Futures Rise, Dollar Slides After Tech Tariff Pause

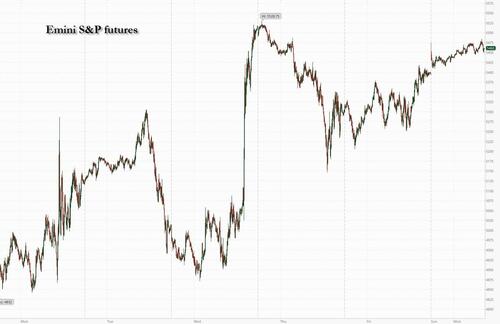

US equity futures are higher, part of a global risk-on rally, after President Trump paused import duties on a range of consumer electronics over the weekend (even as he clarified on several occasions the pause is only temporary). As of 8:00am, S&P 500 futures are up 1.5% while Nasdaq 100 contracts climb 1.9% with Mag7 names are all higher led by AAPL (+4.9%); Semis and Cyclicals outperforming, too; Goldman Sachs was 2.7% higher after its first-quarter earnings. The global risk on rally has meant a broadly positive European and Asian session as well. That said, volatility remains front and center among asset classes, with the VIX holding around 33 and similar gauges for bond and currency swings also staying elevated. The dollar fell for a fifth day as Trump warned that a specific levy for electronics will be announced later; DXY remains at the 100 level, aiding international indices in outperforming the S&P. US bonds retraced some of last week’s losses, pushing 10-year yields down to 4.43% in a bull-steepening move. Commodities are mixed with Energy/Base Metals higher, precious lower, and Ags mixed. Trump is set to give more color on tariffs later today but markets like the delayed implementation at a time when positioning is cleaner. Macro data this week is focused on Retail Sales and Housing data, plus today’s NY Fed Inflation Expectations.

Phone, computer and chip stocks rallied in premarket trading after the tariff reprieve, with Apple gaining more than 5.5% and Nvidia rising about 3%. Other Mag-7 members also edged higher. Shares of semiconductor companies although President Trump subsequently said it is a temporary measure. Analysts see the exemptions as a relief, but caution the situation remains extremely volatile (Advanced Micro Devices +3.8%, Broadcom +2%, Qualcomm +2%). Here are some other notable premarket movers:

- Shares of US obesity drug developers are extending gains in after Pfizer (PFE) said it will stop developing its obesity pill due to a potentially drug-related liver injury. (Eli Lilly +1.9%, Viking Therapeutics +13%, Structure Therapeutics +13% Pfizer shares are about flat).

- Goldman shares were 1% higher after the bank’s stock traders posted their highest quarterly revenue haul on record, riding a wave of volatility triggered by an emerging global trade war that’s roiled financial markets.

- DuPont de Nemours (DD) rises 2.8% as KeyBanc turns bullish on the chemical company, with analysts saying that the firm’s strong balance sheet should allow it to weather a possible downturn in the economy.

- Intel Corp. (INTC) rises 3% as the company is nearing an agreement to sell a stake in its programmable chips unit, Altera, to Silver Lake Management.

- TMC the Metals Co. (TMC) climbs 18% and rare earths miner MP Materials (MP) gains 13% following a report President Trump is planning an order to enable the stockpiling of critical metals.

The late-Friday reprieve – exempting a range of popular electronics from the 145% tariffs on China and a 10% flat rate around the globe – is temporary and a part of the longstanding plan to apply a different, specific levy to the sector, the White House said. Still, a pause in the duties indicates a willingness by Trump to compromise on a deal, according to some analysts.

While the possibility of a softer policy toward technology companies was enough to lift shares, which have been some of the hardest hit this year, Wall Street strategists continued to warn clients about the troubles ahead. Citigroup Inc.’s Beata Manthey cut her view on US equities, and Morgan Stanley lowered its outlook for earnings.

“Consumer electronics is one of the largest portions of total imports from China to the US and will ease considerably the impact on companies like Apple,” said Derek Halpenny at MUFG. “But this will hardly help restore investor confidence much and the angst in the markets last week over confidence in the US Treasury bond market and the dollar is likely to continue.”

