Chinese Stocks Crash After Beijing Seeks To Contain Bubble: What Happens Next

China’s equity rally lost steam in the past few sessions, with the Shanghai Composite sliding -1.3% and losing the 3800 level just 9 days after breaking above it and breaking out above the historic trendline we pointed out two weeks ago. The index is now down 3 days in a row, the longest such streak since May.

The sell off today was triggered by a Bloomberg report of China’s financial regulators mulling cooling measures for the market after a US$1.2t rally stoked worries of a speculative frenzy a la 2025 style. Policymakers are reportedly considering moves such as the removal of short-selling restrictions and the introduction of other measures to curb speculative trading.

To be sure, none of this is not new: as Goldman HK trader Fred Yin writes this morning, since late last week there were already signs that regulators are trying to cool the temperature on the rally. This however, did not come from the government – as a reminder, in China’s centrally planned markets everything is officially sourced – but from “people familiar” so this is almost certainly a plant by someone who missed the China rally and hoped to spark a selloff to get in cheaper. It also expains why the National Team stepped in at the close today to lift stocks – why would they do that if they wanted to hammer the bubble risk?

In any case, some brokers last week raised its margin requirement although it was not an industry-wide action, while over 400 mutual fund products have either announced a halt or cap in subscriptions in August. CSRC Chair Wu Qing signaled determination to ensure stock market stability at a symposium this past weekend, pledging to consolidate the “positive momentum” of the market, while promoting “long-term, value, and rational investing”.

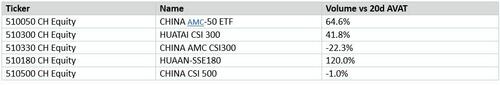

Sure enough, Goldman points out that a list of ETFs favored by state-backed funds (“National Team”) saw elevated volume vs 20d average (translation: China was actively stepping in to prop up markets). However it was nothing extreme, suggesting the correction is still within comfort level for regulators

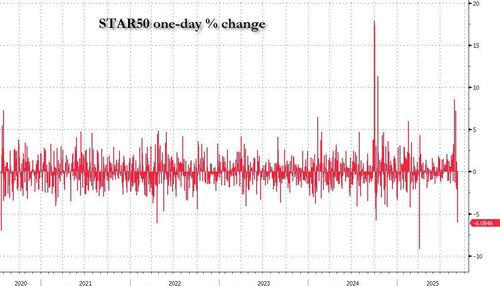

Tech/innovation names were most hard hit: STAR50 had its 4th largest single day loss since inception in Jul 2020

AI infrastructure / data centers / semis / humanoid robots all suffered losses, result of perhaps extreme crowdedness

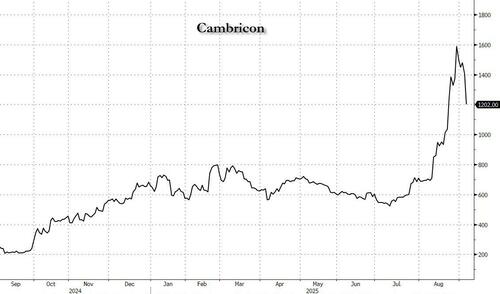

Cambricon (which we profiled two weeks ago as China’s Nvidia) sank 14.5% on the day, bringing its YTD gains to just +82.7%

Adding to the risk-off sentiment, Chinese auto giant BYD (002594) cut its annual sales target by 16% due to intense competition and cooling demand, resulting in -3% slide and extending the recent selloff.

There are some bright spots however: China Solar basket +2.3% was top performing theme after an executive from a leading polysilicon producer said the sector has likely bottomed out

Over on the Goldman high touch execution desk, Yin writes that China A was by far the largest net sold market in the region. Notional traded was over 2x the 4w daily average for a very busy day. The outflow was driven almost entirely by Long Onlies, selling concentrated within Consumer space, ongoing selling namely in EV space stood ou . In addition LOs also sold Industrials / Info Tech and only net bought Utils / Healthcare. Hedge Funds skewed seller too but in smaller size, focusing selling in Healthcare / Info Tech instead.

