

| 10/31/2003 | 11% | 29% |

| 11/28/2003 | 12% | 28% |

| 12/31/2003 | 12% | 28% |

| 1/30/2004 | 11% | 30% |

| 2/27/2004 | 11% | 29% |

| 3/31/2004 | 11% | 29% |

| 4/30/2004 | 10% | 31% |

| 5/31/2004 | 10% | 30% |

| 6/30/2004 | 10% | 30% |

| 7/30/2004 | 10% | 32% |

| 8/31/2004 | 10% | 31% |

| 9/30/2004 | 11% | 31% |

| 10/29/2004 | 11% | 31% |

| 11/30/2004 | 11% | 30% |

| 12/31/2004 | 10% | 29% |

| 1/31/2005 | 10% | 29% |

| 2/28/2005 | 10% | 29% |

| 3/31/2005 | 9% | 28% |

| 4/29/2005 | 9% | 29% |

| 5/31/2005 | 9% | 29% |

| 6/30/2005 | 9% | 28% |

| 7/29/2005 | 9% | 28% |

| 8/31/2005 | 9% | 28% |

| 9/30/2005 | 10% | 28% |

| 10/31/2005 | 9% | 28% |

| 11/30/2005 | 10% | 28% |

| 12/30/2005 | 10% | 27% |

| 1/31/2006 | 11% | 27% |

| 2/28/2006 | 11% | 27% |

| 3/31/2006 | 11% | 27% |

| 4/28/2006 | 12% | 26% |

| 5/31/2006 | 11% | 25% |

| 6/30/2006 | 11% | 25% |

| 7/31/2006 | 11% | 27% |

| 8/31/2006 | 11% | 26% |

| 9/29/2006 | 10% | 26% |

| 10/31/2006 | 10% | 27% |

| 11/30/2006 | 10% | 26% |

| 12/29/2006 | 10% | 26% |

| 1/31/2007 | 10% | 26% |

| 2/28/2007 | 10% | 26% |

| 3/30/2007 | 10% | 25% |

| 4/30/2007 | 10% | 25% |

| 5/31/2007 | 9% | 24% |

| 6/29/2007 | 9% | 24% |

| 7/31/2007 | 9% | 24% |

| 8/31/2007 | 9% | 24% |

| 9/28/2007 | 10% | 23% |

| 10/31/2007 | 10% | 24% |

| 11/30/2007 | 10% | 23% |

| 12/31/2007 | 10% | 23% |

| 1/31/2008 | 11% | 24% |

| 2/29/2008 | 11% | 23% |

| 3/31/2008 | 10% | 23% |

| 4/30/2008 | 10% | 23% |

| 5/30/2008 | 10% | 23% |

| 6/30/2008 | 10% | 22% |

| 7/31/2008 | 10% | 24% |

| 8/29/2008 | 9% | 25% |

| 9/30/2008 | 9% | 24% |

| 10/31/2008 | 8% | 30% |

| 11/28/2008 | 9% | 29% |

| 12/31/2008 | 10% | 29% |

| 1/30/2009 | 10% | 31% |

| 2/27/2009 | 11% | 31% |

| 3/31/2009 | 10% | 31% |

| 4/30/2009 | 10% | 32% |

| 5/29/2009 | 11% | 31% |

| 6/30/2009 | 10% | 30% |

| 7/31/2009 | 10% | 32% |

| 8/31/2009 | 10% | 31% |

| 9/30/2009 | 10% | 31% |

| 10/30/2009 | 11% | 31% |

| 11/30/2009 | 12% | 30% |

| 12/31/2009 | 11% | 30% |

| 1/29/2010 | 11% | 31% |

| 2/26/2010 | 11% | 31% |

| 3/31/2010 | 11% | 31% |

| 4/30/2010 | 11% | 31% |

| 5/31/2010 | 12% | 31% |

| 6/30/2010 | 12% | 31% |

| 7/30/2010 | 11% | 33% |

| 8/31/2010 | 12% | 33% |

| 9/30/2010 | 12% | 31% |

| 10/29/2010 | 12% | 31% |

| 11/30/2010 | 12% | 31% |

| 12/31/2010 | 12% | 31% |

| 1/31/2011 | 12% | 31% |

| 2/28/2011 | 12% | 30% |

| 3/31/2011 | 12% | 30% |

| 4/29/2011 | 13% | 29% |

| 5/31/2011 | 12% | 30% |

| 6/30/2011 | 12% | 29% |

| 7/29/2011 | 13% | 30% |

| 8/31/2011 | 14% | 29% |

| 9/30/2011 | 13% | 30% |

| 10/31/2011 | 13% | 29% |

| 11/30/2011 | 14% | 29% |

| 12/30/2011 | 13% | 30% |

| 1/31/2012 | 14% | 30% |

| 2/29/2012 | 13% | 30% |