Morgan Stanley strategist Mike Wilson slashed his 2025 earnings estimates for the S&P 500 to $257 from $271, joining a wave of Wall Street banks warning that tariffs will curb profit growth. Citi’s Scott Chronert lowered his prediction for the S&P 500 to 5,800, from 6,500. Goldman’s strategists cautioned that liquidity has deteriorated sharply, contributing to the spike in volatility.

Citigroup strategists led by Manthey wrote that cracks in “US exceptionalism” will persist with the emergence of China’s DeepSeek artificial intelligence model, Europe’s fiscal expansion and rising trade tensions that will hit American companies harder than peers in Japan and Europe. They downgraded US equities to neutral from overweight. “The drivers of exceptionalism are fading, both from a gross domestic product and earnings-per-share perspective,” the strategists wrote. “The US market remains relatively expensive, while EPS downgrades are intensifying.”

“Extreme risk levels have fallen, but there is still no visibility on the end situation, and there is a risk that the twists and turns as countries try to negotiate will mean no end to volatility,” said Benjamin Melman, global chief investment officer at Edmond de Rothschild AM.

As earnings season is kicking into full swing, Goldman’s first-quarter figures also benefited from the same trading boost that peers reported on Friday, with volatility driving stock-trading revenue to a record at JPMorgan. Sure enough, the bank reported stronger than expected Equity S&T data, even as FICC missed. Later in Europe, analysts will focus on the potential fallout from US tariffs when LVMH reports revenue numbers.

Against a backdrop of volatile markets, investors will be seeking clues from Fed policymakers on their appetite for lower interest rates. Neel Kashkari on Sunday signaled confidence that markets will remain orderly as investors sort through shifting trade policies and said the central bank must stay focused on keeping inflation expectations anchored. Christopher Waller will speak about the economic outlook later on Monday.

The upbeat market mood is evident elsewhere as havens slip. In Europe, the Stoxx 600 rises more than 2% with energy and banking shares the best-performers, while real estate and utilities stocks are the biggest laggards. Here are the biggest movers Monday:

- European chip stocks rally on Monday after the Trump administration exempted smartphones and other electronics from reciprocal tariffs, offering a major albeit temporary relief to the semiconductor sector

- IHG shares gain as much as 2% after Deutsche Bank upgrades the hotels operator to hold from sell, describing tourism as “a structural growth sector” that had almost fully recovered last year from the Covid crisis

- Ageas shares rise as much as 3.1% after the Belgian insurer reached an agreement with Bain Capital to acquire Esure for £1.295 billion in cash. The deal will allow Ageas to diversify its business and lessen its reliance on Asia

- Convatec gains as much as 5% in London after the advanced wound care company lifted its sales outlook for the year, following the US Centers for Medicare & Medicaid Services’ postponement of local coverage determinations

- Kainos Group shares rise as much as 12% after the IT services provider reported an improved performance in the last quarter. Analysts said this suggests the firm is finally emerging from a tough patch

- SoftwareOne shares rise as much as 11% after they resumed trading following a suspension imposed last Friday while investors voted on proposals at an extraordinary annual general meeting

- Wood Group shares surge as much as 32% to trade at 32.92p, after the UK engineering company received a possible offer from Sidara for 35p per share in cash, according to a statement

- Ashmore shares drop as much as 4.9% after analysts at Citi said assets under management came in lower than expected at the end of the third quarter, which is set to lead to sharp cuts to consensus

Asian stocks rose, led by gains in Hong Kong, as risk sentiment rebounded after the US announced a pause in tariffs on a range of consumer electronics. The MSCI Asia Pacific Index gained as much as 1.9%, with major Chinese technology shares including Alibaba and Tencent among the biggest contributors. The Hang Seng China Enterprises Index climbed as much as 2.7%. Singapore’s benchmark rose as much as 2.3% after its central bank eased monetary policy settings for a second straight review. Key gauges climbed in Japan, South Korea and Australia. A gauge of Asian health-care stocks was the best performing subgauge on the broader MSCI regional index, with analysts expectations that the pharmaceutical sector could receive similar tariff exemptions to the ones applied to consumer electronics. Markets in India and Thailand were shut for holidays Monday. Key points to watch this week include TSMC earnings and South Korean monetary policy on Thursday.

