China Factory Activity Tumbles To 16 Month Low As Exports Crater On Trump Tariffs

China’s manufacturing activity in April saw its worst contraction since December 2023, exposing sharp signs of weakness in Asia’s biggest economy from the trade war with the US, and boosting calls for fresh Chinese stimulus, which is always “just around the corner” but never arrives.

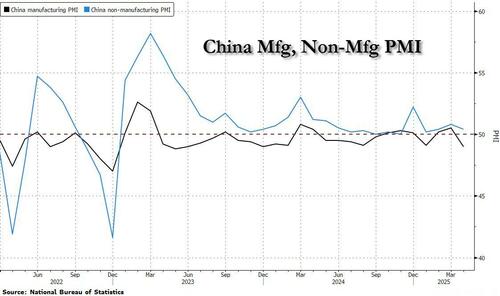

In the aftermath of significantly higher US tariffs, China’s official NBS manufacturing PMI fell to 49.0 in April from 50.5 in March, much lower than consensus expectations, the lowest reading since May 2023. The non-manufacturing PMI, which includes services and construction, fell to 50.4 from 50.8 also missed expectations driven by weakness in both construction and services sectors, but remained above the 50-mark separating growth from contraction.

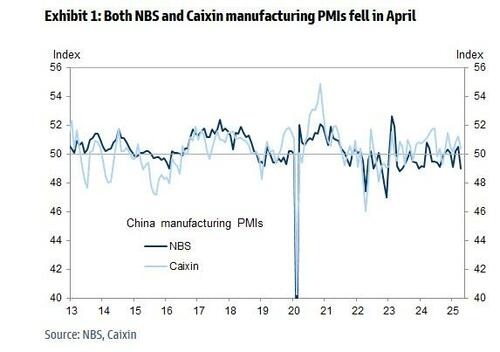

Separately, the unofficial Caixin manufacturing PMI also fell to 50.4 in April from 51.2 in March.

The reading contrasts with Chinese officials’ conviction that the world’s second-largest economy is well placed to absorb the U.S. trade shock and confirms that domestic demand remains weak as factory owners struggle to find alternative buyers overseas.

Here are the details:

- The NBS manufacturing PMI headline index fell to 49.0 in April from 50.5 in March, the lowest reading since May 2023. Among major sub-indexes of NBS manufacturing PMI, the output sub-index fell to 49.8 from 52.6, the new orders sub-index declined to 49.2 from 51.8, and the employment sub-index fell to 47.9 from 48.2. The suppliers’ delivery times sub-index inched down to 50.2 in April from 50.3 in March. NBS commented that the output and new orders sub-indexes of textile and metal products were below 50 in April.

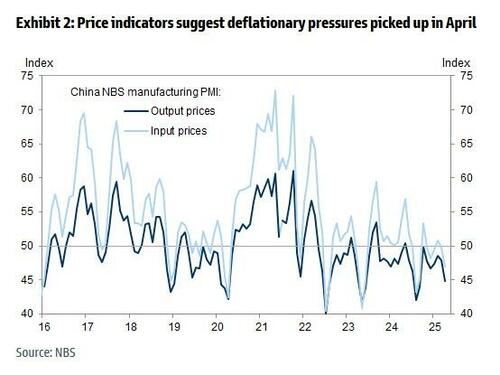

- On the trade-related sub-indexes, the manufacturing new export order sub-index decreased notably to 44.7 in April (vs. 49.0 in March), the lowest reading since December 2022. The import sub-index fell to 43.4 in April (vs. 47.5 in March). Inventory and price sub-indexes showed inventory drawdowns and deflationary pressures. The raw material inventories sub-index edged down to 47.0 from 47.2, and the finished goods inventories sub-index decreased to 47.3 from 48.0. The input cost sub-index decreased sharply to 47.0 (vs. 49.8 in March). The output prices sub-index also fell to 44.8 (vs. 47.9 in March). Larger manufacturers appeared to show a bigger activity deceleration. By enterprise size, the PMI of large/medium/small enterprises fell to 49.2/48.8/48.7 from 51.2/49.9/49.6 in April, respectively.

