BOJ Keeps Rates On Hold, Announces Tapering Of Taper

The first central bank to announce its decision this week (ahead of the Fed and BOE), overnight the BoJ kept rates on hold at 0.5% as widely expected in a unanimous vote after a two-day policy meeting, and provided limited new guidance on their assessment of macro conditions or on the timing of further rates hikes, punting due to uncertainty over tariffs. The key tension in their outlook continues to be between domestic conditions on inflation and wage growth evolving as expected, and a still highly uncertain backdrop from US and global policy on trade and other issues. Their tone on both of these issues was broadly unchanged from previous meetings.

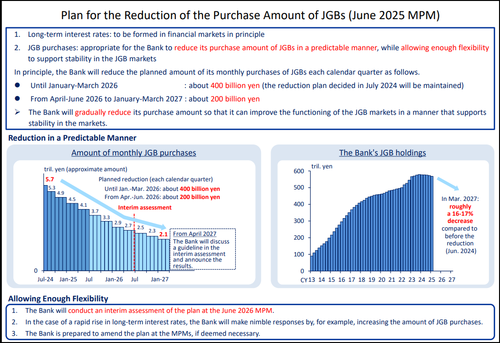

More importantly, the central bank announced that it intends to slow the rate at which it reduces its bond purchases next year: the BoJ signalled it would shift to a slower tapering in JGB purchases from April 2026 (also as expected), maintaining the current JGB purchase reduction guidance, reducing purchases by ¥400 bn per quarter until March 2026, and then continue reducing purchases at a slower pace of ¥200 bn per quarter, to reach around ¥2 tn per month in January-March 2027.

This action is likely aimed at minimizing market disruptions while still providing adequate support for the Japanese economy amidst economic uncertainty arising from US trade policies. Furthermore, the BOJ indicated that it will perform an interim assessment of the plan to reduce bond purchasing in June 2026.

The JGB purchase plan for the upcoming July-September period, released at the same time, showed that the BOJ will maintain the monthly purchase for the ultra-long sectors, and reduce purchases mainly in the medium- to long-term sectors.

The board’s decision follows a recent plunge in long-dated JGBs that rippled across global debt markets.

The BOJ began to reduce its bond purchases in August, five months after ditching its negative interest rate and yield curve control program. The need to subsequently fine tune the quantitative tightening plans is a fairly common occurrence for central banks including the Federal Reserve given the need to maintain market stability and avoid upending the economy. Still, the scale of the BOJ’s balance sheet against Japan’s output stands at around 120%, far bigger than the corresponding ratios for the Fed and the European Central Bank.

“We made our decision to ensure we’re not cutting purchases too fast in a way that would cause a negative impact on the economy through abnormal volatility in yields,” Ueda said at a press briefing after the decision.

As Goldman notes, the BOJ result was announced right after PM open and the result was inline with investors’ expectation. The yen fluctuated in a relatively narrow range against the dollar following the announcement while bonds fell, nudging yields higher on debt across maturities from two- to 40-years.

While the central bank’s decision showed it is aware of the need to carefully calibrate its paring of bond purchases, it also demonstrated a determination to reduce its footprint in the debt market. In that sense, the BOJ remains firmly on a path of normalization despite the high level of uncertainties in a world shaken by trade wars and intensifying conflict in the Middle East.

The new plan helps address recent volatility in the market while maintaining some flexibility, said Shinichiro Kobayashi, chief economist at Mitsubishi UFJ Research and Consulting, noting that the plan doesn’t even take effect until next year. “While balancing those two points with this decision, the BOJ remains on its tightening path.”

In an illustration of the central bank’s intention to keep moving out of the market and to stick to a largely predictable path, it will continue cutting monthly purchases at the current quarterly pace before the new plan kicks in next April.

Traders will watch to see if the central bank’s shift to smaller reductions in next year’s plan helps calm the market. The Ministry of Finance may also offer some reassurance to investors over the coming days, if it signals a reduction in its issuance of super-long bonds, as is expected by economists. Ueda said he was in close contact with the government over the BOJ’s bond purchases.

“The ball is now on the government’s side to calm the bond market,” said Mari Iwashita, executive rates strategist at Nomura Securities Co.

As Bloomberg noes, concerns about the future trajectory of Japan’s spending plans and its bond issuance persist ahead of a national election next month. Prime Minister Shigeru Ishiba is already on the back foot with a minority government that relies on some opposition support to pass legislation. Lowering Japan’s sales tax has become a rallying call for parties outside the ruling coalition ahead of the vote, a move that would further squeeze the nation’s finances.

With next year’s bond-buying plan now out in the open, BOJ watchers also scrutinized Ueda’s comments on the timing of the next rate hike given the ongoing strength of inflation. Japan’s key monthly inflation indicator showed prices rising at 3.5% in April while rice, the nation’s staple food, has nearly doubled of late, helping harden inflationary views among households.

BOJ officials see prices rising a little stronger than they previously expected, people familiar with the matter told Bloomberg earlier this month even before oil prices surged on deepening Middle East tensions. That’s a factor that may open the door to discussions over whether to raise interest rates if the impact from global trade tensions appears manageable.

A meeting between Trump and Ishiba on Monday in Canada failed to deliver a trade deal that can reduce the uncertainties on trade. But no deal was probably preferable to a bad deal for Ishiba ahead of the election. Still, if the two sides can reach an agreement, that may open the path for the central bank to mull its next rate move.

“It’s not appropriate for me to comment on the likelihood of a rate hike in the near future, but I’d like to see how hard data pan out,” Ueda said.

“The BOJ will be watching Japan’s trade talks with Trump and Ishiba’s election as vital points but it’s hard to imagine both of them turn rosy in time for a move in July,” Iwashita said. “The moment of truth for a rate hike will probably come from around September when data will likely start to show the impact of tariffs”

Tyler Durden Tue, 06/17/2025 – 09:30

Source: https://freedombunker.com/2025/06/17/boj-keeps-rates-on-hold-announces-tapering-of-taper/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.