“Trump’s latest move is seen as a concession in his trade tariff policy,” said Belle Liang, chief investment officer for investment and wealth solutions at Hang Seng Bank. “This will likely ease the market’s recent risk-aversion sentiment, and stabilize global markets, including mainland and Hong Kong stock markets.”

In FX, the Bloomberg Dollar Spot Index sank as much as 0.5% to hit its lowest since Oct. 2, before paring some of the losses to trade 0.1% lower on the day; the Swiss franc is the weakest of the G-10 currencies, falling 0.3% against the greenback. China sets the daily reference rate for the yuan at 7.2110 per dollar on Monday, the weakest level since September 2023. While the greenback struggled, yen optimism is spreading among hedge funds and asset managers as US tariffs drive haven demand at a time when traders are reassessing the Bank of Japan’s interest rate hike path. The yen appreciated as much as 0.9% to levels last seen in September. Meanwhile, the euro is emerging as a prime beneficiary of greenback weakness as investors reassess the dollar’s role in the global financial system. Europe’s common currency gained 0.3% on Monday, adding to its fastest rally in a decade and a half.

“Some people believe that rule of law is being degraded in the US and your investment is not that safe in the US,” said Michael Kelly, head of global multi asset at PineBridge Investments. “That could over the long term temper the willingness to invest in the US.”

In rates, treasuries advance, with US 10-year yields falling 4 bps to 4.45%. Treasury yields are 2bp-7bp lower across maturities led by intermediates, steepening 5s30s spread by more than 5bp; US 10-year around 4.435% is down about 5bp with bunds in the sector lagging by 2.5bp and gilts outperforming by 2.5bp. German government bonds also gain although Italian debt outperforms, narrowing the 10-year yield spread by 5 bps after S&P Global Ratings upgraded Italy to BBB+, three notches above junk.

In commodities, Oil prices advance, with WTI rising 0.6% to $61.80 a barrel as traders weighed the latest US moves. Goldman Sachs said the global oil market faces “large surpluses” this year and next as the trade war weighs on demand.

Spot gold drops $16 as Bitcoin rises 1.5% toward $85,000. Remarkably, gold is now outperforming the S&P since the covid crash.

The US economic calendar includes March New York Fed 1-year inflation expectations at 11am. Retail sales, industrial production, housing starts and building permits are ahead this week. Fed speaker slate includes Waller (1pm), Harker (6pm) and Bostic (7:40pm). Chair Powell speaks Wednesday to the Economic Club of Chicago about the economic outlook

Market snapshot

- S&P 500 futures rose 1.6% as of 7:30 a.m. New York time

- Nasdaq 100 futures rose 1.8%

- Futures on the Dow Jones Industrial Average rose 1.1%

- The Stoxx Europe 600 rose 2.2%

- The MSCI World Index rose 0.6%

- The yield on 10-year Treasuries declined four basis points to 4.45%

- Germany’s 10-year yield declined four basis points to 2.53%

- Britain’s 10-year yield declined seven basis points to 4.68%

- West Texas Intermediate crude rose 1.4% to $62.37 a barrel

- Spot gold fell 0.4% to $3,223.30 an ounce

- The Bloomberg Dollar Spot Index fell 0.3%

- The euro rose 0.3% to $1.1391

- The British pound rose 0.8% to $1.3196

- The Japanese yen rose 0.3% to 143.17 per dollar

- Bitcoin rose 1.6% to $84,839.59

- Ether rose 5.4% to $1,675.71

Top Overnight News

- President Donald Trump pledged he will still apply tariffs to phones, computers and popular consumer electronics, downplaying a weekend exemption as a procedural step in his overall push to remake US trade. “NOBODY is getting ‘off the hook,’” the president said in a social post. BBG

- China’s exports surged in Mar beyond expectations (+12.4% vs. the Street +4.6%) as companies rushed orders to get ahead of Trump’s tariffs. WSJ

- China’s Xi embarks on a tour of Vietnam, Malaysia, and Cambodia, warning that Trump’s trade war will “lead nowhere” and produce “no winners”. FT

- China imposes restrictions on daily net equity sales by hedge funds and large retail investors. RTRS

- Brazil will be a major beneficiary of the US-China trade war, as Beijing substantially increases purchases of agricultural products from the country. FT

