JPMorgan Responds To The Fed: There Is A Liquidity Crisis Right Now

Earlier this morning Apollo’s Torsten Slok laid out the following three reasons why bond yields are soaring:

-

With the yen, euro, and Canadian dollar strengthening at the same time, this could be foreigners selling US Treasuries.

-

With the VIX at elevated levels around 50, there is a lot of hedging activity going on, and it could, therefore, be risk reduction among large asset managers managing rates, credit, and equities.

-

With almost $1 trillion in the basis trade, it could be an unwinding of the basis trade among levered hedge funds.

We have discussed 2, and especially 3, quite extensively before, and while 1 is certainly realistic we will have to wait for counterparty data from China (and everyone knows how credible Chinese data is) to get confirmation. But, we agree with Slok that selling by foreign powers, especially China, is likely. It certainly is likely on Friday when, as the chart below shows, the move in the swap spread (i.e., basis unwind) is insufficient to explain the move higher in yields, which means at least part of the move can be attributed to China selling.

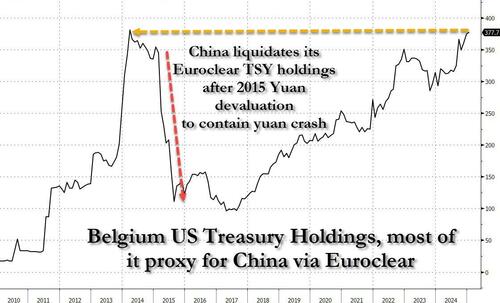

Which brings up an interesting point: we already discussed how China’s central bank, the PBOC (which of course is joined at the hip with the CCP) is doing everything in its power to bolster Beijing in its trade war, be it propping up the market by purchasing record amounts of ETFs/stocks, to making sure the yuan doesn’t crater, and is actively buying the currency (through intermediary banks) while selling the dollar. And, by extension, China is securing the funds it needs to support the currency by selling US treasuries it holds in its reserve, whether domestically or in Belgium via Euroclear… where it appears total TSY holdings are now where they were just before China devalued the yuan in 2015 and liquidated its US paper to contain the subsequent yuan collapse. Expect a similar collapse if and when China devalues this time as Beijing will again scramble to avoid a much worse liquidation in the yuan.

Why does all of that matter?

Simple: at least on China’s side, it is clear that the central bank is doing everything in its power to prop up the government in its trade war with the US and give the impression that China is not getting crushed by the trade war through such primary indicators as the stock market and the currency. We discussed this two days ago in “Beijing Unleashes Record “Plunge Protection” Buying To Prop Up Stocks, Avoid Signaling Weakness In Trade War.”

Surprisingly, the Fed has so far refused to even consider doing the same on the US side. Quite the contrary, as NY Fed president John Williams said…

- *FED’S WILLIAMS SAYS CURRENT RATE STANCE REMAINS APPROPRIATE

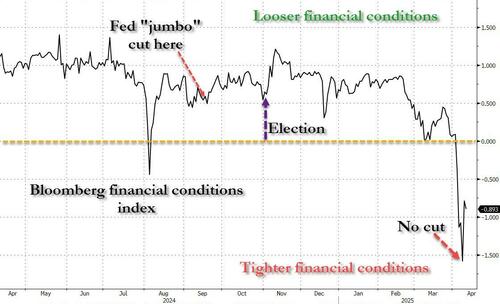

Which is amusing considering the Fed was “jumbo” cutting last September when financial conditions were massively looser and when forward inflation expectations were much higher than they are now.

