Institutional investors are not to blame for U.S. housing prices

Understanding the origin of the current housing crisis is the key to solving it. While many policymakers have been busy drafting policies to expand supply and increase funding to affordable housing programs, some believe the real problem lies elsewhere: institutional investors in the market for single-family homes.

On the news, social media, and even in legislatures, housing market speculators have been taking the blame for high home prices.

CBS Miami said earlier this year, “Finding an affordable home in Florida is becoming increasingly difficult for families as corporate investors buy up properties, driving prices up and limiting options for local buyers.”

Even in Congress, several bills have been introduced to restrict investors from buying houses, and at least half a dozen states have seen similar legislation. Despite calls for such restrictions in Florida, the legislature has instead focused on passing several bills like the Live Local Act that make it easier to increase housing supply statewide.

There has been growth in the role of institutional investment in the housing market throughout the last 20 years, but speculation by major financial players is far from the primary culprit behind current sky-high home prices. Lagging supply remains the largest driver of high housing costs. Rather than being a cause, persistent high prices in the housing market have attracted these investors who are aware of the major shortage.

When Amazon’s Jeff Bezos launched a new company to invest in buying rental properties, he pointed out that after years of housing supply not keeping up with demand, it was a sure investment. Stagnating supply and existing barriers to additional construction are what make entry into the housing market lucrative for investors. Should barriers be reduced, not only would prices fall, but it might spark a reduction in the presence of institutional investors. So, Florida’s legislators are on the right path on housing.

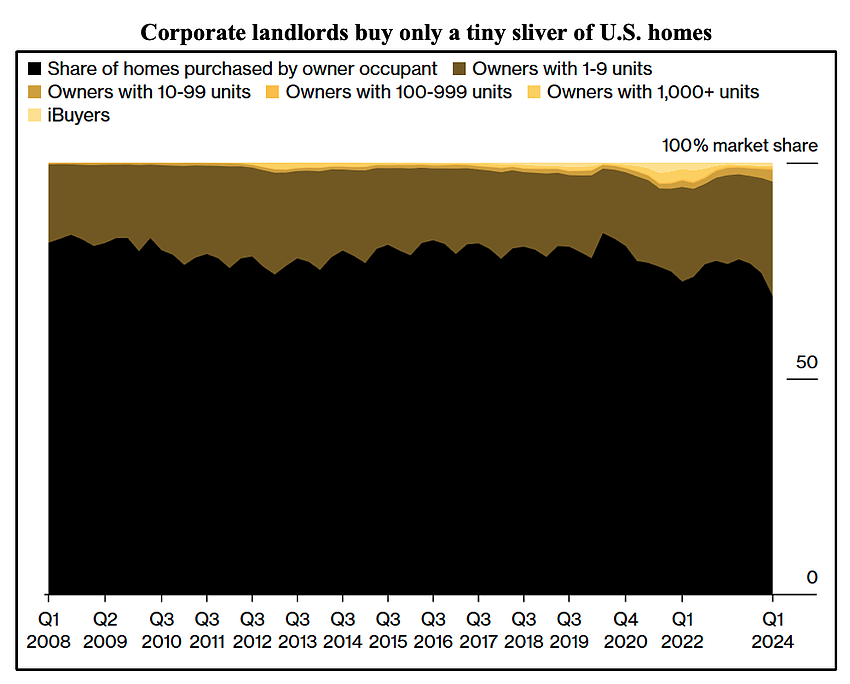

Indeed, there is good reason not to be distracted by the issue of institutional investors. Researchers at the Urban Institute categorize investors in the single-family home market as “mega investors” with over 1,000 units in diverse locations, “small investors” with between 100 and 1,000 units in diverse locations, and “local investors” with over 100 units concentrated in one geographic area. The most common umbrella criterion that characterizes “institutional” is holding over 1,000 units.

These large investors first made a substantial appearance in the aftermath of the 2008 financial crisis. In fact, before 2011, there were no investors who owned more than 1,000 units. After the housing market crash, investors anticipated a rebound and purchased thousands of foreclosed homes. This counterbalanced the mass exit of individual homebuyers and propped up a cascading housing market. Without that infusion of capital, many of those homes would have been abandoned and whole neighborhoods gutted. Today, major investors only own about 2% of the total single-family housing stock in the United States, hardly the seeds of a crisis (see figure). Those numbers are higher in some locations where the supply problem is most severe and investors see that local policies have created a market imbalance: Investors own 5% of single-family homes in the Miami area, 13% in the Orlando area, and 15% in the Tampa area.

In those areas, some are worried that investment firms with massive amounts of capital are outbidding individuals in the market and therefore driving up prices. Further, they worry that through buying properties and renting them, institutional investors are detracting from the for-ownership supply and limiting homeownership opportunities for families.

The current stagnant housing market in Florida shows how oversimplified those arguments are. A lot of things in the market have not worked consistently with that story. If investors buying up homes drives up prices, the natural market response would be to increase supply so that homebuilders could sell to both investors and families. If supply keeps up with demand, prices won’t fluctuate much. But while prices did increase, the expected subsequent supply expansion has had a more difficult time manifesting. Persistent regulatory barriers, including zoning restrictions, have made adjusting to the rise in demand in a cost-effective way difficult or even impossible in many places. Investors see that and are likely to continue to invest in single-family homes.

So, it is not the infusion of capital from investors that disrupts housing markets; it is local government policies that do not let supply keep up with demand. The increased involvement of investors in the housing market should be a wake-up call to policymakers. Housing supply should be able to adjust to the needs of the entire single-family rental and for-ownership sectors of the broader housing market.

A version of this column first appeared in the Sarasota Observer

The post Institutional investors are not to blame for U.S. housing prices appeared first on Reason Foundation.

Source: https://reason.org/commentary/investors-are-not-hurting-the-housing-market/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.