Might Lower Rates Be The Cure For Higher Prices?

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

The Fed is resisting interest rate cuts to help soften inflation to its 2% target. Supporting their policy is the belief that high interest rates lead to lower inflation. Most investors assume that the Fed is all-knowing and that its theories are logical. Are they? Might they be wrong, and lower interest rates are what is needed to reduce inflation?

To wit, economist John Maynard Keynes once said:

The difficulty lies not so much in developing new ideas as in escaping from old ones

Science, of which the field of economics is included, is about uncovering knowledge. In the process, truths are often discarded as falsehoods, and new truths become accepted as facts. Albeit, in most cases, they too prove temporary.

For example, these “facts” that were once highly regarded as truths:

-

The Earth is flat and the center of the universe.

-

Heavy objects fall faster than lighter ones.

-

Housing prices always increase.

-

Trickle-down economics works.

Let’s follow Keynes’s advice and “escape” Fed ideas that most people believe are truths and consider a counterintuitive theory on rates and inflation. Ironically, this exercise rests on a white paper written by the St. Louis Fed almost ten years ago.

Milton Friedman

To help us appreciate the predominant inflation logic used by the Fed and most economists, we need to consider the work of economist Milton Friedman. He may be best known by his statement:

“inflation is always and everywhere a monetary phenomenon.”

In other words, price changes are a function of the money supply. His theory was put into practice by the Fed and other central banks in the late 1970s when inflation was raging. Simply, central bankers managed the money supply in their attempts to control inflation.

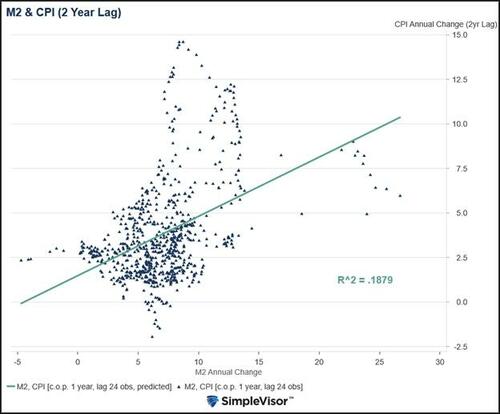

The scatter plot below charts the annual changes in CPI and the money supply (M2) since 1970. We lag CPI by two years, as it provides the most robust statistical relationship, albeit one that is relatively weak, as indicated by its R-squared value. The reason for the poor correlation is that monetary velocity, a measure of how quickly money circulates throughout the economy, is also a key driver of inflation.

Central bankers realized the relationship between the money supply and inflation is weak. Accordingly, many central banks started targeting interest rates instead of the money supply.

While the instrument used to steer inflation has changed, the impact is similar.

All money is lent into existence. Thus, if interest rates are higher, less money will be desired to be borrowed, and the growth in the money supply should slow. Conversely, with lower rates, borrowing becomes more incentivized, and the money supply is expected to grow faster.

Neo-Fisherism

While using the money supply or interest rates to control inflation may seem sensible, the practice has failed. We only need to look back at the post-financial crisis era for evidence.

Throughout much of the decade following the financial crisis, the Fed and many other central bankers struggled to achieve their target inflation rates. This was despite setting interest rates at or near zero, and in some cases, even at negative rates. In addition, QE was a regular mainstay during the period.

In 2016, Stephen Williamson of the St. Louis Fed wrote an article entitled Neo-Fisherism: A Radical Idea, or the Most Obvious Solution to the Low-Inflation Problem?

He sums up the central bankers’ problem as follows:

Now, in 2016, these central banks are typically experiencing inflation below their targets, and they seem powerless to correct the problem. Further unconventional monetary policy actions do not seem to help.

The article discusses the potential for a significant flaw in ZIRP (zero interest rate policy) and QE, the Fed’s tools for generating inflation.

Irving Fisher And The Neo-Fisherites

Williamson’s paper rests on the shoulders of economist Irving Fisher. Fisher provided tremendous insights into how interest rates, the money supply, and inflation expectations shape economic expectations.