- Iran said the first round of negotiations with the US, held over the weekend, were “constructive”, and that additional meetings will take place. BBG

- Neel Kashkari downplayed suggestions the Fed will step in to calm markets. “Investors in the US and around the world are trying to determine what is the new normal in America” and the Fed has “zero ability to affect that,” he said. BBG

- Argentina’s $20 billion IMF rescue program represents a bet that Javier Milei’s cost-cutting will avoid the debacles of the past. As part of the reforms, the peso will be allowed to trade within a range from this week. Scott Bessent will meet Milei in Buenos Aires today. BBG

- META will face off against the FTC in an antitrust case on Monday, the latest indication that Trump 2.0 isn’t taking an easier regulatory approach to the tech industry. NYT

- The dollar weakened to a six-month low on concern that the confusion around the Trump administration’s tariff policy will drive traders away from US assets.

- Treasuries may have hit the bottom for now amid signs of robust foreign demand and expectations for the Federal Reserve to support US government debt when needed, according to JPMorgan Asset Management.

- Some of the world’s largest pension funds from Canada and Denmark are reportedly halting or reassessing their private market investments in the US due to President Trump’s erratic policy blitz: to FT.

Tariffs/Trade

- US President Trump’s administration exempted items from reciprocal tariffs including smartphones, storage devices and some other electronics. However, Trump posted on Sunday that there was no tariff exception announced on Friday and that these products are subject to the existing 20% fentanyl tariffs and are just moving to a different tariff bucket, while he stated that “NOBODY is getting “off the hook” for the unfair Trade Balances, and Non Monetary Tariff Barriers, that other Countries have used against us, especially not China which, by far, treats us the worst!”.

- US President Trump said he is to announce the tariff rate for semiconductors over the next week and that semiconductor tariffs will be in place in the not-distant future, while he added there will be some flexibility on some companies on semiconductor tariffs but it is not clear. Furthermore, Trump responded that they will be announced soon but there has to be some flexibility when asked about tariffs on Apple (AAPL) iPhones.

- US President Trump said the bond market is going good and had a little moment but he solved that problem very quickly. Trump added that the 10% tariff is a floor or pretty close and that it doesn’t matter if the dollar went down as he thinks it will go up and will be stronger than ever.

- US President Trump’s administration is reportedly prioritising trading partners that are strategic to China with the US in talks with Japan, South Korea, India and Vietnam, according to Politico.

- White House spokesperson said US President Trump made it clear America cannot rely on China to manufacture critical technologies such as semiconductors, chips, smartphones and laptops, while President Trump is to issue a Section 232 study on semiconductors soon and said he will have more information on semiconductors on Monday. Furthermore, Trump said that autos, steel, pharmaceuticals, chips and other specific materials will be included in specific tariffs to ensure tariffs are applied fairly and effectively.

- US Commerce Secretary Lutnick said President Trump plans a separate levy on exempted electronics amid a trade war with electronics products to be part of upcoming sectoral tariffs and that semiconductor and electronic tariffs will come in a month or so, while he added that pharmaceutical tariffs will be coming in the next month or two and that the US had “soft entrees” through intermediaries with China on tariffs.

- USTR Greer said there are no plans yet for President Trump to speak with Chinese President Xi and stated electronic exemptions reflect a move from reciprocal tariffs to national security tariffs. Greer said they have to be much more deliberate about the semiconductor supply chain and he believes the US will have meaningful tariff deals with several countries in the next few weeks.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week on the front foot after reports of a tariff reprieve for smartphones and other electronic goods but with gains capped by President Trump’s walk-back regarding this, while participants also digested somewhat mixed Chinese trade data. ASX 200 advanced at the open with real estate, health care and tech leading the broad gains seen in nearly all sectors. Nikkei 225 climbed above the 34,000 level with notable strength in pharmaceuticals and electronic goods/component manufacturers. Hang Seng and Shanghai Comp conformed to the positive risk environment amid some tariff-related reprieve with Chinese consumer electronic goods currently 20% fentanyl tariffs instead of the 145% reciprocal tariffs, although President Trump said he would be announcing the tariff rate for semiconductors over the next week and semiconductor tariffs will be in place in the not distant future. Furthermore, participants digest stronger lending data from China and mostly better-than-expected trade figures in which Trade Balance and Exports topped forecasts but Imports showed a wider-than-expected contraction.

