Super Micro Tanks On Disappointing Preliminary Results

Shares of Super Micro Computer plunged in premarket trading in New York after the U.S.-based technology company reported preliminary third-quarter results that missed Bloomberg Consensus estimates.

Analysts at JPMorgan do not believe the revenue miss signals a broader industry demand slowdown. Meanwhile, Goldman analysts recently revised their peak data center capacity forecasts forward from late 2026 to this year.

“During Q3 some delayed customer platform decisions moved sales into Q4,” Super Micro wrote in a business update and preliminary financial results press release on Tuesday evening, adding that it also saw “higher inventory reserves resulting from older generation products.”

Super Micro produces, designs, and manufactures high-performance servers, storage systems, and networking equipment. It’s a key supplier of data center hardware, and preliminary results may paint an ominous outlook for the artificial intelligence bubble.

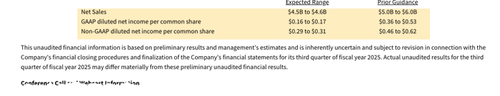

The preannouncement forecasted third-quarter revenue between $4.5 billion and $4.6 billion, with earnings per share of 29 to 31 cents — both well below the prior guidance of $5 billion to $6 billion in revenue and earnings per share of 46 to 62 cents.

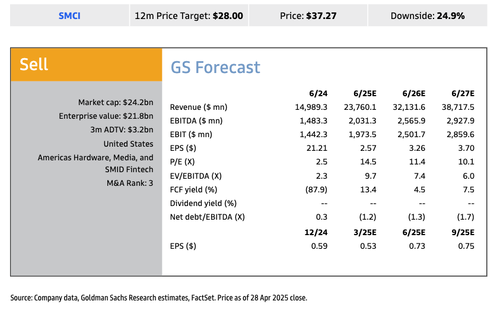

Goldman analysts Michael Ng and others provided their first take on the preannouncement:

Bottom line: SMCI should trade lower on the negative preannouncement which includes a revenue miss – at least in part driven by customer platform decision delays into next quarter – as well as a 220 bps gross margins qoq decline on higher inventory reserves on old products and new product expedite costs. We view read-throughs to the broader AI infrastructure group (e.g., DELL, ANET) as negative given the reference to platform decision delays and the gross margin pressure.

SMCI negatively pre-announced F3Q25 with a revenue, gross margin, and EPS miss. Revenue of $4.5-$4.6 bn missed GS/consensus of $5.3/$5.4 bn (prior guidance of $5.0-$6.0 bn) with SMCI citing customer delays into F4Q. Gross margins of 9.7% declined 220 bps qoq and reflected higher inventory reserves from older generation product and expedite costs to enable time-to-market for new products. EPS of $0.29-$0.31 missed GS/consensus of $0.53/$0.53 (prior guidance of $0.46-$0.62). SMCI will have its earnings call on May 6 after-market.

Ng is “Sell” rated on Super Micro …

Here’s additional analyst commentary on Super Micro (courtesy of Bloomberg):

Bloomberg Intelligence

- “Super Micro’s preannounced 15% 3Q sales miss vs. prior guidance is indicative of a reliance on mega-AI deals,” but “sustained product-design wins suggest AI-server activity could still be intact, despite economic concerns”

JPMorgan (neutral, PT to $36 from $39)

The magnitude of the Super Micro miss is not representative of industry-wide challenges

“Given the limited visibility around the opportunity for SMCI to completely catch up to the revenue push-out in the next quarter”

Citi (neutral, PT $39)

- “The company cited gross margin declined 220bps qq (Street at 12.0%) on higher inventory reserves and expedite costs, while some customer platform decisions were delayed, shifting sales to 4Q”

Lynx Equity Strategies

“Investor concern is obviously going to be whether the much- anticipated AI capex cuts” is hurting SMCI, but “we do not think there has been a fundamental change in end market dynamics”

“Whereas there could be some churn in orders from data centers, we think the US-based nature of SMCI’s production renders their shipments to US customers relatively safe”

Remember last year, when Super Micro delayed its annual report and Ernst & Young abruptly resigned as auditor — a double whammy that sent shares crashing.

As of Tuesday’s close, shares remain 70% below the all-time high of nearly $120 a share, established in early 2024. Shares have yet to recover – and crashed more in premarket on the negative preannouncement, down around 18% at the $29 handle.

Will end with pointing readers to Goldman’s note from three weeks ago, which highlights that the peak data center capacity forecast was revised and brought forward (read: here).

Tyler Durden Wed, 04/30/2025 – 08:05

Source: https://freedombunker.com/2025/04/30/super-micro-tanks-on-disappointing-preliminary-results/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.