China Will Ask Firms Run By Central Government To Buy Unsold Homes

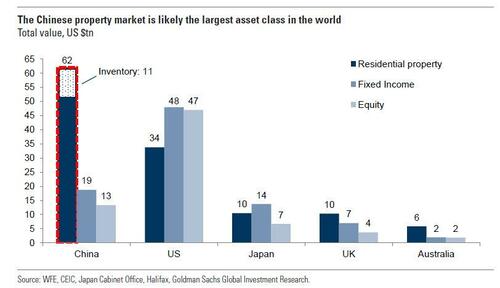

Once upon a time, China’s property market was – as this Goldman chart from 2020 shows – the world’s largest asset class.

Not any more. In fact, ever since the covid crash which saw a historic collapse in Chinese real estate prices and the wholesale implosion of the country’s property developers, Chinese housing has been a total and unmitigated disaster. And with most of the Chinese middle class wealth parked in the housing market, one can figure out why China’s economy has been a deflationary, deleveraging hot mess for the past 4 years.

It’s also why, every month or so, Beijing comes up with another hare-brained, zany or batshit insane scheme to reboot the housing market (without doing the one thing that would actually boost housing, namely flooding trillions of new loans into it). And according to the latest one, China will mobilize companies owned by the central government in Beijing to purchase unsold homes from distressed property developers, following the limited success of all previous initiative that relied on local governments, Bloomberg reported.

With China drowing in excess production of everything from cars, to solar panels to, well, apartments – which is the whole premise of the latest and greatest “anti-involution” campaign – regulators are planning to ask some of the biggest state-owned enterprises and bad-debt managers including China Cinda Asset Management to help clear the housing glut. Unfortunately, as has also been the case in all previous such overtures, there is simply not enough money to eliminate the problem of excess capacity: the firms will be allowed to tap 300 billion yuan ($41.8 billion) of funding that the central bank earmarked for the program last year. That’s about 9.7 trillion yuan short of what is actually needed to clean up the housing market.

The renewed effort, which is still under discussion, could help speed up the clearance of China’s 408 million square meters of excess inventory – larger than the size of Detroit - and ease the financial burden of the troubled developers. Officials are also considering scrapping a price cap for the program, in a bid to accelerate the process and improve the economics of the plan for both developers and state buyers.

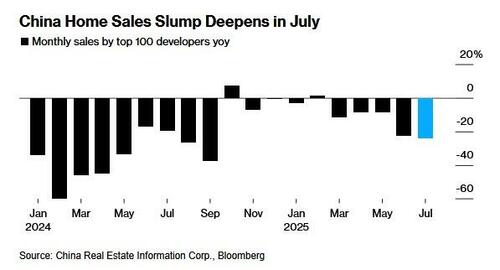

While the move to enlist bad-debt managers might help improve sentiment, the impact will be limited by the firms’ own stretched finances. The plan comes as China’s property sector hits a new low with the delisting of China Evergrande Group and new-home sales by the 100 largest developers falling more than 20% for two consecutive months.

The People’s Bank of China launched a nationwide relending program in May 2024 to help local state-owned companies buy unsold homes, and said a few months later it will ramp up the initiative. The initiative quickly went nowhere and was a total dud.

Last May, Bloomberg Economics estimated that there are about 60 million unsold apartments in the country, which will take more than four years to sell without government aid.However, progress has been especially slow with less than 6% of the announced loans approved so far. Acceleration of the program might be unlikely given a mismatch in the locations of unsold homes and demand for affordable housing.

Amusingly, when China’s property sector started falling into distress more than four years ago, Beijing also sought help from bad-debt managers. Regulators told firms including Huarong and Cinda to participate in the restructuring of weak developers, acquire stalled property projects and buy soured loans. Not long after, in glorious irony, Huarong itself imploded and had to be bailed out.

Then, in early 2023, the PBOC channeled 80 billion yuan of loans through the remaining bad banks to selected developers at an annual interest rate of 1.75%, while encouraging the bad banks to match that amount with funds from their own reserves. However, few projects were actually implemented under the policy, and its effect has been lackluster.

As a result, China’s efforts to put a floor under the years-long real estate slump have underwhelmed as domestic demand and the job market remain weak. And without a rebound in housing – and thus houehold wealth – any attempt to kickstart the economy is doomed to failure.

Meanwhile, terrified of adding to China’s already gargantuan debt load, regulators have yet to offer more drastic stimulus. Chinese President Xi Jinping called for the acceleration of a “new model” for property development at the Central Urban Work Conference last month, promoting a more balanced approach to urban planning and renovation, while falling short of some investors’ expectations for more aggressive measures.

The country’s home sales extended their slump in July as declining prices failed to attract buyers. Analysts including those from UBS Group AG have delayed expectations of China’s property recovery to mid-to-late 2026.

Tyler Durden Thu, 08/14/2025 – 17:20

Source: https://freedombunker.com/2025/08/14/china-will-ask-firms-run-by-central-government-to-buy-unsold-homes/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.