Is Bitcoin Going Cheech And Chong A Bad Sign

By Michael Every of Rabobank

Stocks are at record highs again. Yet there are good and bad reasons for them, and other assets, to be getting high: and counter to the common adage, it’s arguably better if they are doing so on their own supply rather than anybody else’s. Allow me to explain.

Let’s start with the list of potential new Fed Chair candidates expanding to encompass most of the current FOMC –which will do wonders for the team ethic there, and perhaps for views on rate cuts(?)– as well as to market commentators who didn’t think there was any sign of underlying inflation in the last CPI report. Even Yellen’s name was mentioned as a potential candidate by one newsfeed, which says a lot about newsfeeds. For conventional types, this matters. Yet to repeat yesterday’s message, do you actually think a hawk will be appointed?

Treasury Secretary Bessent just stated he wants to see Fed Funds 150 to 175bps lower after backing a 50bps cut at the next meeting: President Trump said Fed Funds should be 1%. As such, focusing on which individual gets the hot seat rather than the hotline that will soon run from the White House to the Fed seems to miss the forest for the trees.

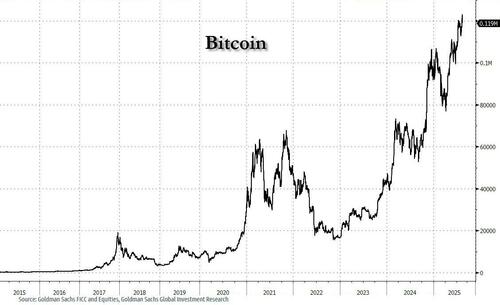

What a lower Fed Fund rate would mean for inflation remains to be seen: but Bitcoin is seeing it, perhaps. It too is at a record high.

But back to supply. Bessent just suggested the US could use the Nvidia “15% fee” model with other industries, so higher tax revenues which may lean against inflation. Moreover, he also reiterated that the vast pledges of inward investment struck with recent US trade deals –$7-8 trillion including those from firms– are a form of ‘private sector sovereign wealth fund’ which D.C. will direct in order to reindustrialize the US. I didn’t hear “because markets” there: did you? Michael Kao correctly uses the term I’d floated in a purely European context as political sugar-coating to a bitter trade pill to swallow: a “Reverse Marshall Plan.” In other words, “We rebuilt you after winning WW2 and the Cold War; now rebuild us, not China, to ‘save the West’.”

Of course, the same counterparties and commentariat who pooh-poohed the idea of paying higher US tariffs before doing so are pooh-poohing this idea too: “It isn’t state investment.” “You can’t compel people to do it.” Right: and the Trump tariffs aren’t a FTAs, but the US is collecting the tariff money anyway “because realpolitik, not markets.”

What if this at-gunpoint wall of capital arrives over the next ten years, alongside US tariffs and low US rates?

If no economic statecraft tools are used to ensure liquidity flows to the supply side, we could see an inflationary boom in which most assets (except bonds and the US dollar) would do well in nominal terms, then a bust.

If statecraft tools are used –Bessent is talking about “directing” foreign capital, and presumably the new Fed Chair will be open to the idea for domestic capital(?)– then we could see initial inflation in some areas, then lower prices alongside higher supply. That’s where stocks getting high would be healthy, and the dollar would likely follow.

So, is Bitcoin going Cheech and Chong a bad sign? Possibly. Yet US economic statecraft is in place, and those who look ahead are thinking of when $tablecoins and Bitcoin enter the mix to further strengthen the US geoeconomic arm. In short, wait and see.

Either way, the spread of potential macro/market outcomes from shifts in geoeconomics and geopolitics are arguably far more important than who the next Fed Chair is, at least compared to how things worked until recently.

Tellingly, after talks with EU leaders, President Trump said there will be “very severe” consequences for Russia if President Putin won’t agree to a real ceasefire tomorrow, and that he won’t trade territory, which implies the risk of real market consequences so far only being felt by India. (‘Trump’s Tariffs Stymie India’s Bid to Steal Manufacturing From China’, says the Wall Street Journal, where “When companies realized they needed to diversify away from China, India was the natural choice. Now, US tariffs threaten that.” – unless a deal is made.)

Yet while that sounds like a red line, ‘Trump to offer Putin minerals for peace’ says The Telegraph), including opening up Alaska’s natural resources to Moscow, as well as Ukraine’s lithium that the US has a deal to develop –but is Russia really short of resources?– as well as lifting some of the US sanctions on Russia’s aviation industry, benefitting Boeing.

Meanwhile, among a flurry of eye-popping Middle East statements and developments, Europe is threatening ‘snapback sanctions’ if Iran doesn’t return to nuclear talks. While this isn’t as dramatic as developments earlier this year, and is dwarfed by what will happen in Alaska, it underlines how energy geopolitics remain to the fore.

As does trade, where we continue to see shifts in where supply comes from.

China’s rejection of US AI chips may be explained by Reuters reporting that the US has been secretly placing tracking devices in shipments of said tech to “catch diversions to China”: from the Beijing standpoint is the thinking that if they can do that then they might be able to do Hezbollah-pager-and-walkie-talkie like things too?

The Free Press just drove this home the other way round in warning ‘Chinese EVs overtaking America are a potential ‘weapon of war’ and “Specifically: Their built-in surveillance systems –loaded with cameras and sensors– could allow the cars to capture data that could then be passed on to the Chinese military.” China banned Teslas from operating in some areas there for similar reasons years ago.

Also worth noting in terms of how supplies arrive is the White House threatening retaliation against any countries backing shipping’s net-zero emissions plan: not only is this about differing views on the environment, but on an international body where the US has little influence setting standards that will require mass new green shipbuilding… in China, which now dominates the industry, at a time when the US also wants to push back there for national security reasons.

Anyway, back to more speculation on who sits in Powell’s chair (and likely far less on the rebuilding of the de facto institution which that chair, and many others, sit in).

Tyler Durden Thu, 08/14/2025 – 10:50

Source: https://freedombunker.com/2025/08/14/is-bitcoin-going-cheech-and-chong-a-bad-sign/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.