FOMC Minutes Confirm Fed ‘Pause’, Potential QT Taper; Officials Blame Trump Policies For Uncertainty

Since the last FOMC meeting – on Jan 29th – the market has coped admirably well with the utter avalanche of headlines spewing from Washington (and around the world). Gold has been the standout choice while stocks, bonds, oil and the dollar are all about flat…

Source: Bloomberg

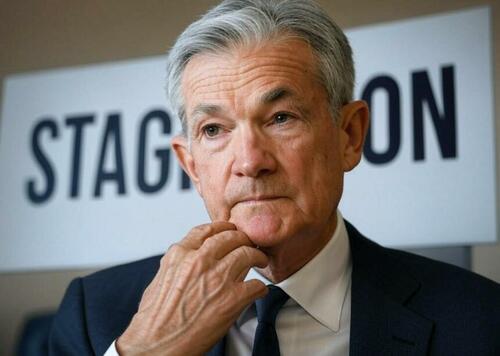

The macro data has been a nightmare (for The Fed) with stagflationary impulses clear as growth surprises have been to the downside while inflation surprises have soared to the upside…

Source: Bloomberg

…which helps explain why rate-cut expectations have tumbled since the last FOMC statement…

Source: Bloomberg

Additionally, FedSpeak since the last meeting has been guardedly hawkish with Powell reiterating his ‘no rush to cut’ comments and various other Fed heads noting that the central bank is ‘in a good place’ after they removed the optimistic ‘inflation keeps trending down’ language from the prior statement.

So, bearing in mind that hot CPI and PPI (and inflation expectations from soft survey data) will not be included in these Minutes, what does The Fed want us to focus on?

Here are the initial highlights:

Fed’s on hold (confirmation)

The Fed’s 19 officials who participate in its interest-rate decisions indicated that “they would want to see further progress on inflation before making” any further cuts.

Fed blames Trump:

The minutes also cited a “high degree of uncertainty” surrounding the economy, which made it appropriate for the Fed to “take a careful approach” in considering any further changes to its key interest rate.

Fed officials said that President Donald Trump’s proposed tariffs and mass deportations of migrants, as well as strong consumer spending, were factors that could push inflation higher this year.

And diving into the details:

Monetary Policy

-

Some participants cited potential changes in trade and immigration policy as having potential to hinder disinflation process.

-

Vast majority of participants judged risks to dual mandate objectives were roughly in balance.

-

A couple of participants noted it appeared that risks to achieving inflation mandate were greater than risks to employment mandate

-

Majority of participants observed that the current high degree of uncertainty made it appropriate for the Committee to take a careful approach in considering additional adjustments to the stance of monetary policy.

-

Many participants noted that the Committee could hold the policy rate at a restrictive level if the economy remained strong and inflation remained elevated, while several remarked that policy could be eased if labor market conditions deteriorated, economic activity faltered, or inflation returned to 2 percent more quickly than anticipated.

Balance sheet

-

Various participants noted it may be appropriate to consider pausing or slowing balance sheet runoff until resolution of debt ceiling dynamics.

-

Many participants noted after conclusion of balance sheet runoff it would be appropriate to structure asset purchases to move maturity composition closer to outstanding stock of Treasury debt.

-

Reserves might decline quickly upon resolution of the debt limit and, at the current pace of balance sheet runoff, might potentially reach levels below those viewed by the Committee as appropriate.

-

Fed survey respondents forecast balance sheet runoff process concluding by mid-2025, slightly later than previously expected.

On financial stability risks

-

Participants noted a range of factors that warranted monitoring. Several participants mentioned issues related to the banking system. A few commented that bank funding risks had lessened and that many banks had improved their ability to access the discount window; however, a couple observed that some banks had increased their reliance on reciprocal deposits, and that the stability of these deposits had not been tested in a time of stress.

-

Several participants noted that some banks remained vulnerable to a rise in longer-term yields and the associated unrealized losses on bank assets.

-

Several participants also mentioned potential vulnerabilities at nonbank financial institutions or nonfinancial corporations to a rise in longer-term yields or to leverage in these sectors.

-

A few participants noted concerns about asset valuation pressures in equity and corporate debt markets.

-

A few participants discussed vulnerabilities associated with CRE exposures, noting that risks remained, although there were some signs that the deterioration of conditions in the CRE sector was lessening.

Inflation

-

A number of participants remarked that current readings of 12- month inflation were boosted by relatively high inflation readings in the first quarter of last year, and several participants noted that cumulative inflation over the past 3, 6, or 9 months showed greater progress than 12-month measures.

-

Most participants commented that month-over-month inflation readings in November and December had exhibited notable progress toward the Committee’s goal of price stability, including in some key subcategories.

-

Many participants, however, emphasized that additional evidence of continued disinflation would be needed to support the view that inflation was returning sustainably to 2 percent.

-

Participants expected that, under appropriate monetary policy, inflation would continue to move toward 2 percent, although progress could remain uneven

-

Business contacts in a number of Districts had indicated that firms would attempt to pass on to consumers higher input costs arising from potential tariffs.

-

Some participants noted that some market- or survey-based measures of expected inflation had increased recently, although many participants emphasized that longer-term measures of expected inflation had remained well anchored.

-

Some participants remarked that reported inflation at the beginning of the year was harder than usual to interpret because of the difficulties in fully removing seasonal effects, and a couple of participants commented that any increase in reported inflation in the first quarter due to such difficulties would imply a corresponding decrease in reported inflation in other quarters of the year.

On Policy Outlook

-

In discussing risk-management considerations that could bear on the outlook for monetary policy, a majority of participants observed that the current high degree of uncertainty made it appropriate for the Committee to take a careful approach in considering additional adjustments to the stance of monetary policy.

-

Factors mentioned by participants as supporting such an approach included the reduced downside risks to the outlook for the labor market and economic activity, increased upside risks to the outlook for inflation, and uncertainties concerning the neutral rate of interest, the degree of restraint from higher longer-term interest rates, or the economic effects of potential government policies.

-

Many participants noted that the Committee could hold the policy rate at a restrictive level if the economy remained strong and inflation remained elevated, while several remarked that policy could be eased if labor market conditions deteriorated, economic activity faltered, or inflation returned to 2 percent more quickly than anticipated.

Read the full Fed Minutes below:

Tyler Durden Wed, 02/19/2025 – 14:00

Source: https://freedombunker.com/2025/02/19/fomc-minutes-confirm-fed-pause-potential-qt-taper-officials-blame-trump-policies-for-uncertainty/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.