This Isn’t Exciting—It’s Exactly the Point

In a world where flashy tech stocks rise and fall with headlines, this REIT quietly does what it’s always done—collect rent, pay dividends, and keep cash flowing.

This isn’t about rapid growth or reinvention. It’s about reliability, diversification, and a business model designed to weather storms. This is a name worth knowing.

Concrete & Contracts: The Core of NNN REIT’s Business Model

NNN REIT, formerly National Retail Properties, operates one of the most straightforward and effective business models in the REIT world: it buys and leases single-tenant retail properties under long-term triple-net leases.

These leases shift most property expenses—like taxes, insurance, and maintenance—to tenants, providing predictable, low-volatility income.

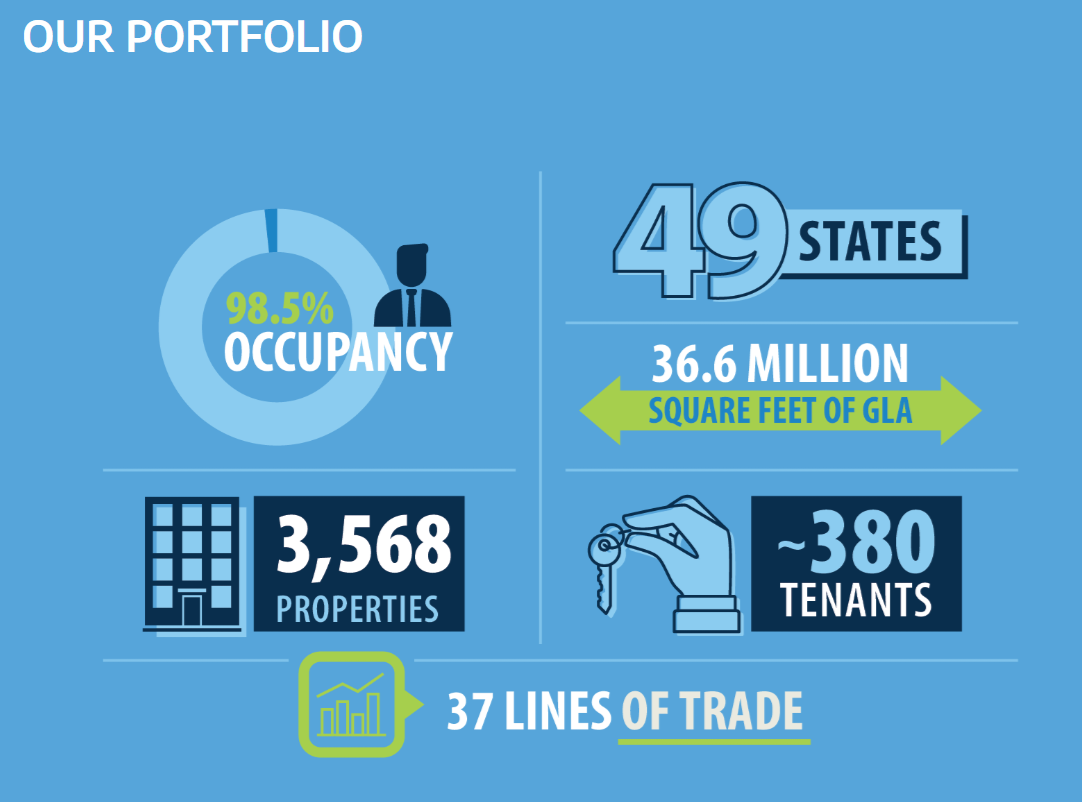

NNN owns 3,568 properties across 49 states, covering 36.6 million square feet. Its portfolio spans more than 370 tenants in 37 industries, including:

-

Convenience stores (7-Eleven, Circle K)

-

Quick-service restaurants

-

Automotive service and parts

-

Health & fitness centers

-

Drugstores and medical services

-

Pet supplies, home improvement, and entertainment venues

Its largest tenant (7-Eleven) accounts for just 4.4% of rental income. That’s diversification by design—and it helps explain NNN’s historical occupancy rate north of 98%.

The Bull and Bear Case for NNN Bull Case: Diversified and Durable

NNN’s superpower is risk-spread simplicity. With thousands of tenants across dozens of industries—and no tenant dominating the rent roll—NNN has constructed a portfolio that practically hums with consistency.

-

Occupancy? A rock-solid 98.5% as of Q4 2024.

-

Exposure? Necessity-based businesses like gas stations and food services dominate.

-

Volatility? Low, thanks to long-term leases with built-in rent escalators.

Even as retail real estate evolves, NNN’s mix of service-oriented tenants makes it less vulnerable to e-commerce disruption. Add to that a conservative balance sheet and well-managed acquisitions, and you’ve got a REIT that earns its income stripe.

Bear Case: Growth Pains and Market Sentiment

NNN hasn’t won the market’s heart lately for all its strengths. Its stock price still trails pre-pandemic highs, and growth remains modest—more crawl than sprint.

