Can The US Avoid Recession? A Lot Depends On The Dollar

Authored by Simon White, Bloomberg macro strategist,

Near-term US recession risk is low, but there are pockets of weakness that could mutate into a downturn later this year. The weaker dollar, though, will be key to whether the US avoids that fate and stocks a significant decline.

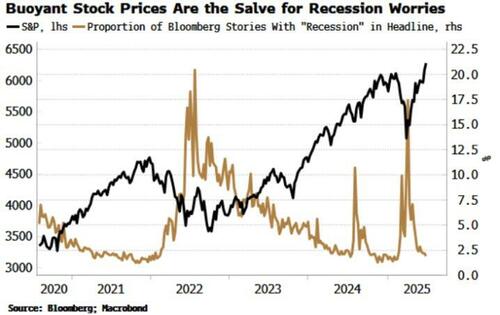

For now, it’s gone quiet on the recession front.

Not long ago, there was febrile speculation that a downturn was imminent, despite a lack of support from leading data.

Since then, the clamour has died down, and that can make one a little uneasy. Not necessarily because we should be worried about an imminent recession, but it does imply the market is now less prepared for bad news, which increases the likelihood of a disproportionate impact on asset prices.

My Recession Gauge – an amalgamation of 14 separate recession indicators – has fallen and is well under the activation threshold. But there are areas of weakness in the economy that could trigger anxiety and cause stock markets to drop, at least temporarily.

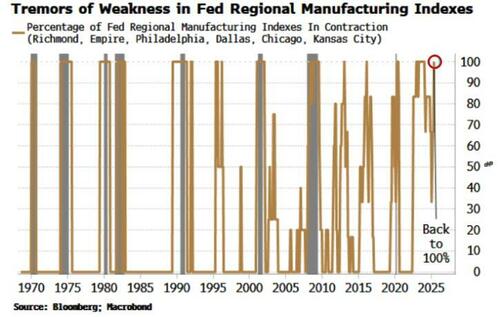

One notable point can be found in the Federal Reserve’s regional manufacturing indexes. Individually they are very volatile. But when they act in concert, they give a more reliable indication. The combined signal has recently jumped back to 100%, with all the indexes now in the contraction zone.

As we can see from the chart above, this particular data point has given a few false positives in the past, so it is not perfect. But equally it’s not something that should be ignored, as manufacturing is one of the most leading sectors in the economy. Moreover, recessions are pervasive. So a nationwide decline in manufacturing is best monitored.

We might also see other signs of economic weakness in the coming months. One point to focus on might be whether the rise in WARN (advance layoff) notices presages weakness in unemployment claims and the wider labour market. Another area to watch is the housing market, and whether that starts to become a wider problem.

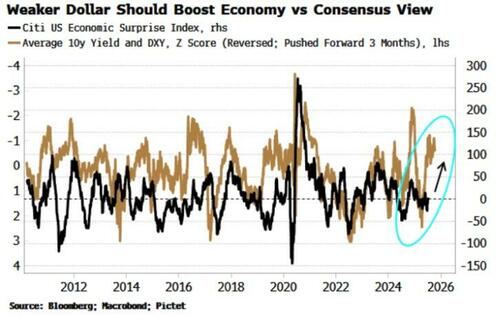

None of these guarantee a recession however, especially if the weaker dollar eases financial conditions to keep a downturn at bay. The drop in the US currency should also translate into a boost for stock earnings.

More broadly, though, dollar weakness and (at least for now) relatively stable yields are typically consistent with economic data improving relative to the consensus.

There are more malign effects from the weaker dollar also in the pipeline such as higher inflation, but at least through the rest of this year, it might be enough to forestall a return of recession angst.

Tyler Durden Fri, 07/11/2025 – 10:25

Source: https://freedombunker.com/2025/07/11/can-the-us-avoid-recession-a-lot-depends-on-the-dollar/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.