The “Too Crowded” Gold Trade

This post The “Too Crowded” Gold Trade appeared first on Daily Reckoning.

According to the latest survey of fund managers by Bank of America, 49% say that gold is the most crowded trade.

This marks the first time in 2 years that the Magnificent 7 tech stocks did not top the “overcrowded” survey.

However, there’s a problem here. The fund managers responding to this survey clearly don’t know much about the gold market. My guess is they have not positioned their clients for the rise in gold, and are lashing out against bullion’s rise.

Gold is by no means a crowded trade, as we will show today. Central banks are driving this bull market in gold. Retail and institutional investors have barely gotten involved (yet).

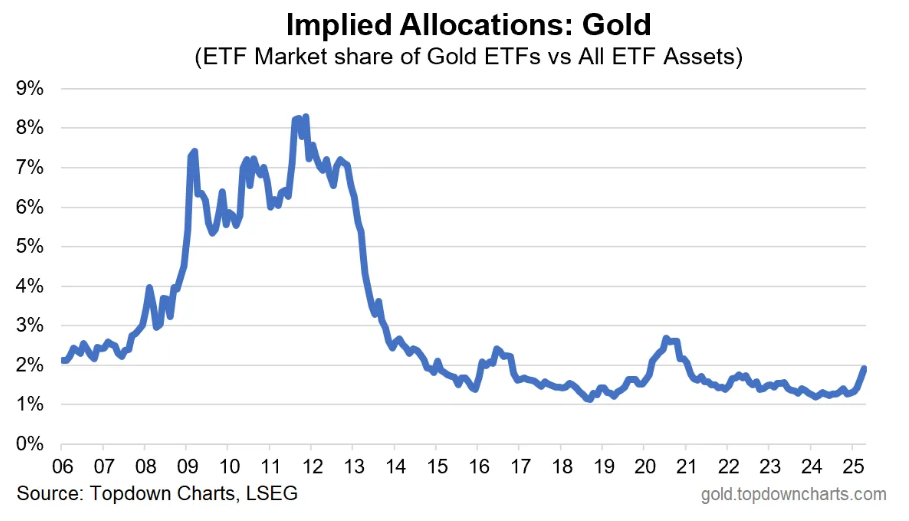

We can tell this in a number of ways. The first is by looking at the chart below, which shows the percentage of all ETF assets which are made up of gold ETFs (like GLD and PHYS).

Source: Topdown Charts

So only about 2% of ETF assets are currently allocated to gold. And during the last bull market, in 2011, that number got up to over 8%.

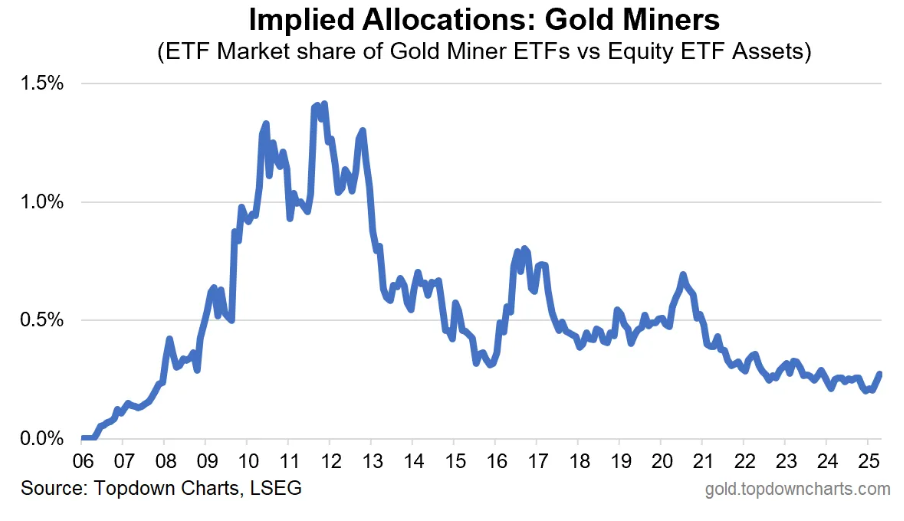

Here’s another interesting nugget. Gold miner ETFs are even more under-owned than bullion funds.

Below is another chart which shows the ETF market share of gold miner funds.

Source: Topdown Charts

As you can see, today gold miner ETFs only make up around a tiny 0.25% of all stock ETFs. Back in 2011 it was nearly 1.5%.

Barely anyone owns gold and silver miners today. It’s a fraction of a rounding error of the total market.

So, no. Gold is not the most crowded trade on Wall Street. The current gold market is not being driven by retail and institutional investors. The vast majority of buying today is being done by central banks (more on that here).

If you’ve already purchased gold (and silver), you’re well ahead of the curve here.

A Different World

We must consider how the market conditions have changed since 2011. The global debt burden is far, far larger.

In 2011, U.S. federal debt was about $14 trillion. Today it’s over $36 trillion and growing much faster.

Meanwhile, China, India, Turkey, and Russia are gobbling up an increasingly large share of global gold production. As we have discussed previously, it is entirely possible China’s gold reserves now exceed America’s by 2 or 3x. And just recently, retail interest in gold in China has absolutely exploded. More on that in a future letter soon.

My point is that it’s an entirely different planet than it was back in 2011. Mainstream asset managers have yet to get the memo. But they will eventually.

For now they simply see gold as a “crowded” trade because the price has increased. They have no idea that central bankers are the ones doing the buying! This is the ultimate insider signal, when the guys who run the fiat printing machines are the ones buying gold.

The fact that central bankers are doing the bulk of gold buying today is important for a few reasons. First of all, they are unlikely to sell it anytime this century. When central banks make a change in their reserve policy, it tends to last at least a few decades. This trend will continue going forward.

When mainstream investors do finally catch onto the precious metal story, and begin to digest the magnitude of our situation, the move in precious metals will be absolutely explosive. They will all rush to buy bullion and miners so they can respond to their clients’ inquiries with, “well of course we own it!”.

Just recently we’ve begun to see a slight uptick in gold and silver miners. I believe it’s truly just the beginning of this move.

A rotation out of traditional stocks, and into precious metals and miners has begun. But it is not anywhere near a “crowded” trade. So feel free to ignore those headlines.

However, in the very near-term, it does seem like gold is due for a break. I could see it pulling back to around $3,000 or a bit lower. Then continuing higher, with $4,000/oz being a reasonable target for the end of this year.

But who knows, we could just continue marching forward as central banks and savvy investors continue to gobble up gold to prepare for the chaos ahead.

I will continue to buy on dips, as we wait for the masses to join us.

The post The “Too Crowded” Gold Trade appeared first on Daily Reckoning.

This story originally appeared in the Daily Reckoning

Source: https://dailyreckoning.com/the-too-crowded-gold-trade/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.