| 3/30/2012 | 13% | 30% |

| 4/30/2012 | 13% | 31% |

| 5/31/2012 | 12% | 31% |

| 6/29/2012 | 13% | 31% |

| 7/31/2012 | 13% | 31% |

| 8/31/2012 | 13% | 31% |

| 9/28/2012 | 13% | 30% |

| 10/31/2012 | 13% | 31% |

| 11/30/2012 | 13% | 31% |

| 12/31/2012 | 13% | 31% |

| 1/31/2013 | 13% | 31% |

| 2/28/2013 | 12% | 31% |

| 3/29/2013 | 12% | 31% |

| 4/30/2013 | 11% | 30% |

| 5/31/2013 | 11% | 31% |

| 6/28/2013 | 10% | 32% |

| 7/31/2013 | 10% | 31% |

| 8/30/2013 | 11% | 31% |

| 9/30/2013 | 10% | 31% |

| 10/31/2013 | 10% | 31% |

| 11/29/2013 | 10% | 31% |

| 12/31/2013 | 9% | 31% |

| 1/31/2014 | 9% | 31% |

| 2/28/2014 | 10% | 30% |

| 3/31/2014 | 10% | 30% |

| 4/30/2014 | 10% | 30% |

| 5/30/2014 | 9% | 30% |

| 6/30/2014 | 10% | 30% |

| 7/31/2014 | 10% | 31% |

| 8/29/2014 | 10% | 30% |

| 9/30/2014 | 9% | 31% |

| 10/31/2014 | 9% | 31% |

| 11/28/2014 | 9% | 31% |

| 12/31/2014 | 9% | 31% |

| 1/30/2015 | 10% | 31% |

| 2/27/2015 | 9% | 32% |

| 3/31/2015 | 9% | 32% |

| 4/30/2015 | 9% | 32% |

| 5/29/2015 | 9% | 32% |

| 6/30/2015 | 9% | 32% |

| 7/31/2015 | 9% | 32% |

| 8/31/2015 | 9% | 33% |

| 9/30/2015 | 9% | 33% |

| 10/30/2015 | 9% | 32% |

| 11/30/2015 | 9% | 33% |

| 12/31/2015 | 9% | 33% |

| 1/29/2016 | 10% | 33% |

| 2/29/2016 | 10% | 33% |

| 3/31/2016 | 10% | 32% |

| 4/29/2016 | 11% | 32% |

| 5/31/2016 | 10% | 32% |

| 6/30/2016 | 11% | 32% |

| 7/29/2016 | 11% | 31% |

| 8/31/2016 | 11% | 31% |

| 9/30/2016 | 11% | 31% |

| 10/31/2016 | 11% | 30% |

| 11/30/2016 | 10% | 31% |

| 12/30/2016 | 10% | 31% |

| 1/31/2017 | 10% | 31% |

| 2/28/2017 | 11% | 31% |

| 3/31/2017 | 11% | 31% |

| 4/28/2017 | 11% | 32% |

| 5/31/2017 | 11% | 31% |

| 6/30/2017 | 10% | 31% |

| 7/31/2017 | 11% | 32% |

| 8/31/2017 | 11% | 31% |

| 9/29/2017 | 11% | 31% |

| 10/31/2017 | 11% | 31% |

| 11/30/2017 | 11% | 31% |

| 12/29/2017 | 11% | 30% |

| 1/31/2018 | 11% | 30% |

| 2/28/2018 | 11% | 30% |

| 3/30/2018 | 11% | 30% |

| 4/30/2018 | 11% | 30% |

| 5/31/2018 | 11% | 30% |

| 6/29/2018 | 10% | 30% |

| 7/31/2018 | 10% | 31% |

| 8/31/2018 | 10% | 31% |

| 9/28/2018 | 10% | 31% |

| 10/31/2018 | 10% | 31% |

| 11/30/2018 | 10% | 30% |

| 12/31/2018 | 11% | 30% |

| 1/31/2019 | 11% | 31% |

| 2/28/2019 | 11% | 31% |

| 3/29/2019 | 11% | 31% |

| 4/30/2019 | 11% | 31% |

| 5/31/2019 | 11% | 31% |

| 6/28/2019 | 11% | 30% |

| 7/31/2019 | 11% | 30% |

| 8/30/2019 | 12% | 30% |

| 9/30/2019 | 12% | 30% |

| 10/31/2019 | 12% | 30% |

| 11/29/2019 | 12% | 30% |

| 12/31/2019 | 12% | 29% |

| 1/31/2020 | 13% | 29% |

| 2/28/2020 | 13% | 29% |

| 3/31/2020 | 13% | 30% |

| 4/30/2020 | 13% | 29% |

| 5/29/2020 | 14% | 29% |

| 6/30/2020 | 14% | 29% |

| 7/31/2020 | 15% | 28% |

| 8/31/2020 | 15% | 28% |

