Co. Discovers Valuable Gold Resource in British Columbia, Targets Major Growth

Source: Streetwise Reports 08/19/2025

Blue Lagoon Resources Inc.’s (BLLG:CSE; BLAGF:OTCQB; 7BL:FSE) Dome Mountain mine in British Columbia marks its grand opening with a celebration as gold continues to ride a bull market. Read why analysts recommend this stock.

Blue Lagoon Resources Inc.’s (BLLG:CSE; BLAGF:OTCQB; 7BL:FSE) Dome Mountain mine in British Columbia marked its grand opening in July with a celebration attended by over 100 guests, including representatives from Crescat Capital and Nicola Mining Inc. (NIM:TSX.V; HUSIF:OTCQB; HLIA:FSE).

Tyson Halsey, CFA of Income Growth Advisors, was there and said he had the opportunity to connect with numerous company employees, advisors, service providers, financial experts, and major investors during the visit. Understanding the complexities of the mining sector, Halsey engaged in in-depth discussions with various contractors and team members to better understand the operational challenges and strategies involved at Dome.

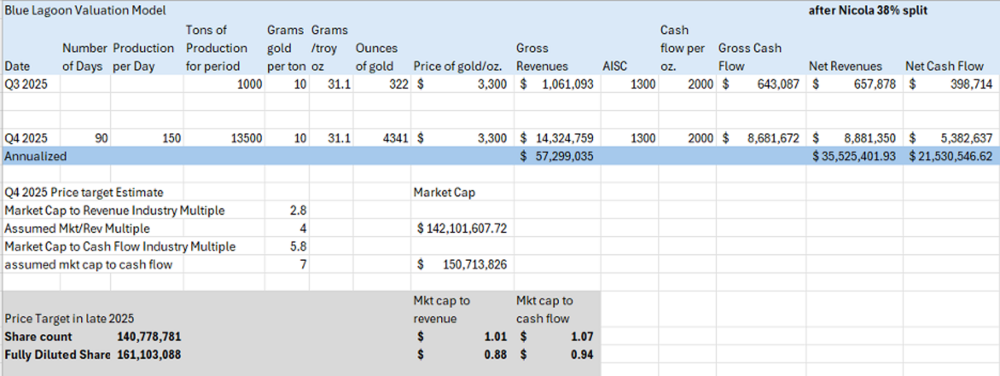

The expert told Streetwise Reports that he feels “very confident that this stock is US$0.90/share to US$1/share by year end.”

“I am all in. I have done the due diligence,” Halsey said. “I’ve seen the mine, I’ve spoken to the consultants, the employees. … I think this is a truly scalable opportunity that could go a long, long way.”

After conversations last week with Bill Cronk, Peter Espig, Michael White, and Rana Vig, Halsey modeled US$0.96/share by year end based on 322 ounces of gold and 4,341ounces of gold being produced in Q3 and Q4, 2025, respectively.

Halsey said the estimate is aggressive as it assumes 90 days production in the fourth quarter and assumes Blue Lagoon will provide monthly production data, “but 4,341 ounces in Q4 is doable.”

He said he could see the stock doubling “this year, next year, and the year after. … I’ve got my money where my mouth is.”

Two of the most respected miners and geological experts (Yannis Tsitos and Quinton Hennigh, respectively) present during his visit confirmed to Halsey the expansion potential, suggesting that the company’s land holdings could potentially contain 2 to 3 million ounces (Moz) gold, Halsey wrote for Streetwise on August 5.

On July 11, Crescat Capital shared an update on YouTube about Blue Lagoon, where respected geologist Quinton Hennigh reiterated his excitement for the company’s alkaline gold geology and the professionalism of the mining team, stating, “My gut says they will kill it.”

The company plans to expand its infill and exploratory drilling to grow the resource at the project, which “will elevate Blue Lagoon’s valuation,” Halsey noted.

Mine Gets Rare Permit

Blue Lagoon Resources is advancing its fully owned Dome Mountain gold project toward production, having secured a comprehensive mining permit in February 2025. The company aims for an initial yearly production of 15,000 ounces of gold, with production expected to commence in the third quarter of 2025.

Situated near Smithers, British Columbia, the Dome Mountain project is among only nine in the province to have received a mining permit since 2015. To date, Blue Lagoon has invested over CA$38 million, with an additional CA$3 million allocated to complete a water treatment facility (now finished) and cover initial operational expenses.

Mineralized material from the project will be processed at Nicola Mining’s Merritt Mill under a profit-sharing arrangement. The current resource estimate includes 218,000 ounces of gold at a grade of 9 grams per tonne (g/t) from the Boulder vein, with 15 more high-grade veins identified on the property.

Notably, over 90% of the 22,000-hectare (ha) area remains unexplored. The production strategy involves processing 55,000 tonnes of mineralized material in the first year, increasing to 75,000 tonnes annually by the second year. Gold recoveries have been reported at 95%, with grades of 9 g/t based on previous bulk sampling.

Co. Gets Positive Attention as it Moves to Production

The company has garnered positive attention from various research firms and investment analysts. Fundamental Research Corp. (FRC) gave the company a “Buy” rating, with a fair value estimate of CA$1.11 per share in a July 2025 research report. After conducting a site visit, the firm expressed confidence in Blue Lagoon’s infrastructure and readiness for operations, projecting that the company could generate around US$21 million in net cash flow during its first year of production.

