Taxing the Investment Income of Foundations Is Consistent with Good Tax Principles, but Fixes to OBBB Plan Are in Order

The philanthropy community is up in arms that the House’s One Big Beautiful Bill (OBBB) would increase taxes on the net investment income of private foundations by as much as $1.6 billion per year, or $15.8 billion over the next decade, according to Congress’s Joint Committee on Taxation (JCT).

Groups such as the Philanthropy Roundtable claim the change amounts to a “600% tax increase on private charity,” which the Council on Foundations says “threatens to reduce funding for communities in need.”

These claims are greatly exaggerated. Taxing the investment income of tax-exempt assets is not a tax on the assets themselves, nor, as activists imply, is it a tax on charity. Indeed, this treatment is no different from how investments in 401(k) accounts are taxed. Individuals deposit tax-deductible contributions into their 401(k) accounts and then pay ordinary income tax rates—as high as 37%—when they withdraw funds during retirement.

Similarly, philanthropists get a federal tax deduction for contributing funds to their foundations, and parity suggests that they should pay a tax on the investment income generated by those tax-exempt funds. Exempting the investment income from tax would provide philanthropists with double the tax benefits.

However, from a pure tax-policy standpoint, the tiered tax structure proposed in the House bill will make this an “optional” tax because it would be easy to avoid by simply moving assets out of a foundation into a donor-advised fund (DAF), which is exempt from the tax. A better solution would be to apply a single rate to the net investment income of both foundations and DAFs.

The Investment Income of Foundations Has Been Taxed for More Than 50 Years

Those who seem shocked by the OBBB tax proposal ignore that private foundations have been required to pay taxes on their net investment income since 1969. In enacting the tax, Congress believed that “private foundations should share some of the burden of paying the cost of government, especially for more extensive and vigorous enforcement of the tax laws relating to exempt organizations.” The tax rate has fluctuated over the years, starting at 4% in 1970, then dropping to 2% in later years—which could be reduced to 1% if certain metrics were met—and settling at a flat 1.39% rate in 2019.

The taxing of private foundations’ investment income for more than five decades has not prevented them from becoming a large and growing sector of the economy. In 2021, IRS data indicates that private foundations held $1.4 trillion in total assets (fair market value)—twice the value of assets held a decade earlier.

IRS microdata for calendar year 2023 (tax year 2022) provides an interesting picture of how much wealth is held in the largest foundations. The data includes about 145 private foundations with more than $1 billion in assets. In total, these foundations held more than $604 billion in assets and reported more than $34 billion in investment income. The IRS data also include 23 foundations with more than $5 billion in assets and nine with more than $10 billion in assets. These nine largest foundations held a combined $259 billion in assets and earned nearly $16 billion in investment income.

The Tiered Rate Structure Will Make This an Optional Tax

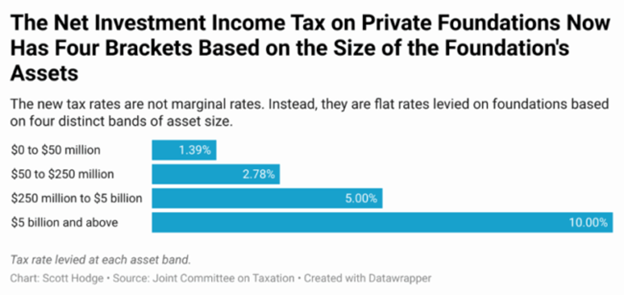

The OBBB proposes replacing the current 1.39% tax on the net investment income of foundations with a tiered, four-bracket tax-rate system based on total asset value. The proposed four tax brackets are not marginal rates, as is the case with individual income taxes. They are fixed bands with cliffs between them, which are likely to cause even more behavioral effects than we see with marginal tax rates, especially because DAFs are excluded from the tax.

The base 1.39% rate would still apply to foundations with assets below $50 million, while the top 10% rate would apply to foundations with more than $5 billion in assets. The chart below illustrates the tax rates for each band of asset class:

Some philanthropists are warning of the problems in taxing foundations but not DAFs. Indeed, in a post on X, philanthropist John Arnold predicted the new tax scheme would prompt a wave of tax avoidance into DAFs:

By only taxing private foundations and not DAFs, the former will roll into the latter. For most funders these entities are interchangeable. In fact, foundations can meet their 5% minimum distribution requirement by moving money to a DAF. Since DAFs won’t be subject to the larger excise tax, everyone will convert foundations to DAFs.

He concludes with the warning, “Any tax law should apply to DAFs and foundations equally, else it does more harm than good.”

JCT’s Revenue Estimate Accounts for Tax Avoidance

JCT has estimated that the tax would generate $15.8 billion in new tax revenues between 2025 and 2034, or roughly $1.6 billion per year. As a test, I tried to replicate JCT’s estimates using IRS microdata drawn from the 2023 Form 990-PF extract of private foundations. Without accounting for any behavioral changes, I estimated that the tax could generate $2.9 billion in additional revenues per year, which is nearly twice JCT’s average annual estimate.

This result suggests that JCT did account for behavioral effects in its estimate—for example, “Laffer Curve effects,” such as altered investment decisions based on the higher tax rates, or avoidance effects, such as wealthy people shifting assets foundations into a DAF.

The Senate should take this warning to heart and look to close this DAF loophole before sending the bill back to the House. A better plan would be to levy a single flat rate on both foundations and DAFs. This would remove the incentives for tax avoidance and level the playing field between similar charitable funds. And raising the tax rate on their net investment income would make the tax code fairer between the rates paid by retirees and charitable entities.

Editor’s note: At present, the current Senate version of the One Big Beautiful Bill would not increase taxes on the net investment income of private foundations.

This article first appeared in the Giving Review on June 16, 2025.

Source: https://capitalresearch.org/article/taxing-the-investment-income-of-foundations-is-consistent-with-good-tax-principles-but-fixes-to-obbb-plan-are-in-order/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.