- The Caixin manufacturing PMI, which was released shortly after the NBS print, fell to 50.4 in April from 51.2 in March, amid a sharp fall in new export orders and overall factory activity slowing. Sub-indexes in the Caixin manufacturing PMI suggest a modest decline in the output sub-index in April (51.6 vs. 51.8 in March), a significant slowdown in new orders (50.5 vs. 52.1 in March), weaker employment (49.0 vs. 50.1 in March), and deflationary pressures in price indicators (input prices increased to 49.7 from 48.4 and output prices increased to 49.2 from 49.1). The new export orders sub-index fell sharply to 47.5 in April from 52.0, the lowest reading since July 2023, suggesting weaker external demand amid higher US tariffs. Surveyed companies noted that greater competition among vendors amid subdued demand for inputs led to a drop in input costs in April. Firms often shared cost savings with their customers, and lowered their selling prices accordingly.

- The official non-manufacturing PMI (comprised of the services and construction sectors) fell to 50.4 in April (vs. 50.8 in March). The services PMI decreased to 50.1 (vs. 50.3 in March). According to the survey, the PMIs of air transportation, telecommunications, radio, insurance, television and satellite transmission services sectors were above 55 while the PMIs of water transportation and capital market services were below 50 in April. The construction PMI fell in April to 51.9 (vs. 53.4 in March). NBS noted that the growth of the infrastructure-related construction PMI rose to 60.9 in April from 54.5 in March.

Manufacturers had been front-loading outbound shipments in anticipation of the duties, but the arrival of the levies has called time on that strategy, putting pressure on policymakers – who had for the past year merely promised to do something instead of actually doing something – to finally address rebalancing the economy.

“The sharp drop in the PMIs likely overstates the impact of tariffs due to negative sentiment effects, but it still suggests that China’s economy is coming under pressure as external demand cools,” Zichun Huang, China Economist at Capital Economics, said.

“Although the government is stepping up fiscal support, this is unlikely to fully offset the drag, and we expect the economy to expand just 3.5% this year.”

Huang added that negativity among the survey’s respondents “probably exaggerates the impact of the tariffs,” noting that “the new export orders index dropped back to its lowest level, COVID-19 disruptions aside, since April 2012.”

Trump’s decision to single Beijing out for import duties of 145% comes at a particularly difficult time for China, which is struggling with deflation due to sluggish income growth and a prolonged property crisis.

Beijing has largely relied on exports to shore up the fragile economic recovery since the end of the pandemic and only began to take steps to boost domestic demand more earnestly late last year.

Zhao Qinghe, an NBS statistician, said the drop was largely down to “sharp changes in (China’s) external environment,” in a note accompanying the release. China’s yuan inched lower against the dollar following the data’s release, as the first data since Trump’s tariff announcement pointed to early signs of damage to the economy.

While China has repeatedly denied it is seeking to negotiate with the U.S. a way out of the tariffs, and appears to instead be betting that Washington makes the first move, continued economic deterioration will force Beijing’s hand.

“We expect the manufacturing PMI to be in contraction in May, but it is expected to rise to about 49.5, driven by an increase in stable growth policies,” said Wang Qing, chief macro analyst at Oriental Jincheng.

He said further cuts to interest rates and the amount commercial banks must hold in reserve may be needed as conditions worsen. On Monday, the vice head of China’s state planner said the National Development and Reform Commission (NDRC) would roll out new policies over the second quarter in line with the prevailing economic conditions of the time.

That followed pledges by the Communist Party’s elite decision-making body, the Politburo, on Friday to support firms and workers most affected by the duties. The general consensus among China observers is a second trade war with the U.S. will significantly weigh on growth, but the NDRC’s Zhao Chenxin said he was confident the country would achieve its 2025 economic growth target of around 5%.

The International Monetary Fund, Goldman Sachs and UBS all recently revised down their economic growth forecasts for China over 2025 and into 2026, citing the impact of U.S. tariffs – none of them expect the economy to hit Beijing’s official growth target.

Tyler Durden Wed, 04/30/2025 – 12:29

Source: https://freedombunker.com/2025/04/30/china-factory-activity-tumbles-to-16-month-low-as-exports-crater-on-trump-tariffs/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.