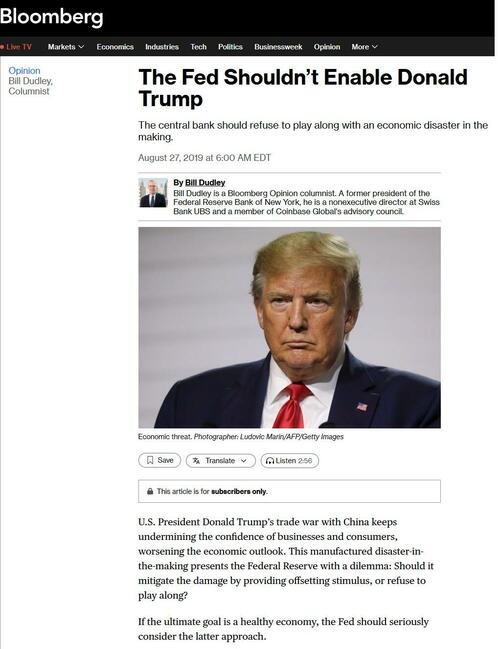

So why is the Fed not cutting now? This is also simple: the Fed, which has become extremely political – recall former NY Fed president Bill Dudley penned an op-ed during the peak of the first Trump trade war with China – in which he urged his former Fed colleagues not to stimulate and to crash the economy, in order to destroy Trump (no we aren’t joking).

But an unconditional denial of easing to Trump would be too obvious (especially one which is based on something as flimsy as UMichigan inflation expectations, the very same thing that Fed Chair Powell said during his last FOMC meeting to completely ignore), especially if and when the market went haywire and people start asking questions why the Fed is refusing to move as things start to break (like the basis trade for example).

Which brings us to escape clause: moments ago, the FT published an interview with Boston Fed president Susan Collins in which she said that “The Federal Reserve “would absolutely be prepared” to deploy its firepower to stabilise financial markets should conditions become disorderly, according to one of the central bank’s top officials” adding that the Fed “does have tools to address concerns about market functioning or liquidity should they arise”.

Great…. but – there is of course a but - Collins also said “markets are continuing to function well” and that “we’re not seeing liquidity concerns overall”.

In other words, the Fed has a liquidity put… there is just no liquidity crisis.

Only – even if one ignores the blow up of the basis trade which as we explained previously has soaked up all the market’s available liquidity - there is a liquidity crisis according to JPMorgan.

Below we excerpt from a note published this morning by JPMorgan’s Market Intel team, which quotes trader Marissa Gitler, in which she said that liquidity is now gone and that what happens next could be ugly.

While it’s important to take a fundamental stance on the macro environment, the declining liquidity picture is an important piece of the puzzle and it’s worth flagging. To put statistics around it: Top-deck bid-ask for ESM5 and TYM5 are both roughly -80% worse than the 20d market average. These are historically two of the most liquid contracts in global macro markets. The top-deck in UX1 is roughly -95% worse. There appears no recovery this morning either.

De-leveraging and deterioration of macro sentiment has morphed into a situation in which liquidity dynamics are now meaningfully impaired in liquid markets. The lack of liquidity could result in price moves that are outsized relative to the amount of flow that is actually going through. This is in BOTH directions – significant bounces can take place ‘on air’ while it could similarly lead to unruly market outcomes to the downside. This is important context as we head into risk events such as UST auctions, the FOMC Minutes, CPI, and, realistically, just every minute of the trading day now as we are subject to Tariff tape bombs.

She concludes as follows:

Equity turmoil has been fairly transparent via the selloff in indexes globally, but yesterday [April 8] the conversation rapidly flipped from equities back into the fixed income world as UST yields surged meaningfully led by the long end. It’s pretty impossible for anyone to predict where we go from here (myself included), but deterioration of the broader liquidity framework is never a great setup for risk markets.

So while the Fed may ignore warnings by entities – such as this website – that liquidity is gone, imagine a world where there is a full-blown funding crisis, banks are failing and the Fed is blamed for ignoring not just the all too clear signs, but also ignoring a warning from the largest US bank, JPMorgan.

That is not a world that Jerome Powell, no matter how much he wants to listen to Bill Dudley and crush Donald Trump, would want to be in.

More in the full JPMorgan note available to pro subscribers.

Tyler Durden Sat, 04/12/2025 – 07:16

Source: https://freedombunker.com/2025/04/12/jpmorgan-responds-to-the-fed-there-is-a-liquidity-crisis-right-now/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.