1 Birthright Gold Stock, 1 Pure Silver Play

This post 1 Birthright Gold Stock, 1 Pure Silver Play appeared first on Daily Reckoning.

As most of you know, I spent last week at Rick Rule’s annual investment conference.

It was a bonanza for natural resource bulls. Especially us gold and silver bugs.

We heard from and spoke with some of the best mining companies in the world. From early-stage exploration stocks to giants like Agnico Eagle Mines (AEM). And everything in between.

Today we’re going to look at two of the fascinating mining stocks which were at the event. I have chosen to focus on stocks which I don’t own (yet) because both are on the smaller side, and it doesn’t seem right to promote the ones already in my portfolio, considering their size (tiny and low volume).

However, I assure you these are high-quality opportunities. Every company at the conference was hand-selected by Rick Rule (a legend in the space), and he’s invested in all of them. That’s what makes this event truly stand out from the competition.

Let’s get started…

Dakota Gold Corp (NYSE: DC)

As we explained in The Dirt on Gold Miners, most companies at the conference operated outside the U.S

However, if you prefer to invest in America, Dakota Gold (NYSE: DC) is definitely worth a look

Dakota was founded by a legend in the mining space, Bob Quartermain. Bob took Silver Standard (SSR) from a market cap of around $2 million all the way up to $2 billion. This guy knows the mining industry inside and out.

We heard from Mr. Quartermain a few times last week, and his interactions with Rick Rule tell us much. Rick clearly respects Bob greatly, and repeatedly stated how much money they had made together.

Dakota is revitalizing historically rich gold deposits known as the Homestake District in South Dakota

This area has been producing gold for more than 140 years, and over that span has generated more than 40 million ounces of gold! An incredible amount of wealth has come out of this ground, and there appears to be plenty more left to go.

However, in 2002, when gold was down around $250/oz, it became non-economical to continue operations. Combine low prices with the fact that red tape and regulation were out of control, and the district went virtually untouched for two decades.

But now Bob Quartermain and his stellar team are determined to revive this vast and rich resource. With gold trading well over $3,000 oz, and the regulatory environment improving rapidly, the outlook for mining in the U.S. is suddenly bright

The Dakota Gold story fits right into Jim Rickards’ American Birthright thesis, and it looks like an excellent way to bet on this ongoing shift.

However, investors in Dakota Gold should realize that it is an exploration and development company, not in full production yet. They don’t expect to get there until 2029. So for now, you’re betting on the team and the asset. But the payoff down the road could be substantial

I’m still researching Dakota, but it just might be a great way to play the rebirth of gold mining in America. All-star team, great asset, access to capital, and a bullish gold market.

Aya Gold and Silver (OTC: AYASF, TSX: AYA)

The official name of the company is “Aya Gold and Silver”, but it’s really a silver play. In fact, it’s one of the purest silver mining plays you’ll find.

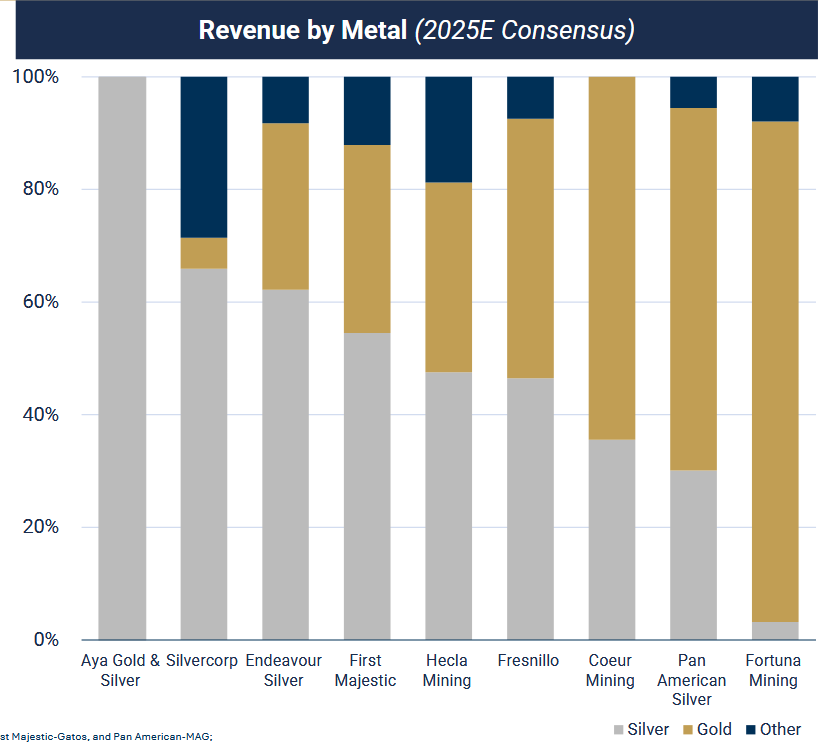

Here is a slide from Aya’s most recent investor presentation, showing how the company compares to other “silver” producers:

As you can see, many large “silver miners” such as Pan American Silver and Coeur Mining (both of which I like and own) derive a majority of their current revenue from gold. They might have 30-40% exposure to silver, and for the industry, that’s high.

Aya’s current operating mine, Zgounder, is located in Morocco, North Africa. It is a unique mine because it is almost exclusively silver. Most silver is produced as a by-product of mining other metals, such as gold, zinc, and copper. Not in this mine. Silver is the main course, and anything else is a small by-product.

So Aya is highly leveraged to the price of silver. That’s the primary reason it stood out to me in a sea of promising stocks.

Eventually, Aya does plan to branch out into gold as well, when its other mines, currently under exploration and development, come into production. But for now it’s a pure silver play, which is extremely rare.

The Moroccan Advantage

Aya’s CEO and President Benoit La Salle gave an excellent presentation. You can sense his passion from a mile away.

One of his most convincing points about Aya is the low costs associated with mining in Morocco. For example, Benoit said that drilling in his jurisdiction costs about $145/meter. In the United States, by comparison, it costs around $600/meter.

Proper exploration and development of a large site requires hundreds of thousands of meters of drilling, so these cost savings really add up over time. Overall, Aya’s G&A (overhead) costs are quite low for the industry.

Its cash costs per ounce of silver are under $20/oz. With silver currently trading around $38/oz, it’s a recipe for high-margin mining. And if silver goes to $100/oz, as many of us believe it will, silver producers like Aya stand to benefit significantly.

That, combined with the fact that the company has tremendous direct exposure to the price of silver, caught my attention.

Aya is currently ramping up production at its Zgounder mine, and exploring at its other properties.

Overall, I like this one quite a bit and plan to continue my research. I will likely buy it if and when we get a correction in the sector. As you all know, I’m a huge silver bull and this is one of the most interesting ways to play it with leverage.

Needless to say, investing in individual mining stocks is riskier than buying bullion. But with the right stock, you gain the potential to buy a fast-growing and expanding business which is able to re-invest its profits and provide a return far higher than the underlying metals.

To be clear, mining stocks are not a quick trade for me. These are best-treated as long-term investments. Over the short-term, the only guarantee is volatility. But over the long run, mining stocks have the potential to provide excellent returns, especially during chaotic periods.

The post 1 Birthright Gold Stock, 1 Pure Silver Play appeared first on Daily Reckoning.

This story originally appeared in the Daily Reckoning

Source: https://dailyreckoning.com/1-birthright-gold-stock-1-pure-silver-play/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.