Is A Second Wave Of Inflation Coming?

Authored by Jeffrey A. Tucker via The Epoch Times (emphasis ours),

Commentary

The Trump administration has been urging a cut in interest rates. The reasons are obvious. This would make home loans more affordable, reduce pressure on government interest payments, and spur business investment.

But there is a genuine downside that should also be considered. Lower rates also risk fanning the flames of inflation. Even now, the devastation from the last five years is very obvious to all. And it’s hardly gone: the CPI came in fairly hot last week.

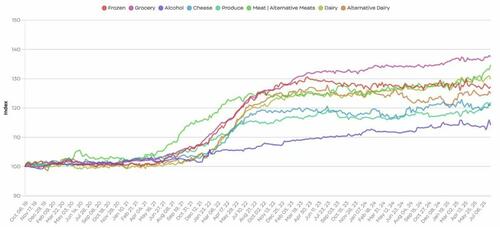

In three to four years, the prices of everything have shot up. You know the story with housing prices: double in many places. You feel it every time you go to the grocery store. Meat has again taken an upturn. Groceries in general are up nearly 40 percent in these strange years. They are not going back either. We are stuck and the American household is squeezed as never before.

Groceries are particularly painful because you feel it every day.

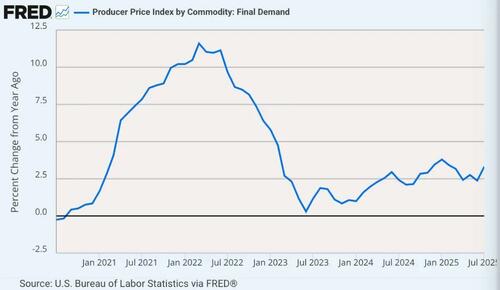

Wholesale prices reflected in the Producer Price Index (PPI) have shown new energy too. That’s particularly unsettling because it foreshadows new price pressure on the consumer side too.

The PPI came in at an intolerable 3.3 percent. That’s not entirely attributable to tariffs. In fact, all evidence points to the ways importers are eating the tariffs themselves via lower profit margins but this is not yet being passed on to consumers. The price energy on the wholesale side seems to have monetary origins.

David Stockman comments: “The wholesale price index excluding food and energy has risen by a fulsome 33.3 percent since January 2017 when the Trump Era began. That is, for the past eight and one-half years the basic wholesale price index has been climbing relentlessly higher at a 3.4 percent annual rate. Do that for two decades and a dollar earned or saved today will buy exactly 51 cents.”

Other indexes confirm some upward inflation pressure. The Truflation index has been the most credible of the last five years. It is also showing upward movement in consumer goods and services. It’s not over 2 percent in general but it is far higher than its low from January and February.

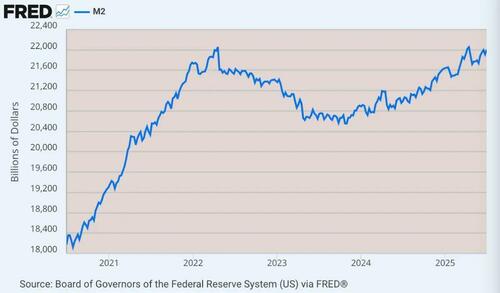

It’s a good time to check in on the main monetary aggregate, which is M2 (the Fed broke M1 back in 2020 for unknown reasons). This is the number to watch to see future price trends. The COVID period saw the biggest increases on record combined with zero interest rates. The Fed then vacuumed much of the excess out of the system. But those efforts then stopped before the 2024 election. The monetary aggregate now stands where it was at its peak.

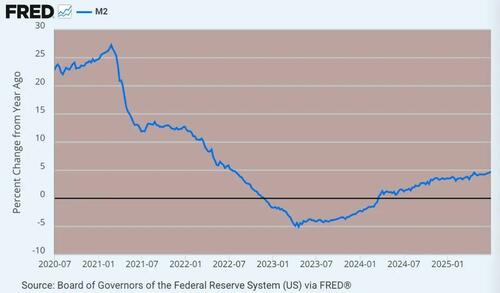

That said, we have seen an upward trend in the rate of money creation. It is now trending toward 5 percent, which is very high and risky. This is without rate cuts. With more rate cuts, the trends would accelerate.

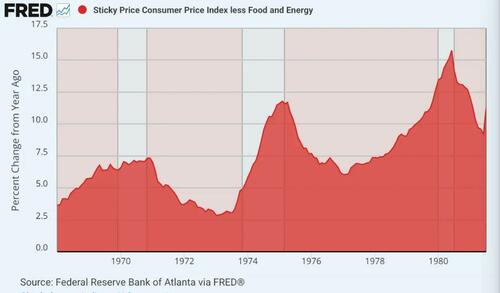

None of these numbers bode well for avoiding the worst fear of economists. The concern traces to the famous three waves of inflation from the 1970s. It kicked off, pulled back, came back higher and pulled back, and then the third wave hit with a ferocity that no one saw coming.

Anyone who lived through it will never forget. It came about following the end of the gold standard. The experts predicted the best monetary system ever. Once again, the experts were wrong. Then they blamed the American people for consuming too much.

Government was reduced to distributing WIN buttons: Whip Inflation Now.

None of this three-wave pattern was intentional. It traces to the arrogance of the central bankers in thinking that they had conquered the previous inflation. Once they believed the coast was clear, they lowered rates and pursued a looser policy. They could not control the machinery the way they believed and their actions kicked off a second wave.

One might suppose that would be enough to prevent yet another reckless cut but nope. They did it anyway. That’s when inflation hit double digits, gutted the U.S. capital stock, bankrupted households, and forced millions of young mothers into the workforce just to pay the bills. The finances of the American household never really recovered from this disaster.

We simply cannot afford to risk this yet again. Trump certainly does not want this on his watch. Another round of inflation would discredit the whole of his second term. It would likely be blamed on tariffs. This is the risk. One hopes that he does not get his wish of a Fed rate cut. Nothing could be worse for his presidency.

In this way, Jerome Powell is correct to resist the calls for a rate cut. He is not being ornery. He is the rare case of a responsible central banker, at least for now. The worry is that his replacement will have one job only and that is to lower rates further. Keep in mind that in real terms, short-term rates are not actually high right now once you consider inflation.

Monetary policy in general is an insidious influence over U.S. politics. Every new president wants lower rates in order to generate the appearance of higher growth. Also, lower rates reduce pressure to cut the budget because they cause the servicing of the debt to fall on the margin, thus freeing revenue for other forms of expenditures.

That said, there are always consequences to artificially low rates. They distort production structures toward capital goods industry, blow up housing prices with new demand, and further financialize an already highly leveraged financial industry. They also create the condition for more inflation down the line. It could be a year or two but it will eventually come.

This is the danger. The Trump administration needs to put a priority on killing inflation. The rumors of its death were greatly exaggerated, and the price pressure is already clawing its way out of the coffin and through the dirt. Beware! This is no time to lower rates. It’s in the long-term political interest of the Trump administration to generate economic growth the old-fashioned way: through saving and investment, not fiat money.

The second wave is not here yet. But there are already reasons to be on the lookout.

Tyler Durden Wed, 08/20/2025 – 06:30

Source: https://freedombunker.com/2025/08/20/is-a-second-wave-of-inflation-coming/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.