Top Asian News

- China’s auto sales surged 11.2% year-on-year in the first quarter of 2025, reaching 7.47 million vehicles; growth was driven by strong domestic demand, supported by expanded trade-in subsidies incentivising consumers to upgrade vehicles, via Caixin.

- China Customs said at present, China’s exports are facing a complex and severe external situation, but added the sky will not fall and China is actively building a diversified market and deepening cooperation with all parties in the supply chain. Furthermore, it stated that importantly, China’s domestic demand is broad and the import decline in the first quarter was mainly due to the decline in international product prices and fewer working days.

- China is to roll out more monetary easing steps with China to ramp up counter-cyclical policy adjustments and implement various monetary policy measures in the future, according to Shanghai Securities News.

- China may cut rates and RRR if the trade war hurts the economy, according to PBoC-backed Financial News citing former PBoC adviser Yu Yongding.

- Japanese senior LDP official Onodera said a weak yen has caused higher domestic living costs and Japan must strengthen the yen by making its companies stronger, while Onodera said that Japan, as a US ally, shouldn’t think about using its US treasury holdings as a negotiating tool in bilateral trade talks.

- Taiwan’s Financial Regulator announced short-selling stock curbs will be extended for another week.

- Monetary Authority of Singapore announced it will continue with the policy of a modest and gradual appreciation but slightly reduced the slope of the SGD NEER policy band as expected, while it maintained the width and level where the band is centred. MAS said imported and domestic cost pressures will remain low and its core inflation is forecast to stay well below 2%, while risks to inflation are tilted towards the downside.

European bourses (STOXX 600 +2%) are entirely in the green, following a mostly positive APAC session as traders react to the latest trade-related updates, which included an “exemption” of some electronic-related goods. European sectors hold a strong positive bias, in-fitting with the risk tone; some of the sectoral movers today are attributed to the weekend’s tariff updates. Tech is one of the best performing sectors today, lifted by a number of semi-conductor names after US President Trump’s administration exempted items from reciprocal tariffs including smartphones, storage devices and some other electronics. The likes of Infineon (+1%) and ASML (+3%) both gain.

Top European News

- UK reportedly races to secure coal required to keep British steel furnaces, according to FT.

- S&P raised Italy’s sovereign rating by one notch to BBB+ from BBB; Outlook Stable.

FX

- Another downbeat session for the Dollar and currently trading in a 99.20-99.91 range. Price action this morning has been rather horizontal amid eerily quiet newsflow. US trade policy continues to appear disorderly, with temporary exemptions for some Chinese electronic exports (about 20% of China’s exports to the US) followed by expectations of new tariffs on semiconductors and potentially pharma over the next month or two.

- EUR is modestly firmer this morning as a function of the softer Dollar coupled with some reprieve from US President Trump classifying semiconductor tariffs under a separate basket instead of reciprocal tariffs. EUR/USD resides in a current 1.1280-1.1424 range and well within the 1.1188-1.1473 parameter set on Friday.

- USD/JPY retreated to a sub-143.00 level owing to the weaker dollar and in a continuation of last week’s downward bias, but is off worst levels given the broad positive risk environment across Asia-Pac and then Europe. USD/JPY trades within a 142.23-144.30 range, contained in Friday’s 142.05-144.60 parameters.

- GBP is again, posting gains as a function of the Dollar, with Cable rising to an overnight peak of 1.3174 as it eyes the peak from the 3rd of April at 1.3207.

- Gains across the antipodeans amid the broader constructive tone across the markets after US President Trump watered down his semiconductor tariffs, clarifying that it is separate from the basket of reciprocal tariffs. Aussie continues to be slightly more restricted than the Kiwi, with sub-par Chinese import data overnight likely hampering gains.

- PBoC set USD/CNY mid-point at 7.2110 vs exp. 7.3251 (Prev. 7.2087).

