What’s Behind Ethereum’s Recent Price Surge?

Authored by James Hunt via TheBlock.co,

Ethereum has lagged behind Bitcoin and alternative Layer 1s throughout this cycle amid a wave of relative bearishness.

And yet, since the crypto market’s April lows, ETH has surged nearly 100% – gaining 65% in the last 30 days alone to tap $2,750, back above pre-election levels (and key technical levels).

So what’s driving the move?

Analysts at research and brokerage firm Bernstein, led by Gautam Chhugani, said in a Wednesday note to clients that several narratives have been put forward attempting to explain this performance.

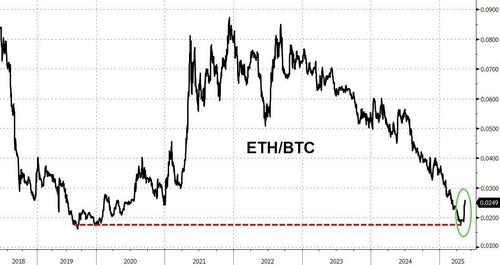

While bitcoin claimed all-time highs, crossing the psychological $100,000 barrier, the ETH/BTC ratio has dropped 45% over the past year as bitcoin dominated store-of-value mindshare amid the success of Bitcoin exchange-traded funds and corporate treasury adoption, while retail flows shifted to faster Layer 1s like Solana, the analysts wrote.

Ethereum, caught between its Layer 2 roadmap and limited ETF traction comparatively, was “stuck somewhere in the middle,” they added – neither the best store of value, nor the best blockchain destination for speculative retail trenches.

Stablecoins and tokenization, Layer 2 institutionalization, and an ETH short unwind

However, according to the analysts, the narrative is beginning to change amid a boom in stablecoin and securities tokenization, Layer 2 institutionalization, and an ETH short unwind.

The cycle is expanding beyond store-of-value use cases, they said, with stablecoin payments and tokenized securities gaining real traction.

Stripe’s $1.1 billion acquisition of stablecoin platform Bridge and Meta’s recent comments about reigniting its stablecoin venture are helping to bring back a focus on the underlying blockchains, and Ethereum — which holds 51% of the total stablecoin supply — is emerging as the key platform proxy for this growth trend, they added.

Traditional finance giants like BlackRock and Franklin Templeton are also advancing adoption of a real-world asset tokenization market now valued at over $22 billion, according to RWA.xyz — with Ethereum again dominating deployment.

Secondly, while critics question the value accretion of Layer 2s to ETH, the Bernstein analysts said that with networks like the Coinbase-incubated Base earning revenue of around $84 million last year, Ethereum Layer 2s are taking a growing role in institutional crypto infrastructure. With Robinhood’s recent acquisition of WonderFi — which also runs an Ethereum Layer 2 — brokers may soon offer tokenized equities on their own chains, they argued. Since these Layer 2s use ETH for gas and settlement, they help drive Ethereum demand and position it as a leading platform for institutional smart contract adoption, they added.

Finally, the third driver of ETH’s recent outperformance is more tactical, in the analysts’ view. Over the past 12 to 18 months, crypto hedge funds have often used ETH as a delta-neutral hedge – staying long BTC and SOL while shorting ETH. But as the narrative shifts toward institutional adoption of blockchain and stablecoin payments, and beyond store of value, ETH’s role as the underperformer is becoming harder to justify, they said.

As a result, the resurgence of ETH and other non-bitcoin assets is good for crypto exchanges and broker-dealers, they argued, as a broader crypto market rally reinvigorates retail traders, driving stronger volumes.

Tyler Durden Wed, 05/14/2025 – 14:45

Source: https://freedombunker.com/2025/05/14/whats-behind-ethereums-recent-price-surge/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.