‘Hawkish’ FOMC Minutes Shows ‘Majority’ Fear Inflation More Than Employment

Since the last ‘dovish’ FOMC statement (and Powell’s post-statement ‘hawkish’ presser) on July 30th, we have had ‘cool’ payrolls print and ‘hot’ inflation prints with retail sales mixed… and now everyone is anticipating Friday’s speech by Powell at Jackson Hole. So, maybe these Minutes will be a nothingburger…

Source: Bloomberg

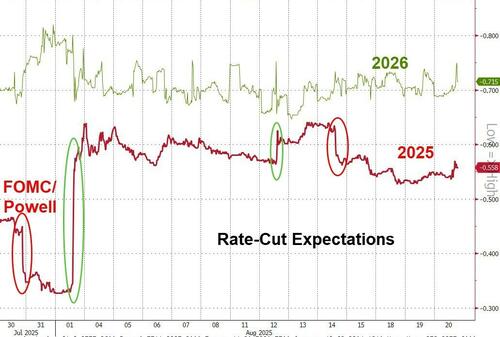

Overall, rate-cut expectations are higher…

Source: Bloomberg

…with September price-in as almost a done-deal for a cut…

Source: Bloomberg

Markets have generally gone nowhere in that time (except for crude prices, which have plunged on the heels of potential peace breaking out). Under the hood, there is some considerable pain in stock land (as momo and retail favorites have all suffered in recent days)

Source: Bloomberg

So, with two dissents (preferring to cut than hold), we anxiously await The Fed Minutes to see what Powell and his pals want us to know about the division within The (expensive) Eccles Building…

Key highlights from the Minutes (via Bloomberg):

The Minutes suggest members believe rates are not restrictive… Several Officials Said Current Rate May Not Be Far Above Neutral – Minutes

“Several participants commented that the current target range for the federal funds rate may not be far above its neutral level; among the considerations cited in support of this assessment was the likelihood that broader financial conditions were either neutral or supportive of stronger economic activity.”

But clearly they are front and center terrified about inflation:

Many Noted Full Effect Of Tariffs Could Take Some Time

“Participants judged that considerable uncertainty remained about the timing, magnitude, and persistence of the effects of this year’s increase in tariffs. In terms of timing, many participants noted that it could take some time for the full effects of higher tariffs to be felt in consumer goods and services prices. Participants cited several contributors to this likely lag. These included the stockpiling of inventories in anticipation of higher tariffs; slow pass-through of input cost increases into final goods and services prices; gradual updating of contract prices; maintenance of firm–customer relationships; issues related to tariff collection; and still-ongoing trade negotiations.”

Majority Saw Employment Risk Outweighed By Inflation Risk (remember this was prior to the payrolls revisions)

“Participants generally pointed to risks to both sides of the Committee’s dual mandate, emphasizing upside risk to inflation and downside risk to employment. A majority of participants judged the upside risk to inflation as the greater of these two risks, while several participants viewed the two risks as roughly balanced, and a couple of participants considered downside risk to employment the more salient risk.”

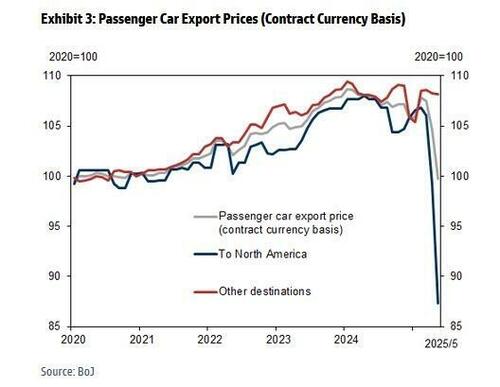

Despite zero evidence of this (and in fact the opposite – remember the Japanese automakers…) Several Expected Firms Would Pass Tariffs To Customers

“Several participants, drawing on information provided by business contacts or business surveys, expected that many companies would increasingly have to pass through tariff costs to end-customers over time. However, a few participants reported that business contacts and survey respondents described a mix of strategies as being undertaken to avoid fully passing on tariff costs to customers. Such strategies included negotiating with or switching suppliers, changing production processes, lowering profit margins, exerting more wage discipline, or exploiting cost-saving efficiency measures such as automation and new technologies.”

“few participants observed that evidence so far suggested that foreign exporters were paying at most a modest part of the increased tariffs, implying that domestic businesses and consumers were predominantly bearing the tariff costs

Few participants stressed inability to pass through price increases

A few participants stressed that current demand conditions were limiting firms’ ability to pass tariff costs into prices. Regarding inflation persistence, a few participants emphasized that they expected higher tariffs to lead only to a one-time increase in the price level that would be realized over a reasonably contained period. A few participants remarked that tariff-related factors, including supply chain disruptions, could lead to stubbornly elevated inflation and that it may be difficult to disentangle tariff-related price increases from changes in underlying trend inflation

The future is scary…

Several Flagged Risk Of Inflation Expectations Unanchoring

“Participants noted that longer-term inflation expectations continued to be well anchored and that it was important that they remain so. Several participants emphasized that inflation had exceeded 2 percent for an extended period and that this experience increased the risk of longer-term inflation expectations becoming unanchored in the event of drawn-out effects of higher tariffs on inflation.

Does this look like its ‘unanchored’?

But wait, there’s more fearmongering… Several Noted Concerns About Elevated Asset Valuations (We are surprised only ‘several’ saw that?

“The staff provided an updated assessment of the stability of the U.S. financial system and, on balance, continued to characterize the system’s financial vulnerabilities as notable. The staff judged that asset valuation pressures were elevated. In equity markets, price-to-earnings ratios stood at the upper end of their historical distribution, while spreads on high-yield corporate bonds narrowed notably and were low relative to their historical distribution. Housing valuations edged down but remained elevated”

Some Stressed Interplay between Tariffs and monetary policy

“Some participants stressed that the issue of the persistence of tariff effects on inflation would depend importantly on the stance of monetary policy.”

Some Expected Economic Activity To remains Solid

“Some participants noted that economic activity would nevertheless be supported by financial conditions, including elevated household net worth, and a couple of participants highlighted stable or low credit card delinquencies”

But, Several Saw Slowdown in the second half

“Participants observed that growth of economic activity slowed in the first half of the year, driven in large part by slower consumption growth and a decline in residential investment. Several participants stated that they expected growth in economic activity to remain low in the second half of this year.”

Many talked about stablecoins

“Many participants discussed recent and prospective developments related to payment stablecoins and possible implications for the financial system. These participants noted that use of payment stablecoins might grow following the recent passage of the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act). They remarked that payment stablecoins could help improve the efficiency of the payment system. They also observed that such stablecoins could increase the demand for the assets needed to back them, including Treasury securities. In addition, participants who commented raised concerns that stablecoins could have broader implications for the banking and financial systems as well as monetary policy implementation, and thus warranted close attention, including monitoring of the various assets used to back stablecoins.”

Read the full Minutes below:

Tyler Durden Wed, 08/20/2025 – 14:00

Source: https://freedombunker.com/2025/08/20/hawkish-fomc-minutes-shows-majority-fear-inflation-more-than-employment/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.