How State Income Taxes Have Changed Since 2000

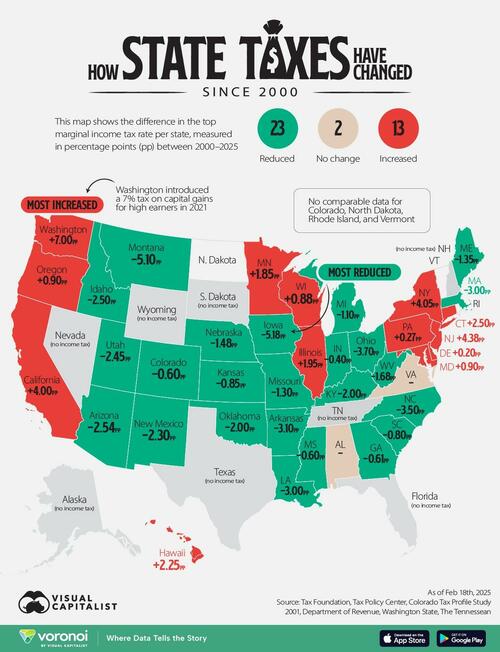

In this graphic, Visual Capitalist’s Pallavi Rao compares how the state income taxes have changed between 2000 and 2025. The visualized value is the difference in the top marginal tax rate, measured in percentage points (pp).

We also published just the current top rate in 2025, earlier this month for further context.

Current and historical data for this map is sourced from the Tax Foundation and Tax Policy Center.

Changes are not compared for four states—Rhode Island, Vermont, North Dakota, and Colorado—since their 2000s tax rates were charged as a percentage of federal liabilities owed.

As a result, they have been grayed out on the map and are not discussed in this article.

States Income Tax Burdens Have Broadly Fallen Since 2000

Led by Iowa (-5.18pp), 23 states reduced their top marginal income tax rate since 2000.

Furthermore, two states (Tennessee and New Hampshire) removed income taxes entirely, joining six others that do not tax incomes.

| State | Code | 2000 Top Rate | 2025 Top Rate | Change |

|---|---|---|---|---|

| Alabama | AL | 5.0 | 5.0 | No change |

| Alaska | AK | 0.0 | 0.0 | No income tax |

| Arizona | AZ | 5.0 | 2.5 | -2.54 pp |

| Arkansas | AR | 7.0 | 3.9 | -3.10 pp |

| California | CA | 9.3 | 13.3 | +4.00 pp |

| Colorado | CO | % of federal liability | 4.4 | n/a |

| Connecticut | CT | 4.5 | 7.0 | +2.50 pp |

| Delaware | DE | 6.4 | 6.6 | +0.20 pp |

| Florida | FL | 0.0 | 0.0 | No income tax |

| Georgia | GA | 6.0 | 5.4 | -0.61 pp |

| Hawaii | HI | 8.8 | 11.0 | +2.25 pp |

| Idaho | ID | 8.2 | 5.7 | -2.50 pp |

| Illinois | IL | 3.0 | 5.0 | +1.95 pp |

| Indiana | IN | 3.4 | 3.0 | -0.40 pp |

| Iowa | IA | 9.0 | 3.8 | -5.18 pp |

| Kansas | KS | 6.5 | 5.6 | -0.85 pp |

| Kentucky | KY | 6.0 | 4.0 | -2.00 pp |

| Louisiana | LA | 6.0 | 3.0 | -3.00 pp |

| Maine | ME | 8.5 | 7.2 | -1.35 pp |

| Maryland | MD | 4.8 | 5.8 | +0.90 pp |

| Massachusetts | MA | 12.0 | 9.0 | -3.00 pp |

| Michigan | MI | 4.4 | 4.3 | -1.10 pp |

| Minnesota | MN | 8.0 | 9.9 | +1.85 pp |

| Mississippi | MS | 5.0 | 4.4 | -0.60 pp |

| Missouri | MO | 6.0 | 4.7 | -1.30 pp |

| Montana | MT | 11.0 | 5.9 | -5.10 pp |

| Nebraska | NE | 6.7 | 5.2 | -1.48 pp |

| Nevada | NV | 0.0 | 0.0 | No income tax |

| New Hampshire | NH | 5.0 | 0.0 | No income tax |

| New Jersey | NJ | 6.4 | 10.8 | +4.38 pp |

| New Mexico | NM | 8.2 | 5.9 | -2.30 pp |

| New York | NY | 6.9 | 10.9 | +4.05 pp |

| North Carolina | NC | 7.8 | 4.3 | -3.50 pp |

| North Dakota | ND | % of federal liability | 2.5 | n/a |

| Ohio | OH | 7.2 | 3.5 | -3.70 pp |

| Oklahoma | OK | 6.8 | 4.8 | -2.00 pp |

| Oregon | OR | 9.0 | 9.9 | +0.90 pp |

| Pennsylvania | PA | 2.8 | 3.1 | +0.27 pp |

| Rhode Island | RI | % of federal liability | 5.99 | n/a |

| South Carolina | SC | 7.0 | 6.2 | -0.80 pp |

| South Dakota | SD | 0.0 | 0.0 | No income tax |

| Tennessee | TN | 6.0 | 0.0 | No income tax |

| Texas | TX | 0.0 | 0.0 | No income tax |

| Utah | UT | 7.0 | 4.6 | -2.45 pp |

| Vermont | VT | % of federal liability | 8.75 | n/a |

| Virginia | VA | 5.8 | 5.8 | No change |

| Washington | WA | 0.0 | 7.0 | +7.00 pp |

| West Virginia | WV | 6.5 | 4.8 | -1.68 pp |

| Wisconsin | WI | 6.8 | 7.7 | +0.88 pp |

| Wyoming | WY | 0.0 | 0.0 | No income tax |

Note: Washington’s 7% tax on capital gains has been listed as an income tax by the source. This is discussed further in the next section.

Many states have switched to flat tax rates in the past 25 years, with Arizona, Georgia, Idaho, Iowa, Kentucky, Louisiana, Mississippi, North Carolina, and Utah reducing both the rate and multiple brackets to just the one.

However, some argue that flat rates are regressive as it imposes a larger burden on low income households than higher incomes ones.

Only two states, Alabama and Virginia, have made no changes.

So, Who Increased Their Tax Rates?

Thirteen states and D.C. increased the top rate, with Washington (+7.0 pp) registering the most increase.

However Washington’s 7% flat rate is only applicable for earnings from stocks and bond sales that are above $250,000.

There is an argument that a capital gains tax is different from an income tax since it requires both a sale and declared profit to incur the tax. Furthermore, as far back as 1933, a statewide income tax in Washington was ruled unconstitutional.

However, to stay consistent with the source’s categories, it has been included as income. New Hampshire’s removal of interest and dividends tax is also counted as eliminating income taxes.

If not considering Washington, then New Jersey has seen the highest top rate increase (+4.38pp).

Finally, Massachusetts is the only state that switched from flat to marginal rates: putting in a 9% bracket for income above $1.8 million in a year.

Taxes play a huge role in how each state earns revenue. Check out: Every State’s Biggest Source of Tax Revenue for a quick overview.

Tyler Durden Tue, 03/25/2025 – 22:10

Source: https://freedombunker.com/2025/03/25/how-state-income-taxes-have-changed-since-2000/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.