Fixed Income

- USTs are firmer but much more modest than has been the case in recent days. As it stands, USTs are rangebound just below the 110-00 mark and well within Friday’s 109-08 to 110-21 band. Focus this morning is, as usual, on tariffs. Risk sentiment has been supported by the announcement of some tariff exemptions for smartphones etc, however, Trump clarified this weekend that there are no exemptions with the measures just moved into different categories i.e. fentanyl.

- Bunds are in the red but, as with USTs, rangebound throughout the European morning and comfortably within Friday’s 129.92-131.42 band. Specifics for the bloc light this morning, attention in Europe is of course on trade/tariffs (EU negotiator Sefcovic to meet US officials) but earnings season is getting underway and macro commentary from LVMH after the cash equity close could be pivotal for the region.

- A firmer start as Gilts gapped higher by 38 ticks. A move that acknowledged the action seen late-doors on Friday and is also a function of Gilts finding some reprieve from recent marked selling pressure. However, like its peers, the benchmark remains well within Friday’s 90.47-91.75 band. After gapping higher at the open Gilts extended a touch to a 91.24 high, but have seen reverted back to and remain at opening levels just above 91.00.

Commodities

- Crude futures trade towards the top of their narrow intraday parameters, with Brent and WTI each up around 0.40/bbl as tailwinds from the mostly positive risk appetite are being offset following “very positive and constructive” talks between the US and Iran over the weekend.

- Mostly softer trade across precious metals with spot gold and silver unwinding some of their risk premium after US President Trump watered down his semiconductor tariffs, clarifying that it is separate to the basket of reciprocal tariffs, whilst US-Iran talks also went ahead over the weekend, with a second round planned. Spot gold resides in a USD 3,213.35-3,245.84/oz parameter vs Friday’s 3,177.26-3,245.49/oz. Bloomberg reported that the PBoC has allocated fresh gold import quotas for banks; limited reaction following this news.

- Mostly firmer across base metals following the tariff clarification on Friday and over the weekend, whilst overnight, reports pointed to more imminent Chinese stimulus.

- PBoC has allocated fresh gold import quotas for banks, according to Bloomberg; to meet increased demand from institutional and retail investors amid the escalating trade war.

- US Energy Secretary Wright said the US and Saudi Arabia will sign an agreement on energy investments and civilian nuclear technology, while he stated there will be lower average oil prices over the next four years under the Trump administration and he expects long-term cooperation between the US and Saudi to develop the civilian nuclear industry in the kingdom.

- Iraq signed an undersea oil exports pipeline deal with Italy’s Micoperi and Turkey’s Esta which will have a 2.4mln bpd capacity.

- US President Trump plans to stockpile deep sea metals to counter China, according to FT.

Geopolitics: Middle East

- Israel bombed a Gaza hospital as its military expanded its offensive, according to FT.

- Israeli military said sirens sounded in several areas in Israel and interception attempts were made after two missiles were launched from Yemen.

- US President Trump said Iran talks are going well and that Ukraine-Russia talks might be going okay but added there is a time when you have to put up or shut up. Furthermore, Trump separately commented that they will be making a decision on Iran shortly, while the White House said Iran discussions were very positive and constructive, as well as noted that the sides agreed to meet again next Saturday and US special envoy Witkoff underscored to Iran’s Foreign Minister that he had instructions from President Trump to resolve differences through dialogue and diplomacy if possible.

- Iran’s Foreign Minister Araqchi said both sides want an agreement in the short-term and not ‘talks for talks’, while he added the second round of talks will probably be next Saturday.

Geopolitics: Ukraine

- Ukraine’s air force said on Saturday morning that Russia launched 88 drones in an overnight attack and announced on Sunday that Russia launched 55 drones targeting Ukraine, while the mayor of Ukraine’s Sumy said over 20 were killed after a Russian missile strike on the city.

- Russian Defence Ministry said Russian forces captured Yelyzavetivka in eastern Ukraine and Russian air defence systems shot down a Ukraine F-16 jet, according to Interfax. It was also reported that Russia accused Ukraine of attacking its energy infrastructure on several occasions over the weekend.

- Russian Foreign Minister Lavrov said they have been keeping their word on a 30-day energy strikes moratorium and there were no direct or indirect contacts between Russia and Ukraine at the Antalya Forum. It was also reported that Turkish and Russian Foreign Ministers discussed efforts to achieve a ceasefire in the Russia-Ukraine war.