| 9/30/2020 | 14% | 28% |

| 10/30/2020 | 14% | 28% |

| 11/30/2020 | 14% | 28% |

| 12/31/2020 | 14% | 27% |

| 1/29/2021 | 14% | 27% |

| 2/26/2021 | 13% | 28% |

| 3/31/2021 | 13% | 28% |

| 4/30/2021 | 13% | 28% |

| 5/31/2021 | 14% | 27% |

| 6/30/2021 | 13% | 28% |

| 7/30/2021 | 14% | 27% |

| 8/31/2021 | 14% | 27% |

| 9/30/2021 | 13% | 27% |

| 10/29/2021 | 13% | 27% |

| 11/30/2021 | 13% | 27% |

| 12/31/2021 | 14% | 27% |

| 1/31/2022 | 14% | 26% |

| 2/28/2022 | 14% | 26% |

| 3/31/2022 | 15% | 26% |

| 4/29/2022 | 15% | 26% |

| 5/31/2022 | 14% | 26% |

| 6/30/2022 | 14% | 27% |

| 7/29/2022 | 14% | 26% |

| 8/31/2022 | 14% | 26% |

| 9/30/2022 | 14% | 27% |

| 10/31/2022 | 14% | 27% |

| 11/30/2022 | 14% | 26% |

| 12/30/2022 | 15% | 26% |

| 1/31/2023 | 15% | 26% |

| 2/28/2023 | 15% | 26% |

| 3/31/2023 | 15% | 25% |

| 4/28/2023 | 15% | 25% |

| 5/31/2023 | 15% | 25% |

| 6/30/2023 | 15% | 26% |

| 7/31/2023 | 15% | 25% |

| 8/31/2023 | 15% | 25% |

| 9/29/2023 | 15% | 25% |

| 10/31/2023 | 16% | 26% |

| 11/30/2023 | 16% | 25% |

| 12/29/2023 | 16% | 25% |

| 1/31/2024 | 16% | 25% |

| 2/29/2024 | 16% | 25% |

| 3/29/2024 | 17% | 25% |

| 4/30/2024 | 17% | 25% |

| 5/31/2024 | 17% | 24% |

| 6/28/2024 | 17% | 24% |

| 7/31/2024 | 18% | 25% |

| 8/30/2024 | 18% | 24% |

| 9/30/2024 | 19% | 24% |

| 10/31/2024 | 20% | 23% |

| 11/29/2024 | 19% | 23% |

| 12/31/2024 | 19% | 23% |

| 1/31/2025 | 20% | 24% |

| 2/28/2025 | 20% | 24% |

| 3/31/2025 | 22% | 23% |

| 4/30/2025 | 22% | 23% |

| 5/30/2025 | 22% | 23% |

| 6/30/2025 | 24% | 23% |

As political uncertainty and geopolitical risks continue to fuel safe-haven demand, this purchasing momentum has also lifted prices: gold surpassed $4,000 an ounce for the first time ever in October 2025.

Why “More Gold than Treasuries” Matters

Crossing above Treasuries signals that reserve managers are prioritizing durability, portability, and neutrality over yield.

According to the IMF, gold’s share of global reserves climbed to about 18% in 2024, up sharply from mid-2010s levels, reflecting a structural reweighting toward tangible assets.

Seen as an alternative to heavily indebted fiat currencies, especially the U.S. dollar, the share of gold in central bank reserves has increased most among emerging market economies. China, Russia, and Türkiye have been the largest official buyers over the past decade.

If you enjoyed today’s post, check out U.S. Dollar Index Falls 10.1% in 2025, Steepest Drop in Three Decades on Voronoi, the new app from Visual Capitalist.

Tyler Durden Fri, 10/10/2025 – 23:00

Source: https://freedombunker.com/2025/10/10/central-banks-now-hold-more-gold-than-us-treasuries/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.