Shadow Fed Chair Waller?

By Elwin de Groot, head of macro strategy at Rabobank

European bond yields inched up by several basis points whilst equity markets took a breather following the oil-price inspired rebound as the truce between Iran and Israel appeared to hold. Along with a 3bp decline in US Treasury yields, the dollar index slipped to its lowest level in more than three years, as President Trump is considering to announce his pick for the next Fed Chairman earlier than planned.

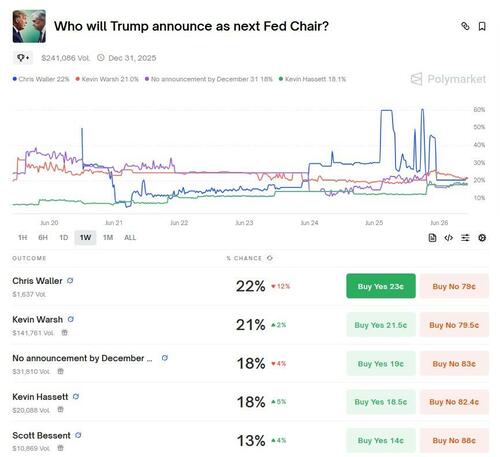

The Wall Street Journal writes this could be already in September or October, so well ahead of the official end to Powell’s term, which still has some eleven months to run. Even as Powell is likely to resist pressures to cut rates (quickly), an early nomination could undercut his ability to steer rates. Once his successor is known, markets will split their attention between Powell and the views of the next Fed chair. And whomever Trump picks, they are likely to be more dovish than Powell. Hence the distinct bend in the OIS forward curve in recent months with markets pricing in a higher probability of significant rate cuts over the course of 2026.

Other than that, a light data calendar on both sides of the Atlantic left market participants largely bound to the geopolitical news flow, in particular the NATO summit. To some extent, the latter even stole the show from the World Economic Forum, taking place in Tianjin, China this week.

After all the preparations and last-minute haggling between members, there was little doubt that the NATO summit was going to be successful. And, indeed, from a zoomed-out perspective, it was a success. Historic, even, by some standards. In its here. We basically assumed that in the coming years debt issuance will play a significant role, which is to be followed at some stage by fiscal consolidation. But the key message is also that to get sufficient ‘bang for the buck’, the design, execution and strategic patience will be the keys to success (or failure!) of these defense spending plans. That means leaving sufficient room for the European industrial complex to benefit from this spending, ensuring a coordinated approach (so that not everyone’s going to produce drones), make innovation with a significant ramp-up in defense R&D a key objective and ensure simplification of administrative processes, etc.

But, will there be sufficient (political) will in the future to consolidate after a debt binge? Or, if member states want to do this in a (budgetary) neutral way, how can they ensure that the economy doesn’t break down before they reach their strategic objective? Or how can Europe ensure that everyone meets their objective, and not just the countries with relatively sound debt-to-GDP ratios and the fiscal space (i.e. Germany)? So if you think that, somehow, this is not going to work then need to start thinking more out-of-the-box to ensure that funding will flow to the right sectors, that the financial burden is fairly distributed, and that these long-term security and defence objectives are ultimately reached without blowing up bond markets. There are no straightforward answers there, but the only suggestion I’d make is that at least we start thinking about this rather than just assuming that the current budgetary/financial framework we operate under can handle all this.

Tyler Durden Thu, 06/26/2025 – 11:00

Source: https://freedombunker.com/2025/06/26/shadow-fed-chair-waller/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.