- Russia’s Kremlin said relations with the US are moving ahead very well and mutual visits by Russian and US envoys are very good reliable channels for communicating positions to each other.

- Military representatives from Turkey and foreign nations are to meet in Turkey on April 15th-16th to discuss Black Sea security after a possible ceasefire between Ukraine and Russia, according to the Turkish Defence Ministry.

- German Chancellor-in-waiting Merz said Germany is willing to send Taurus missiles to Ukraine, according to FT.

US Event Calendar

- NY Fed 1-Yr Inflation Expectations (prev 3.13%)

Central Banks

- 1:00 pm: Fed’s Waller Speaks on Economic Outlook

- 6:00 pm: Fed’s Harker Speaks on Role of Fed

- 7:40 pm: Fed’s Bostic Speaks in Fireside Chat on Policy

DB’s Jim Reid concludes the overnight wrap

As we enter a shortened week for markets ahead of Easter, most investors will surely be hoping for an easing of the turmoil that has embroiled markets since the US reciprocal tariffs announcement on April 2. Over the weekend, Henry published a note reviewing the key market moves over this period (see here), which by several metrics has been the most volatile outside the peak of the GFC and the initial Covid shock.

Even as US equities recovered last week after President Trump’s 90-day pause for reciprocal tariffs on non-retaliating countries, Treasuries massively underperformed with the 30yr Treasury yield seeing its largest weekly increase (+46bps) since 1987 and the 10yr Treasury-bund spread seeing its biggest weekly widening on record in data back to German reunification (+50bps). Despite higher US yields, the dollar lost ground with the dollar index touching a three-year low this morning as volatile tariff headlines have driven reallocation away from US assets.

Tariffs continued to dominate headlines over the weekend, starting with news late on Friday that smartphones, computers and some other electronics would be exempt from US reciprocal tariffs, including the 125% rate on China. These categories make up about 12% of all US imports and about 20% of US imports from China, so it’s a significant exclusion. US officials later played down this exemption, with Commerce Secretary Lutnick saying that it was temporary with these goods would be covered by a forthcoming levy on semiconductors. On Sunday evening, President Trump reiterated that electronics from China would still face earlier 20% tariffs over fentanyl and indicated that tariffs on semiconductors will be announced in the coming week. That said, he also signaled some openness on the scope of tariffs on electronics, saying “We’ll be discussing it, but we’ll also talk to companies”. Earlier on the weekend, China’s commerce ministry described the electronics exclusion as a “small step by the US toward correcting its wrongful action of unilateral ‘reciprocal tariffs’”, while encouraging Washington to fully remove the levies.

Markets have taken a positive spin on the electronics exemption news, with futures on the S&P 500 (+0.98%) and NASDAQ 100 (+1.45%) moving higher this morning. STOXX 50 futures (+2.41%) are posting a larger advance, having closed before Friday’s recovery in US markets fully played out. Asian equities have also started the week on a strong footing, with the Hang Seng index on course for its best performance in nearly four weeks (+2.41%), driven by tech companies, especially those exporting to the US. Japan’s Nikkei (+1.80%) and Topix (+1.55%) have also rallied, while the KOSPI (+0.88%) and S&P/ASX 200 (+1.42%) are both rebounding from a volatile week. Mainland China indices are seeing more modest gains, with the Shanghai Composite up +0.86% and the CSI +0.47%. Meanwhile, 10yr Treasury yields are -3.0bps lower at 4.46% in Asia trading as we go to print.

However, the US dollar has extended its decline, trading -0.47% lower this morning and having now fallen by -4.01% since April 2. In comments on Friday evening, President Trump insisted that the dollar would always remain “the currency of choice” and that “If a nation said we’re not going to be on the dollar, I would tell you that within about one phone call they would be back on the dollar”.

