Insurers Request Huge Obamacare Rate Hikes, Many Over 20%

Authored by Mike Shedlock via MishTalk.com,

Medical care costs are surging already. A big leap is coming.

Health Care Shock Coming

The Wall Street Journal reports Obamacare Insurers Seek Double-Digit Premium Hikes Next Year

If you buy your own health insurance, you are probably going to pay more next year—a lot more.

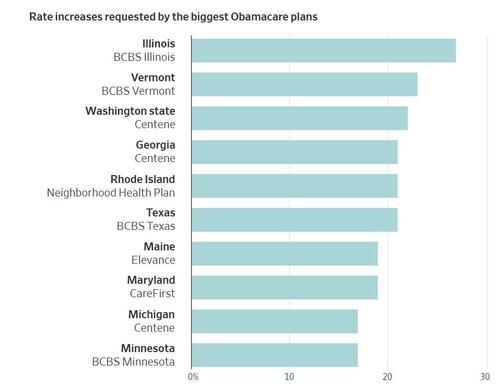

Insurers are seeking hefty 2026 rate increases for Affordable Care Act marketplace plans, the coverage known as Obamacare. Blue Cross & Blue Shield of Illinois wants a 27% hike, while its sister Blue Cross plan in Texas is asking for 21%. The largest ACA plans in Washington state, Georgia and Rhode Island are all looking for premiums to surge more than 20%.

The companies say the big increases are needed because of higher healthcare costs and changing federal policy, including cuts to subsidies that help consumers pay for plans. The higher premiums would come after years of enrollment growth and mostly single-digit rate increases in the Obamacare market, where individuals and families buy insurance for themselves. About 24 million people have ACA plans.

At the request of The Wall Street Journal, the health-research nonprofit KFF analyzed the rate requests for the largest ACA plans by enrollment in 17 states where the insurers’ filings have already become public, as well as the District of Columbia. They showed that some of the biggest national ACA players, including Centene and Elevance Health, are seeking double-digit increases in several states. The Blue Cross & Blue Shield plans of Texas and Illinois are both owned by Health Care Service, a giant nonprofit.

Most Obamacare enrollees’ monthly insurance bills will go up substantially next year because of reductions in federal subsidies that help pay for their coverage. Enhanced payments passed by Congress in 2021 will lapse at the end of December. The drop-off in subsidies is both helping to drive higher premiums and making it harder for many consumers to pay them.

Some people “are going to be hit with this double whammy” of bigger monthly insurance bills and losing the subsidy that blunts their cost, said Cynthia Cox, a vice president at KFF.

In rate filings, some insurers said tariffs could add to the cost of drugs and medical supplies.

Health Insurers Are Becoming Chronically Uninvestable

Also consider Health Insurers Are Becoming Chronically Uninvestable

After a rough 2024, insurers are warning that 2025 won’t be better. The trouble started when industry giant UnitedHealth Group UNH ousted its chief executive and withdrew its outlook in May, blaming higher costs in Medicare Advantage. Then, earlier this month, Centene CNC pulled its guidance, citing a sicker-than-expected population on plans under the Affordable Care Act, or Obamacare. And this week, Molina Healthcare cut its profit forecast, citing cost pressure across all its government plans, including Medicaid.

The trouble has sent shares of insurance companies plunging. This also comes as the recently passed tax-and-spending package is set to cut more than $1 trillion in healthcare spending over a decade.

Some might see an opportunity to buy the dip. But value can only be measured if you can trust company numbers—and increasingly, investors can’t. “Against a backdrop in which executives are being increasingly challenged by sharp changes in the industry, it becomes harder for investors to make educated decisions,” said Jared Holz, healthcare strategist at Mizuho Securities.

The core problem is that the assumptions insurers rely on to price plans—how many people will enroll, how sick they will be and how much care they will use—are no longer holding up. Medical usage has surged and become more volatile in the postpandemic landscape. Changes to how insurers and providers are allowed to bill and code care have eroded margins for payers. And the mix of healthy and sick enrollees in government-sponsored plans is shifting, as millions fall off insurance rolls.

The reasons each government program is struggling might differ, but the bigger picture is the same: Surging medical costs are outpacing what the government is willing to pay.

Over the past four years, most large managed-care companies have lost investors money. UnitedHealth, Centene, CVS, Elevance and Humana HUM are all down over that stretch. Of the major competitors, only Cigna CI has delivered a positive return. The reason? It steered clear of the government-heavy business lines now under pressure. Cigna left Medicare Advantage and has focused instead on commercial plans sold to employers.

Will This Show Up in the CPI?

Only partially. The CPI only covers prices directly paid by consumers.

To the extent Medicare, Medicaid, and corporate plans pick up the costs of these premium hikes, the CPI will not pick up the jumps.

AI Overview

In the United States, around 65.4% of the population has private health insurance, which includes both employer-sponsored plans and direct-purchase plans. A significant portion of these individuals pay a portion of their premiums, with employers typically covering a large percentage. For instance, employers pay on average between 82-85% of individual coverage costs and 67-75% of family coverage costs, according to Wellhub.

Other sources of coverage include Medicaid (18.9%), Medicare (18.9%), TRICARE (2.6%), and VA and CHAMPVA (1.0%).

The CPI will only reflect the percentages directly paid by consumers.

Your costs may jump 24 percent but the CPI will only reflect a tiny bit of that.

CPI Weights

-

Medical Care Services: 6.736 percent of total CPI

-

Medical Care Commodities: 1.516 percent of total CPI

Tell anyone who pays their own insurance that medical care services is only 6.7 percent of their budget and they will think you are on mars.

But that’s what the BLS says after factoring in the percentages paid by Medicare, Medicaid, and employer coverage.

What About the PCE?

The Personal Consumption Expenditures (PCE) price index is the Fed’s preferred measure of inflation.

The PCE overweighs health care and underweights shelter relative to the CPI. And shelter was one of the CPI bright spots.

PCE does include prices paid on behalf of consumers. Since Medicare and Medicaid are underpriced, the PCE is understated as well. But the PCE will pick up employer costs.

In June, medical care services jumped 0.56 percent in the CPI. That will have a bigger impact in the next PCE report.

A year ago June, the PCE rose 0.12 percent month-over-month. Anything higher will cause the year-over-year PCE price index to rise.

Year-over-year the CPI rose by 0.3 percent in June. Expect something similar for the PCE price index. I am not as optimistic as the Cleveland Fed Inflation Nowcast.

My Conclusion

Healthcare costs will rise more than will be reflected in either the CPI or PCE, but especially the former.

Tyler Durden Sun, 07/20/2025 – 14:00

Source: https://freedombunker.com/2025/07/20/insurers-request-huge-obamacare-rate-hikes-many-over-20/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.