The “Zombie Market” Vs NVDA Earnings

The sell-off last week exemplified a classic post-OPEX window of weakness, reinforced by Wednesday’s VIX expiration. With structural support somewhat removed, the market experienced a measured four-day decline from 6,455 to 6,345.

Then, Powell’s Jackson Hole speech on Friday delivered exactly the dovish tone markets were hoping for, triggering a sharp reversal that saw the SPX rocket from its morning lows near 6,385 to close around 6,467.

This rally was clearly amplified by options positioning: dealers who had been forced to sell into weakness from negative gamma below 6,400 suddenly found themselves buying back those same hedges as the market reclaimed positive gamma territory.

The sharp rally on Friday gained additional momentum from systematic strategies and vol-selling programs that had been waiting for exactly this type of policy clarity, with short-dated IV collapsing as the binary Jackson Hole event risk evaporated.

The Friday SPX close above 6,400 shifts the gamma landscape firmly into stabilizing and bullish territory, likely resuming the “zombie market” crawl we have observed throughout the summer.

Our positional analysis shows substantial positive gamma from 6,400-6,500, and the overhead target remains 6,500-6,505 due to resistance from the JPM Collar Trade.

The combination of declining realized volatility and persistent vol-selling strategies has created a feedback loop that supports the current market rally, though it also suggests the market has become increasingly dependent on continued low volatility to maintain current positioning levels.

NVDA earnings on Wednesday (8/27) is the next major event for traders to watch out for. This will largely determine whether the zombie market continues, or whether volatility ignites as the summer draws to a close.

Last Week: PLTR’s Reversal

While options positioning shifted from slight weakness to strength across the market, this evolving dynamic played out dramatically in individual names such as PLTR.

By mid-week, PLTR showed a pronounced negative gamma profile as the stock tumbled over 16% from Monday to Wednesday morning.

The negative gamma concentration became less severe near the major 140 strike, where the stock found support during Wednesday’s sell-off.

This negative gamma profile then facilitated a reversal for PLTR, as downward pressure from dealers suddenly flipped to buying pressure as the stock began to bounce, reclaiming the 155 Hedge Wall and securing more stabilizing flows. Ultimately, this dynamic helped launch PLTR up 10% from Wednesday’s lows to the Friday close.

This Week: All Eyes on NVDA

This week presents a critical inflection point for the broader market with NVDA earnings on Wednesday (8/27) and PCE data on Thursday (8/29) serving as two events that could validate or challenge the bullish, low-vol narrative.

Looking at Nvidia’s gamma profile ahead of earnings, dealers appear to be long gamma across most of the implied 5.91% move range ($167-$188), with the current price of $178 resting amidst overall positive gamma.

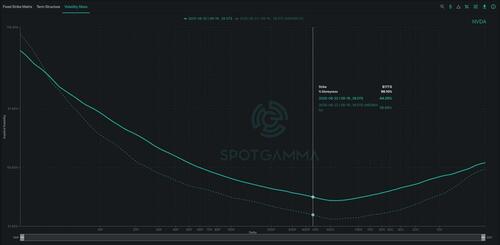

However, NVDA’s volatility skew tells a more defensive story: with 25-delta puts trading at significantly higher implied volatility than equivalent calls, traders are paying much greater premium for downside protection ahead of earnings.

Analysis from SpotGamma’s FlowPatrol report reveals institutional positioning that reflects optimism-with-caution. Buy-side funds appear defensively positioned, utilizing complex spread structures rather than outright bullish bets.

Heavy use of call vertical spreads (158/175 strikes with $49.5M sold premium vs $22.6M bought), diagonal spreads rolling positions forward, and weekly vertical credit spreads (180/190 strikes) all suggest institutions expect limited upside surprise and are prioritizing risk management and premium collection over directional exposure.

If NVIDIA’s results prove market-friendly and align with the dovish Fed narrative, we’re likely back to the “zombie market” again — characterized by low volatility, positive dealer gamma, and grinding price action that could persist until September OPEX.

Post J-Hole

At any point moving forward should SPX break under 6,400 this market could get pretty nasty, as that is where negative gamma comes in.

Further, that downside action would clash with volatility expectations that are de minimus – so VIX/vol would jump.

We read this as downside is wide open into 6,150. The current best case scenario is a move to 6,525 to the upside, which also syncs with QQQ needing ~2% upside to match the ATH set into Aug OPEX.

* * *

Trade with an edge using SpotGamma to see how options flow impacts stocks in real-time.

Tyler Durden Mon, 08/25/2025 – 09:05

Source: https://freedombunker.com/2025/08/25/the-zombie-market-vs-nvda-earnings/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.