Amazon Tumbles On Soft AWS Revenue, Disappointing Profit Forecast

Ahead of Amazon’s earnings, and following two blowout results from the first two giga-cap companies MSFT and META, UBS said that the “fast money seems to be short Amazon into the quarter on AWS and North America sales growth, with no upward revisions on the print.” Meanwhile, the longer duration money “continues to like the story around AWS reacceleration, potential EBIT upside to Street, compelling valuation and potential AI theme around core ecommerce.” In short, there was a tension between the short-term traders and long-term HODLers.

Judging by the kneejerk reaction to Q1 earnings just released, the short-termers were right, with the stock dumping after reporting mixed Q1 earnings but it was the guidance that was really disappointing.

Here are the details:

-

EPS $1.59 vs. $1.86 q/q, beating estimate $1.36

-

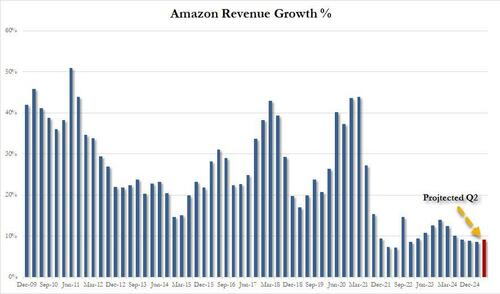

Net sales $155.67 billion, +8.6% y/y, beating estimates of $155.16 billion

-

Online stores net sales $57.41 billion, +5% y/y, beating estimates of $56.85 billion

-

Physical Stores net sales $5.53 billion, +6.4% y/y, beating estimates of $5.41 billion

-

Third-Party Seller Services net sales $36.51 billion, +5.5% y/y, missing estimates of $36.98 billion

-

Subscription Services net sales $11.72 billion, +9.3% y/y, beating estimates of $11.65 billion

-

-

North America net sales $92.89 billion, +7.6% y/y, beating estimate $92.63 billion

-

International net sales $33.51 billion, +4.9% y/y, beating estimate $33.07 billion

-

Third-party seller services net sales excluding F/X +7% vs. +16% y/y, beating estimate +6.92%

-

Subscription services net sales excluding F/X +11% vs. +11% y/y, beating estimate +8.86%

-

-

So far so good (with some exceptions).

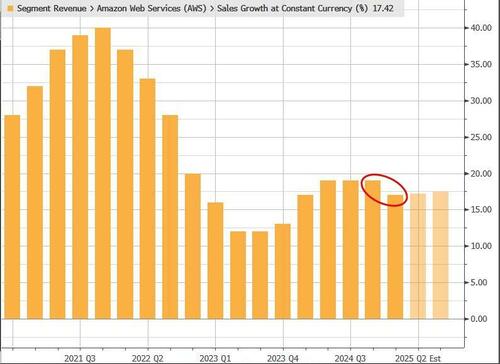

But what first caught the market’s attention first was Amazon’s AWS revenue, which came in just below estimates:

-

Amazon Web Service net sales $29.27 billion, +17% y/y, missing estimates $29.36 billion

-

Amazon Web Services net sales excluding F/X +17% vs. +17% y/y, also missing estimates +17.2%

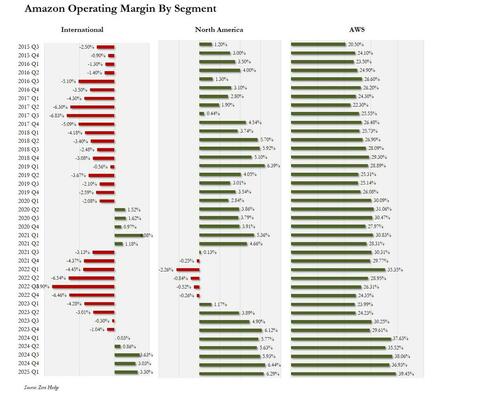

Turning to operating profits, here the results were uniformly solid:

-

AWS operating profit 39.45%, up sequentially from 36.83% and smashing estimates of 35.25%

-

Operating income $18.41 billion, +20% y/y, beating estimate $17.51 billion

-

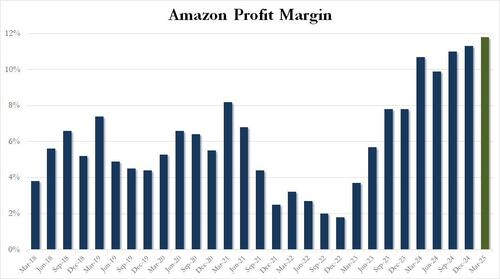

Operating margin 11.8% vs. 10.7% y/y, beating estimate 11.2%

-

North America operating margin +6.3% vs. +5.8% y/y, missing estimate +6.65%

-

International operating margin 3% vs. 2.8% y/y, beating estimate 2.96%

-

As for fulfillment expenses, these came in slightly above estimates, while the seller unit mix was slightly worse than expected. These will likely rise quite a bit in a tariff regime:

-

Fulfillment expense $24.59 billion, +10% y/y, higher than estimate $23.78 billion

-

Seller unit mix 61% vs. 61% y/y, worse than estimate 61.8%

Of the above, the most notable highlight – as per our preview – was AWS which grew revenue by 17% to $29.27BN, just below the sellside estimate of $29.36BN, and the first notable slowdown in the topline in two years.

Still, if revenue growth for AWS was a bit light, the record 39.5% margin more than offset it, beating estimates of 35.35%. Elsewhere, North American profit rose to $5.84 billion, resulting in a profit of 6.29%, if below the estimate of 6.65%. Meanwhile, international margins rose to 3.30% from 3.03%.

As a result of the jump in AWS profits, Amazon’s consolidated operating margin continued to grow impressively and in Q1 grew for a 4th consecutive quarter to a new all time high of 11.8%.

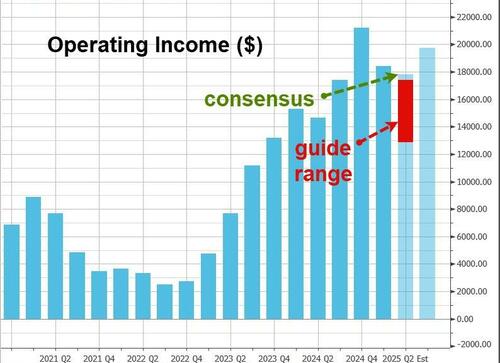

However, while the above data was mixed if generally solid, it was the company’s guidance that led to an after hours drop in the stock; that’s because the company projected profit and revenue in the current quarter both of which were seen as coming in soft vs Wall Street expectations:

-

Sees net sales $159.0 billion to $164.0 billion, in line with the estimate of $161.4 billion

-

Sees operating income $13.0 billion to $17.50 billion, below the estimate $17.82 billion, vs $14.7 billion in Q2 2024.

-

Guidance sees impact of about 10 basis points from FX

If accurate, that would mean that after revenue grew at the slowest pace since 2022 in Q1, the outlook sees revenue growth post a modest improvement, rising just over 9% in Q2.

But again, it was the subpar operating income forecast that was the big disappointment.

In response to the soft guidance and the disappointing AWS revenue growth, the stock initially pumped but then dumped…

Tyler Durden Thu, 05/01/2025 – 16:39

Source: https://freedombunker.com/2025/05/01/amazon-tumbles-on-soft-aws-revenue-disappointing-profit-forecast/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.