Bonds Break, Bullion Breaks Out

This post Bonds Break, Bullion Breaks Out appeared first on Daily Reckoning.

Global markets have reached a day of reckoning. This has been decades in the making. Now, massive changes are sweeping the world.

No, what we’re seeing in the markets is not “normal.” Instead, this is the:

- Moment precious metal investors have been waiting for

- Birth of a multipolar world order (U.S. is no longer the sole superpower)

- Start of a very uncertain period for bonds and fiat currency

- Peak of globalization

In short, you no longer have the luxury of relying on the old rules, the old way of thinking. It’s time for a new playbook.

Bond Outlook: Murky

Since the early 1980s until recently, U.S. Treasury Bonds have been the perfect compliment to stocks. When stocks were doing poorly, bonds did well. And vice versa. Hence why the 60/40 (60% stocks, 40% bonds) was such a popular portfolio model.

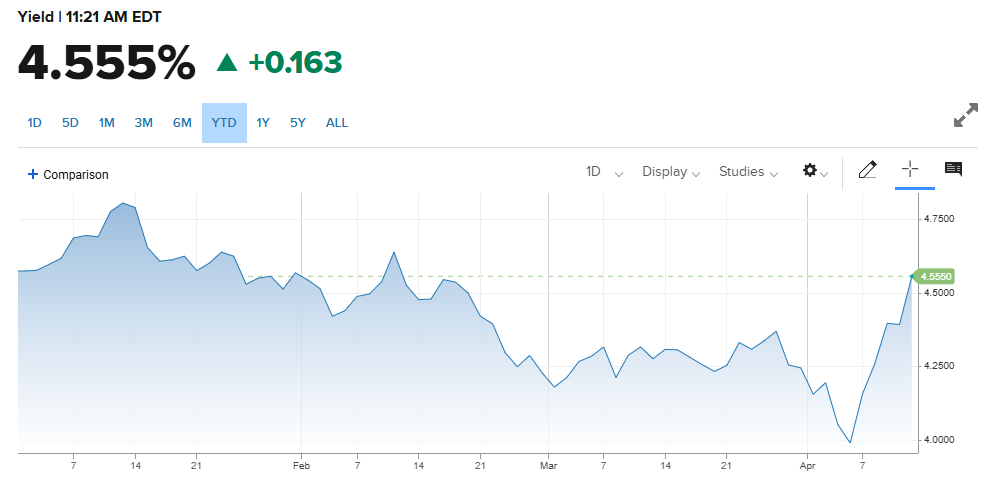

This relationship is breaking down. As U.S. stocks have been crashing, the value of bonds is also falling. This can be seen in the chart below, which shows the U.S. 10-year Treasury Bond yield (as the value of the bond falls, the yield rises). This chart shows the yield on the 10-year bond year-to-date.

Source: CNBC

See that big spike in yields over the last week? That’s a worrying sign. Investors are selling bonds when they “should” be buying.

Scott Bessent’s Treasury Department has about $9 trillion worth of treasuries maturing over the next year. Those bonds and bills will need to be refinanced. If rates are high when these new treasury securities are issued, the government’s interest costs will soar even higher (already over $1 trillion/year).

At some point, the Fed will have to get involved. Emergency rate cuts and eventually a massive new round of QE (money printing to buy treasuries) seem inevitable. Who else is going to buy $9 trillion worth of treasuries over the next year?

Eventually the Fed may even have to begin “yield curve control”, which means pegging the yield on treasuries at artificially low levels. For example, during and after WW2, when the U.S. was heavily indebted, the Fed froze the 10-year yield at 2.5%, even as inflation raged as high as 14%.

The goal was to dramatically lower U.S. debt-to-gdp levels by encouraging inflation and capping yields. Bond holders and savers got hosed. This is known as financial repression. And it could happen again.

Yield curve control and financial repression are probably some years out. But I much prefer to keep the “safe” part of my portfolio in gold and silver instead of government bonds. The upside potential is far higher, and taxes can be deferred for decades (until you decide to sell).

Gold and Silver: Just Getting Started

Rick Rule famously says, “I don’t own gold because I think it’s going to $3,500. I own it because I’m afraid it’s going to $10,000.”

This is an excellent way to look at our current situation. This move in gold, which just surpassed $3,200/oz, is a flashing warning signal. The global debt-based monetary system is on the verge of breaking down.

And instead of rushing into treasuries as a safe haven, the world’s central banks are increasingly turning to gold.

If you want an idea of just how high gold could potentially go, be sure to read Jim Rickards’ $27,000 Gold if you haven’t yet. This is not an arbitrary price target, but the result of Jim’s careful calculation. Of course, Jim doesn’t guarantee we get there, but it should give you an idea of what’s possible.

My message here is that if you’re just now thinking about starting a position in gold, you’re not too late.

Interest in precious metal miners is just now picking up. One of the largest gold miners, Newmont (NEM), which we highlighted as a buy last week at around $45, soared to $55 today.

And don’t get me started about silver, which is still about 35% below its 2011 high of $49.50.

Once we break through silver’s $35/oz level, it’ll be off to the races. I’m a buyer of silver here. And gold miners still haven’t caught up with the spot price of bullion, so I will look to add there on dips.

The vast majority of investors still have almost no exposure to gold, silver, and miners. This will change over the coming years. My advice is to get positioned for the shift now. You are not too late.

The post Bonds Break, Bullion Breaks Out appeared first on Daily Reckoning.

This story originally appeared in the Daily Reckoning

Source: https://dailyreckoning.com/bonds-break-bullion-breaks-out/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.