On the derivs desk, as broader market has corrected for 3 consecutive sessions and falling through 20dma, we are seeing two way traffic in spot (profit taking vs fresh dip buying). Also worth noting is the rotation in size factor since mid-August, which is to some extent correlated to quants performance. Futures basis reverts higher. Even though such inverse spot/basis dynamics observed recently dampens realize volatility, fixed strike vols are in strong bid over the day especially around the afternoon dip. Goldman thinks spot can continue to trade choppy due to thin spot/futures liquidity so convexity remains favorable to own, even though they seem hard to carry on a close-to-close basis.

Below are illustrative buy/sell flows in major markets on the bank’s high touch desk:

Source: GS GBM as of 4Sep25, past performance not indicative of future results

It is worth noting that with the notable exception of 2014-2015 “crazy bull” market rally, Chinese equity market has mostly kept pace with underlying economic conditions. Yet this time around things are showing early signs of stress, or as the Goldman trader puts it, “perhaps the market is getting slightly ahead of the fundamentals.” We were less politically correct:

We got ourselves another bubble folks. pic.twitter.com/5kDJmhPmHl

— zerohedge (@zerohedge) August 25, 2025

Upcoming data releases will be key to watch on whether the economic recovery is on track, including trade data (Sep 8), inflation (Sep 9), and new loan trends (Sep 12)

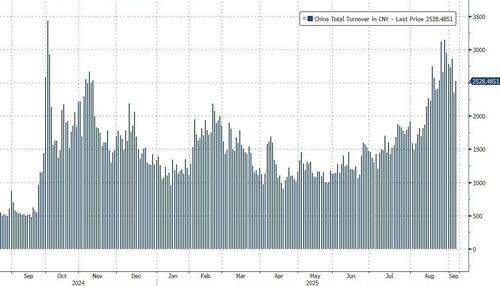

Taking a step back though, risk appetite remains positive, with activity level remaining extremely high. For a 17th day in a row, turnover in A shares exceeded 2t yuan, the longest stretch on record

Outstanding margin balance earlier this week climbed to 2.28t yuan, surpassing the previous record of 2.27t yuan record set in 2015.

Source: BBG as of 4Sep25, past performance not indicative of future results

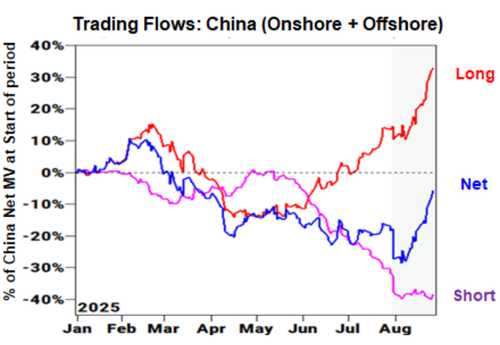

GS PB data shows Chinese equities last month with long buys dominating the flows.

A-shares led both net and gross activity. H-shares and ADRs saw net inflows led by short covers.

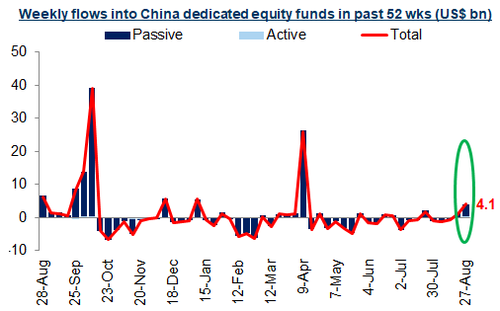

Flows into China equity funds picked up, with US$4.1b of net buying last week being the largest since Apr

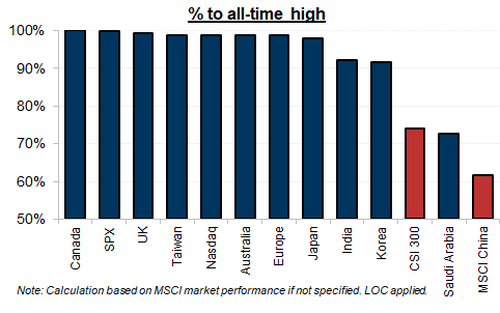

That’s still unlikely to meaningfully address the fact China is still the most U/W market for EM funds (active only)

This chronic U/W to China could trigger a flurry of inflows from global allocators, especially with other major markets trading close to ATHs

More in the full Goldman note available to pro subscribers in the usual place.

Tyler Durden Thu, 09/04/2025 – 10:45

Source: https://freedombunker.com/2025/09/04/chinese-stocks-crash-after-beijing-seeks-to-contain-bubble-what-happens-next/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.