Revenue growth is slow, and AFFO (Adjusted Funds From Operations) has remained relatively flat. Rising interest rates make debt refinancing more expensive, eating into margins. And like many REITs, NNN is unlikely to deliver explosive capital gains—it’s mostly about income, not appreciation.

The bottom line? If you’re looking for growth, this REIT might feel more like a bond proxy than an equity rocket.

What’s New? Steady Income, Flat Growth—and a Look Ahead

NNN REIT’s most recent quarterly update, released on February 20, 2025, reflected another stable but unremarkable performance. Revenue rose by just 1%, with flat AFFO per share, mirroring the impact of higher interest rates and limited organic rent growth. The modest top-line increase came primarily from strategic property acquisitions, while NNN maintained its strong 98.5% occupancy rate across its portfolio.

Notably, the company released five properties during the quarter, highlighting its disciplined approach to asset management. Looking ahead, NNN provided guidance for 2025, projecting Core FFO between $3.33 and $3.38 per share and AFFO in the range of $3.39 to $3.44—signaling expectations for steady cash flow despite market headwinds.

And of course, the dividend kept rolling in—reliable as ever.

Looking for the Best Dividend Growers? Start with the Rock Stars

The Dividend Rock Star List is your shortcut to finding the market’s most consistent and promising dividend-paying companies.

The Dividend Rock Star List is your shortcut to finding the market’s most consistent and promising dividend-paying companies.

Curated using DSR’s time-tested metrics—including revenue, EPS, and dividend growth—this exclusive list highlights high-conviction stocks that stand out for their financial strength and long-term reliability.

Whether you’re building or refining your portfolio, the Rock Star List helps you focus on quality, not noise.

Dividend Triangle in Action: Strong Foundation, Slow Climb

Let’s put NNN through the Dividend Triangle lens—our go-to framework for evaluating dividend durability:

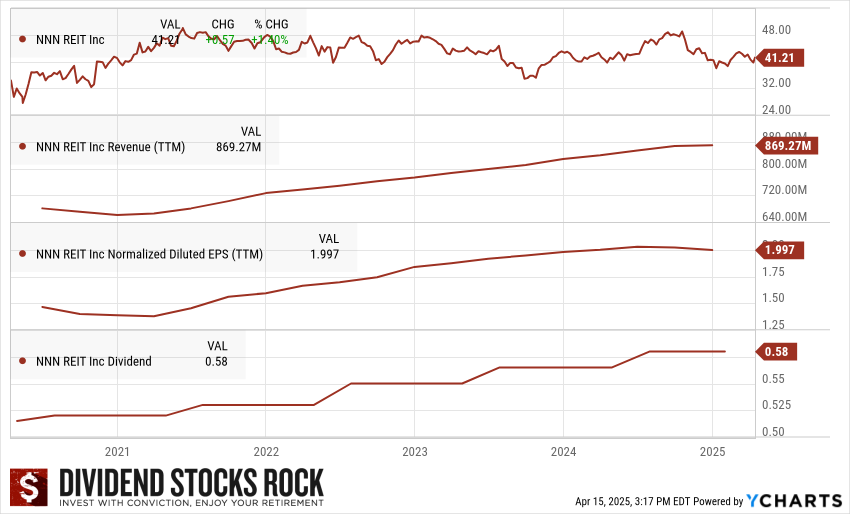

- Revenue: Steady, modest growth to $869.27M (TTM). Not flashy, but reliable.

- Earnings (EPS/AFFO): Normalized EPS is at $1.997 (TTM). Flat in recent quarters, but underpinned by stable leases and tenant performance.

- Dividend: Currently at $0.58/share, reflecting slow-but-steady growth. NNN raises its dividend almost every year, with a conservative payout ratio that keeps it sustainable.

Boring, Predictable—and That’s the Point

NNN REIT won’t excite your portfolio—but it might anchor it.

This is a REIT designed for stability: high occupancy, consistent cash flow, conservative growth, and a dividend you can count on. In a world where uncertainty is the norm, NNN offers something refreshingly predictable.

It’s not going to double in price—but it’s going to keep paying you, quarter after quarter, backed by thousands of real assets across America.

Get More Dividend Stock Ideas for Your Portfolio!

The Dividend Rock Star List is your shortcut to finding the market’s most consistent and promising dividend-paying companies.

The Dividend Rock Star List is your shortcut to finding the market’s most consistent and promising dividend-paying companies.

Curated using DSR’s time-tested metrics—including revenue, EPS, and dividend growth—this exclusive list highlights high-conviction stocks that stand out for their financial strength and long-term reliability.

Whether you’re building or refining your portfolio, the Rock Star List helps you focus on quality, not noise.

The post This Isn’t Exciting—It’s Exactly the Point appeared first on Dividend Monk.

Source: https://www.dividendmonk.com/nnn-reit-analysis/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.