In the mid-2010s, Williamson and other economists, known as Neo-Fisherites, presented a straightforward argument to central bankers. Economist and journalist Noah Smith summed up their theory as follows:

But what if QE had the opposite of the intended effect? That is the claim of a small but well-credentialed group of macroeconomists that I once labeled the “Neo-Fisherites,” after the famous monetary economist Irving Fisher. These economists wonder if quantitative easing reduced inflation, instead of increasing it as many feared it would. The Neo-Fisherites go even further than that — they wonder if low interest rates, which we usually think of as being inflationary, are actually deflationary!

Neo-Fisherite Theory

The Neo-Fisherite theory that interest rates and inflation have a positive correlation, not a negative one, is based on the following Fisher formula:

R = r + π

R (Nominal interest rates) = r (real interest rates) + π (expected inflation)

The following paragraph is from Stephen Williamson’s article.

Then, suppose that the central bank increases the nominal interest rate R by raising its nominal interest rate target by 1 percent and uses its tools (intervention in financial markets) to sustain this forever. What happens? Typically, we think of central bank policy as affecting real economic activity—employment, unemployment, gross domestic product, for example—through its effects on the real interest rate r. But, as is widely accepted by macroeconomists, these effects dissipate in the long run. So, after a long period of time, the increase in the nominal interest rate will have no effect on r and will be reflected only in a one-for-one increase in the inflation rate, π. In other words, in the long run, the only effect of the nominal interest rate on inflation comes through the Fisher effect; so, if the nominal interest rate went up by 1 percent, so should the inflation rate—in the long run.

The gist of his argument is interest rate changes can directly impact the economy and inflation in the short run. However, in the long run, inflation expectations exert a greater influence on inflation.

His graph below shows that when the interest rate (blue) rises, the real rate (less inflation- red) increases one for one. But, over time, the real rate declines as expected inflation (green) increases.

Have Rates Been Too High For Too Long?

The biggest problem with this graph is that it lacks dates or periods on the X-axis. Thus, we are left with the vexing question: over what period do inflation expectations have a bigger impact than the declining benefits from the change in rates?

There is no definitive answer to the question, as many variables impact inflation, most of which are challenging to account for. For instance, might monetary velocity become swayed by inflation expectations, causing inflation to be sticky?

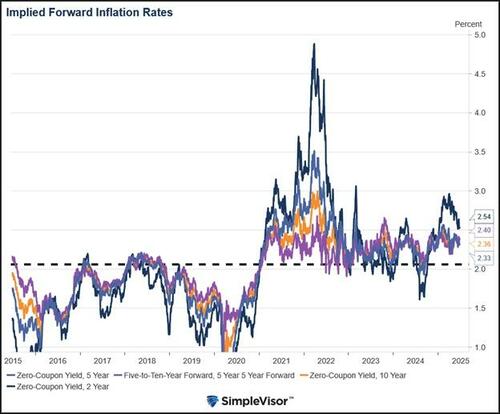

Is it possible that the Fed, through its elongated high-interest rate policy, is causing inflation expectations to remain above pre-pandemic levels?

The graph below illustrates a notable shift in inflation expectations before and after the outbreak of inflation in 2021.

Summary

Williamson asks:

If the central bank wants inflation to go down, then it should decrease the nominal interest rate target.

We do not doubt that inflation expectations are contributing to inflation being higher than it otherwise would be. However, we also know that high interest rates are subduing economic activity, which weighs on demand and ultimately inflation. The housing market is a great example.

If the Fed were to follow Williamson’s advice and cut rates, it would potentially risk a short-term spurt in inflation due to the marginal positive economic benefit of lower interest rates. In the long run, however, inflation expectations could fall, and with it, inflation.

Our advice to Powell is to consider both sides of the argument. Furthermore, don’t give in to political expediency and act to lower inflation in the long term.

Tyler Durden Thu, 07/10/2025 – 08:05

Source: https://freedombunker.com/2025/07/10/might-lower-rates-be-the-cure-for-higher-prices/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.