*On July 22, John Newell of John Newell & Associates also rated Blue Lagoon as a “Speculative Buy,” highlighting its fully permitted status, engagement with First Nations, and imminent production potential. He noted technical indicators pointing to a breakout and described Dome Mountain as a revitalization of a high-grade, previously productive mine poised for a new gold cycle.

Income Growth Advisors, LLC, which has accumulated over 4 million shares of Blue Lagoon since 2024, expressed confidence in the company’s management and development team. Income Growth Advisors expects a valuation re-rating as Blue Lagoon transitions from a development-stage resource company to a gold producer.

Nicola Mining, which operates the toll milling facility, maintains a strong operational and financial partnership with Blue Lagoon. Nicola has processed previous ore samples from Dome Mountain and has provided unsecured credit and equity investment. A site visit report by FRC in July 2025 highlighted the project’s strong local support, particularly from the Lake Babine First Nation, and emphasized the strategic alignment with Nicola Mining. FRC’s report also noted that while Blue Lagoon is not basing its production decision on a feasibility study, it benefits from existing infrastructure, historical and current processing data, and an established 43-101 compliant resource.

In his piece on August 5, Halsey also did a technical analysis of the stock, saying it “appears to be consolidating following its substantial 500% licensing-driven appreciation. Shares appear to have found support and forming a ‘cup with handle’ pattern.”

He continued, “Our fundamental assessment indicates Blue Lagoon represents an attractive undervalued gold producer warranting purchase.”

“The investment community often notes that ‘time in the market’ rather than ‘market timing’ generates superior returns,” Halsey wrote. “This principle has been demonstrated by Warren Buffett and Peter Lynch alongside our most successful clients’ experiences. Blue Lagoon potentially represents an exceptional long-term investment. The company’s existing resource could support elevated growth rates for years if not decades. We project Blue Lagoon could expand 60-100% annually over the next three years before continuing robust growth rates thereafter.”

The Catalyst: Gold Remains Stable

Gold prices remained relatively stable on Monday as investors turned their attention to U.S. President Donald Trump’s upcoming meeting with Ukrainian and European leaders, as well as the Federal Reserve’s annual symposium in Jackson Hole later this week, Noel John reported for Reuters August 18.

Spot gold held steady at US$3,334.81 per ounce at 11:56 a.m. ET after reaching its lowest point since August 1 earlier in the day. U.S. gold futures for December delivery dipped by 0.1% to US$3,379.70. The U.S. dollar strengthened by 0.3%, making gold priced in dollars more costly for holders of other currencies, John wrote.

The main focus for investors Monday was a meeting at the White House between Trump and Ukrainian President Volodymyr Zelenskiy, along with European leaders, as the U.S. pushes for a rapid peace agreement to resolve Europe’s most lethal conflict in 80 years.

This follows Trump’s meeting with Russian President Vladimir Putin on Friday, where both leaders agreed to work towards a peace deal without initiating a ceasefire. “There was not much reaction in gold to the Putin-Trump meeting. I think we’ll continue in this price range. The next inflection point is the Federal Reserve (conference),” commented Marex analyst Edward Meir, according to John.

Minutes from the U.S. central bank’s July policy meeting are expected on Wednesday, ahead of the Fed’s annual conference in Jackson Hole, Wyoming, scheduled for August 21–23. Fed Chair Jerome Powell is anticipated to deliver a speech at the event. Investors will be keenly observing Powell’s comments on the economic outlook.

Garrett Goggin, the lead analyst for the Golden Portfolio, highlighted on June 16 that despite the ongoing positive developments in the gold market, gold stocks remain significantly undervalued. [OWNERSHIP_CHART-10023]

For the first time in 50 years, gold prices have surged dramatically, yet gold stocks have not followed suit. He referenced a recent report indicating that international traders are increasingly choosing to receive payments in their own currencies rather than in U.S. dollars. Additionally, foreign investors have been decreasing their U.S. dollar holdings.

Goggin stated, “That kind of bond destruction is part of the reason why I believe this gold trend is not just an ordinary, short-term uptrend. It’s a long-term, widespread sea change in the currency markets.”

He also pointed out that global rivals to the U.S. have been stockpiling gold for years, with China likely underreporting its acquisitions. According to Bloomberg on June 3, Goldman Sachs estimated that central banks around the world are collectively purchasing about 80 metric tons of gold each month, valued at approximately US$8.5 billion at current prices.

Ownership and Share Structure

According to Blue Lagoon Resources’ Investor Presentation, founders and insiders own 14% of the company. There are three strategic investors, Crescat Capital with 8%, Nicola Mining Inc. with 6% and Phoenix Gold Fund with 6%.

The remaining 66% of Blue Lagoon is in retail.

The soon-to-be-gold producer has 140.78 million issued and outstanding shares. Its market cap is CA$80.24 million. Its 52-week range is CA$0.10–0.87 per share.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Blue Lagoon Resources Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the John Newell article published on July 22, 2025

- For the quoted article (published on July 22, 2025), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it’s advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.

( Companies Mentioned: BLLG:CSE; BLAGF:OTCQB;7BL:FSE, )

Source: https://www.streetwisereports.com/article/2025/08/18/co-discovers-valuable-gold-resource-in-british-columbia-targets-major-growth.html

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.