Turning to the week ahead, while tariffs will remain the center of attention, investors will also be keeping an eye on incoming US data with the March retail sales and industrial production prints on Wednesday. For the retail print, our economists expect a strong headline (+0.8% mom vs. +0.3% previous) supported by frontloading of car purchases, with a slower but still solid growth in retail control (+0.3% vs +1.0% prev.). Amid increased fears of a US recession, markets and the Fed will be watching whether hard data start to catch down to the sharp weakening in surveys seen over the past couple of months. Weaker US sentiment was seen again in the University of Michigan’s preliminary consumer survey for April last Friday. The main sentiment index fell back to 50.8 (vs. 53.8 expected), its weakest since June 2022, while inflation expectations continued to climb, with the 1yr measure up to +6.7%, the highest since 1981. And the 5-10yr measure jumped to +4.4%, the highest since 1991.

It will be another busy week for Fedspeak, with Chair Powell’s speech on Wednesday the main event (see the full day-by-day week ahead at the end). Recent rhetoric from Fed officials has focused more on risks of a persistent inflation shock, with tariffs raising the bar for rate hikes unless evidence of weaker growth becomes more prevalent. Given the growth risks and rise in yields, there will also be increasing focus on the upcoming budget reconciliation process. Detailed work will now begin after the House passed the budget blueprint last week, but it will likely take at least a few weeks before we get a clear sense of the key details of the upcoming tax bill.

Over in Europe, the latest ECB meeting (Thursday) is widely expected to deliver another 25bps cut. Our economists see the ECB maintaining its open-ended guidance but think that the risks of disinflation are being underestimated, given the recent moves in FX and energy prices and risks of trade diversion (see their full preview here). The ECB will also publish its quarterly bank lending survey on Tuesday.

Elsewhere, we will see decisions from two other central banks exposed to the US trade war, namely the Bank of Canada (Wednesday) and the Bank of Korea (Thursday), while data highlights will include CPI prints in the UK (Wednesday) and Japan (Friday) as well as the Q1 GDP and March activity data in China (Wednesday).

Lastly, the earnings season will gather steam with more US bank results, including Goldman Sachs, Citigroup and Bank of America. Other notable US corporates reporting include UnitedHealth, Johnson & Johnson and American Express, while in the tech space we will hear from Netflix in the US, ASML in Europe and TSMC in Asia.

Early morning data showed that China’s exports rebounded +12.4% y/y last month (v/s +4.6% expected; -3.0% in February) as businesses kept frontloading outbound shipments to avoid prohibitive US tariffs. At the same time, imports slipped -4.3% y/y in March (v/s -2.1% expected), suggesting still soft domestic demand. Separately, on Sunday, the PBOC showed that China’s aggregate social financing flows totalled a stronger-than-expected 15.2trn yuan in March (vs. 14.3trn expected), pointing to ongoing flows of stimulus to support the real economy.

Reviewing last week’s seismic market moves in more detail, US equities actually recovered some ground, as the S&P 500 rose +5.70% (+1.81% Friday), recovering about half of its -10.73% decline in the two days after April 2 reciprocal tariff announcements. That recovery was mainly because of President Trump’s decision to delay most reciprocal tariffs by 90 days, which led to a huge +9.52% surge on Wednesday. So all-in-all, the S&P 500 ended up posting its best week since November 2023, albeit having come off the back of its 9th-worst weekly performance since WWII.

However, even as equities recovered some ground, US Treasuries reversed course, with the 10yr yield moving up every single day last week. In fact, the rise in the 10yr yield of +49.5bps (+6.4bps Friday) was the biggest weekly rise since 2001, taking it back up to 4.49%. And the 30yr yield (+46.2bps to 4.87%) saw its biggest rise since 1987, with the 30yr real yield rising +41.4bps to 2.69%, its highest level since 2008.

Outside the US, equities struggled a lot more last week. For instance, Europe’s STOXX 600 fell -1.92% (-0.10% Friday), and Japan’s Nikkei fell -0.58% (-2.96% Friday). And emerging markets struggled in particular, with the MSCI EM index down -3.90% (+1.59% Friday). Conversely, sovereign bonds put in a much better performance outside the US, with yields on 10yr bunds coming down -0.9bps (-1.0bps Friday). One asset that did particularly well was gold, rising +6.56% last week (+1.93% Friday) to a record high of $3,238/oz

Tyler Durden Mon, 04/14/2025 – 08:25

Source: https://freedombunker.com/2025/04/14/futures-rise-dollar-slides-after-tech-tariff-pause/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.