Bonds & Bullion Bid As Fed Chair Powell Delivers ‘Dovish’ Remarks From Jackson Hole

Update (1000ET): Well, Powell surprised many with a notably dovish tilt:

-

*POWELL: SITUATION SUGGESTS DOWNSIDE RISKS TO EMPLOYMENT RISING

-

*POWELL: SHIFTING BALANCE OF RISKS MAY WARRANT ADJUSTING POLICY

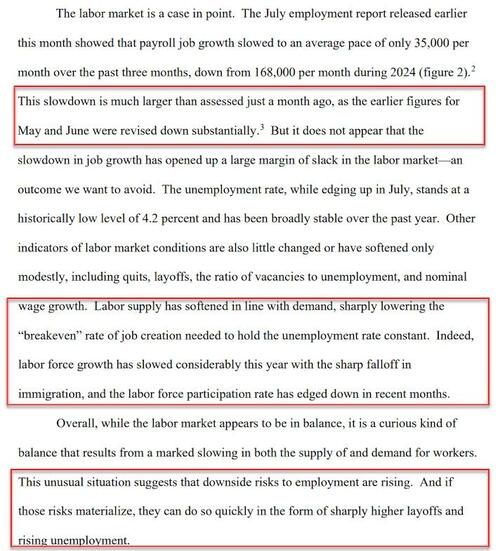

Powell recognizes that the employment picture is significantly worse…

Here’s the key paragraph:

Putting the pieces together, what are the implications for monetary policy?

In the near term, risks to inflation are tilted to the upside, and risks to employment to the downside—a challenging situation. When our goals are in tension like this, our framework calls for us to balance both sides of our dual mandate.

Our policy rate is now 100 basis points closer to neutral than it was a year ago, and the stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance.

Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.

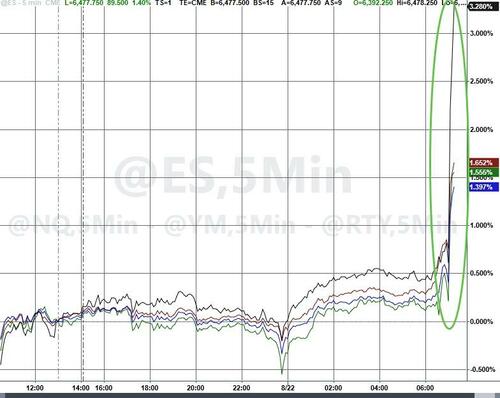

This sent stocks, gold, and bond (prices) higher…

Small Caps are leading the charge (up 3%)…

And the dollar notably lower…

And rate-cut odds spiked…

The rest of the statement is just Powell undoing FAIT policy from the 2020 Jackson Hole speech.

Full speech below:

* * *

The big day has finally arrived as Fed Chair Powell delivers what will be his last speech from the wilds of Wyoming.

The big question here is whether he will specifically set up a September rate cut. At his last press conference, on July 30, Powell declined to tip his hand on whether he expected to move in September.

At that July press conference, Powell highlighted that several economic reports were due before the September meeting.

“We’ll be taking that information into consideration and all the other information we get as we make our decision at the September meeting,” he said back then.

What have the reports shown?

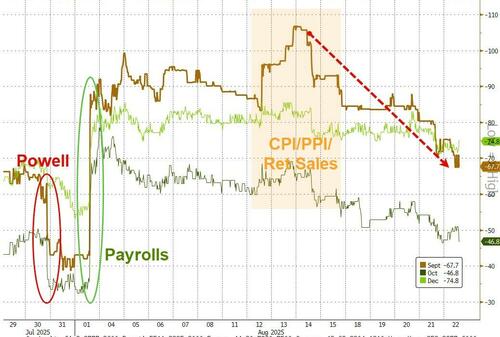

Most memorably, that the job market looks much weaker than it did on July 30.

Major data revisions showed the average three-month payroll gain went from 150,000 before the July employment report to just 35,000.

Amid much speculation of what he will offer up to the market gods amid the summer doldrums, Goldman Sachs expects Powell to modify his statement from the July FOMC press conference that the FOMC is “well positioned” to wait for more information.

Instead, he might note that the FOMC is well positioned to address risks to both sides of its mandate but emphasize that downside risks to the labor market have grown following the July employment report, while reiterating that tariffs are likely to have only a one-time effect on the price level.

We expect the FOMC to partially reverse some of the changes it made in 2020, as it has foreshadowed in the minutes to its recent meetings.

Specifically, we expect the FOMC to return to saying that it will respond to “deviations” from maximum employment in both directions rather than just to “shortfalls” or to at least water down the shortfalls language and to return to flexible inflation targeting (rather than flexible average inflation targeting) as its main strategy while retaining the option to use a make-up strategy at the zero lower bound.

Bottom line, Goldman does not expect Powell to decisively signal a September cut, but the speech should make it clear to markets that he is likely to support one.

We suspect that most FOMC participants who have expressed mixed feelings about cutting in September will be willing to support a cut if Powell pushes for one, but that he will think it more reasonable to make that case to them closer to the meeting with more data in hand

Additionally, Academy Securities, Peter Tchir expects Powell to push back on the “labor market is weak” narrative (which Tchir continues to believe is true and why the Fed should be cutting in September).

Economists seem to be honing in on a “replacement rate” level of hiring, in the 50k to 80k range.

That seems low and if discussed, will likely agitate the President as numbers less than 100k as the level of hiring required to keep the unemployment rate stable, just don’t seem that exciting.

Even if the Fed plans to cut, they would like it to be a bit of a surprise (keeping the probability of a rate cut at the next meeting closer to 50 than 100 likely suits them best).

If Powell is able to convince markets jobs are comfortable but inflation isn’t, look for bond yields to go higher, dragging stocks down with them.

Some of this already has been priced in, so the move should be “normal” in size, rather than some outlier.

Recent news on the AI/Data Center side seems to have slowed the excitement for investing in those sectors a little this week.

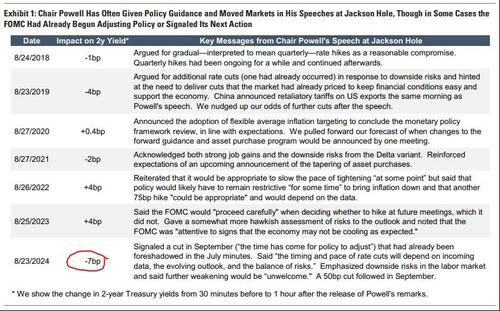

The market’s reaction to Powell’s has been varied over the years…

Watch the full speech live here (due to start at 1000ET):

Meanwhile, here’s a Bingo Card to play along (via Bloomberg)

Tyler Durden Fri, 08/22/2025 – 09:45

Source: https://freedombunker.com/2025/08/22/bonds-bullion-bid-as-fed-chair-powell-delivers-dovish-remarks-from-jackson-hole/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.