Pumping Steady Cash Flow into Dividends

Energy companies are often seen as unpredictable, with results swinging up or down depending on oil prices. But among the chaos, some players manage to stand out for their discipline, scale, and ability to keep rewarding shareholders. This is one of those cases — a global powerhouse that balances production with refining, turning barrels into steady streams of cash flow.

A Business Built for Energy Cycles

Chevron Corporation (CVX) is one of the world’s largest integrated oil and gas companies and the second-largest U.S. energy major behind ExxonMobil. Its business is split into two primary segments:

-

Upstream (≈75% of earnings in recent years): exploration, development, and production of crude oil and natural gas, including liquefied natural gas (LNG). Key assets include a dominant position in the Permian Basin, long-life production in Kazakhstan’s Tengizchevroil, and growing volumes in the Gulf of Mexico. The company also owns stakes in major international pipelines and has a role in carbon capture and storage projects.

-

Downstream (≈25% of earnings): refining crude oil into fuels, lubricants, petrochemicals, and additives. This segment also includes marketing of refined products, operation of pipelines, and the growing renewable fuels portfolio. Chevron has about 1.8 million barrels per day of refining capacity spread globally.

By being vertically integrated, Chevron generates profit at multiple stages of the value chain. High oil prices boost upstream earnings, while refining and marketing activities can help soften the blow in downturns. That balance — combined with disciplined capital allocation — underpins Chevron’s ability to return consistent cash to shareholders through dividends and buybacks.

When Oil Majors Play It Smart Bull Case: A Machine for Free Cash Flow

The integration of Hess has already proven to be a shrewd move. With $1B in synergies expected this year and 2026 free cash flow guidance raised to $12.5B, management has given investors a clear message: dividends and buybacks come first, growth second. The acquisition also secured long-term growth from Guyana, one of the most promising oil basins in the world.

The company’s low-cost upstream barrels are another strength. More than 70% of its production is liquids, which historically carry stronger cash margins. Permian acreage comes with unusually low royalty rates, giving the firm a cost advantage compared to peers. Add disciplined capital allocation, and you get a business that can keep generating cash even if oil prices don’t soar.

Production growth is on track, with Tengiz and Gulf of Mexico projects contributing meaningfully. Management targets 6–8% growth in 2025, then moderating in 2026 to ensure discipline. It’s a classic case of “slow and steady wins the race” — and for dividend investors, that’s exactly what matters.

Bear Case: Still an Oil Game

No matter how strong the portfolio looks, this is still a commodity-driven business. If crude oil slides due to oversupply or weak demand, cash flow falls quickly. The liquids-heavy mix that drives high margins when prices are strong also makes earnings volatile in downturns.

Downstream operations have been shaky, with losses dragging on results. That’s a risk when refining margins compress — instead of balancing the cycle, the downstream unit can deepen the downturn.

The Permian, while profitable, comes with high decline rates that require constant reinvestment. Cost inflation, tariffs, and execution risk in massive projects (like Tengiz) are additional headwinds. Investors should also keep in mind that large-scale energy investments are notoriously prone to delays and cost overruns.

Free Webinar: Avoid Price Confusion

When a stock dives or spikes, most investors react to the price. However, successful investors know how to examine the business first thoroughly.

Join our free webinar on Thursday, September 18 at 1:00 p.m. ET:

Join our free webinar on Thursday, September 18 at 1:00 p.m. ET:

-

Learn a simple framework to understand when to ignore headlines and when to listen

-

Use the Dividend Triangle to separate bargains from traps

-

Walk away with a repeatable method to invest with conviction

Seats are limited to the first 500 attendees. Can’t make it live? No worries — a replay will be sent to all registrants.

Save your spot (or get the replay): dividendmonk.com/webinar

What’s New: Output Up, Prices Down

The latest quarter highlighted the dual nature of being in oil:

-

Revenue down 12% and EPS down 31%, hurt by lower commodity prices.

-

Record production of 3.4M boe/d, including >1M boe/d from the Permian.

-

Growth contributions from Tengizchevroil and Gulf of Mexico projects.

-

Ballymore subsea tieback start-up supported volumes.

-

Downstream and chemicals posted mixed margins, offsetting some upstream gains.

In short, operations were solid, but realizations (prices) drove financial weakness.

The Dividend Triangle in Motion

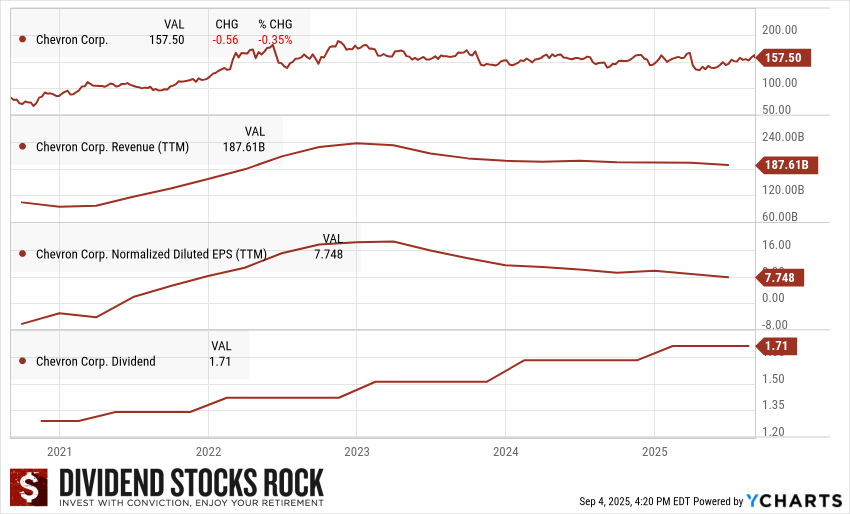

Chevron’s Dividend Triangle shows a mix of stability and cyclicality:

-

Revenue: At nearly $188B, revenue reflects both operational strength and the unavoidable impact of commodity cycles. The last few years show stability after the post-2022 surge.

-

EPS: Earnings per share remain cyclical — peaking when oil prices climb, compressing when they fall. The latest dip shows the downside of reliance on commodity realizations.

-

Dividend: Now at $1.71 per share quarterly, the dividend continues its steady march higher. With a payout ratio supported by strong free cash flow, dividend safety remains intact.

This balance of revenue scale, cyclic EPS, and growing dividends explains why many investors hold the stock as a core energy allocation.

Final Thoughts: A Dividend Engine with Commodity Risks

This isn’t a smooth ride — no oil major ever is. But when you look past the quarterly noise, the long-term story is consistent: disciplined capital allocation, advantaged assets, and a commitment to return cash to shareholders. For dividend investors, the company remains a strong play on energy markets, with the dividend supported by both scale and discipline.

Secure Your Webinar Seat

Market noise can easily shake even disciplined investors. That’s why this upcoming session is so timely.

- Free Webinar: Avoid Price Confusion and Act with Conviction

- Thursday, September 18th at 1:00 p.m. ET

- Replay available for all registrants

If you’re tired of not knowing whether to sell, hold, or buy after earnings swings, this is for you.

Register now: dividendmonk.com/webinar

The post Pumping Steady Cash Flow into Dividends appeared first on Dividend Monk.

Source: https://www.dividendmonk.com/chevron-cvx-analysis/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.