GeoWire Monthly, Vol. 4, Issue No. 11, November 2024 Review

In This Month’s GeoWire

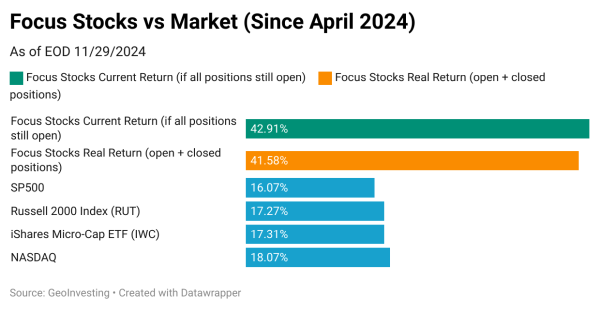

GeoInvesting has launched a few Model Portfolios since 2016. However, we have been tweaking the Model Portfolio framework over the past few months. The latest is the Open Forum Focus Model Portfolio (launched earlier this year), finally replacing the Legacy Top 5 Faves Portfolio, which delivered a 203.81% average return over the course of its existence, or since 2019. The new model portfolio aims to highlight GeoInvesting’s highest-conviction, earnings per share growth-driven ideas in response to shifting investor sentiment favoring value and quality vs. pure growth stocks, since 2022.

Our stated goal is to add stocks to the Focus Model Portfolio that have at least 50% short-term upside and long-term multibagger upside. Because of our hyperfocus on quality, we are optimistic that this Model Portfolio will eventually exceed the performance of the Legacy Top 5 Faves Portfolio.

A few stats that support the success of our shift:

- 4 stocks already attained a return of at least 50%.

- 2 stocks already attained a return of at least 100%.

In this issue, we review what the Focus Model Portfolio alpha over the major stock indexes already looks like:

Just Added The Tenth Stock To The Focus Model Portfolio

A GeoInvesting development some of our subscribers might view as surprising is the reintroduction of a customer experience management company as a high-conviction pick, this time in the Focus Model Portfolio (after having just removed it from the Legacy Top 5 Faves) after stronger-than-expected Q3 results and clear statements on improving profitability. This renewed focus on profitability is driven by management making subtle changes in the company’s blend of on-the-ground services and software solutions. Just like that, with shares just trading a run-rate P/E of 8x, we see multibagger potential. We predict this will be driven by accelerating EPS growth and an expansion of the P/E ratio, driven by growth investors finally being attracted to the story.

Speaking of discovering profitability, another data center stock we have been following closely is making progress toward profitability, bolstered by multiple new contracts, including an upfront cash payment deal that could bring the company to break-even profitability while reducing its reliance on additional capital raises. The stock has already started to climb on the contracts, but the crowd has yet to find this little OTC company

Additionally, an air pollution control systems company has been newly added to our Model Portfolio Universe. Strong demand, a healthy order backlog, and the emergence of new recurring revenue streams suggest significant growth potential for this already very profitable chemical company..

These updates were just a few of a myriad of GeoInvesting’s company coverage as part of deeper conversations during our December 2024 Open Forum reviewing last month’s research and Model Portfolio actions.

We intend to stay as nimble as we can with our strategies to better align with investor appetite for microcap quality, while taking feedback from our subscribers very seriously. We do this better than anyone else, and as a matter of fact,we got the messages below from our members IN JUST THE LAST MONTH, which validates our commitment to working hard for our community is delivering alpha for our subscribers

—

Hi Maj and Geo team, First of all, all the time and effort you guys put on keeping us informed with news and being to top of everything is greatly appreciated. What you guys do is a titanic task.

—

“@majgeoinvesting is great! One of the hardest working guys in microcap. Thanks for the Model Portfolio Updates and Earnings Coverage. Great email update !!!!!!!”

—

“Hi guys, Hope you are having a wonderful Thanksgiving. I wanted to express my gratitude for all the hard work you all do at GeoInvesting.” Also wanted to thank you for the new pick. This name seems very under the radar, which is great. I can’t seem to find a lot of folks on message boards following the company.”

—

“@majgeoinvesting Please post more about this one [company] with only 1.3 million share float. Thanks for having your service…finding something like this can be very lucrative. I think their earnings will come out very soon. Thanks again great service”

—

“Thanks for taking the time to do this. I think I found [this company] with my own screens, but there is no way I’d have the confidence to size up and hold it without your work.”

—

“Thank you for a great December Open Forum. So many symbols. How do you do it? I’m interested in 3/4/5, each one better than the next. I have about five symbols of interest from the Open Forum.”

—

“””Data Centers are the Dot Com’s of the 90’s.”” Great call. I’m hiding in less liquid symbols, for now. {these companies]. You do “yeomans work”, if that is a word.” {{yes it is a word – hard, valuable, and successful work, especially when it’s done to support a cause or help a team}}”

—

“Thanks for your work and thanks for the format of this email”

—

Read More at Our Last 2 Weekly GeoWire Issues, Here and Here

200+ Multibaggers And Counting

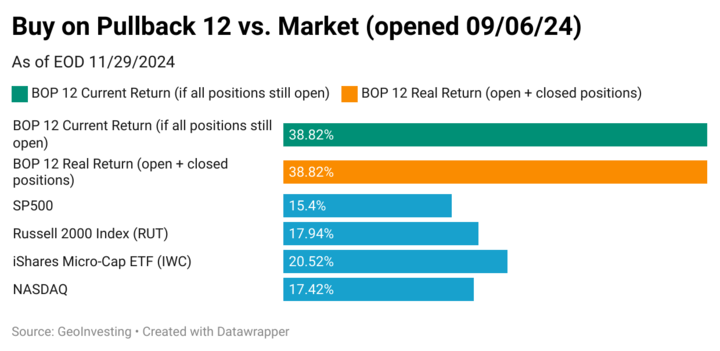

Buy on Pullback Model Portfolios are aimed at swiftly capitalizing on mispriced opportunities in the market, identifying stocks experiencing negative or muted reactions to positive news or downside overreactions to negative news that we see as temporary.

Misunderstood company developments, emotions, or negative market sentiment can often be at the core of the mispricing, so the pullbacks often stem from investor overreactions and may not necessarily reflect the underlying fundamentals of the business.

High-conviction Open Forum Picks arise from analysis of an already bullish basket of stocks in our coverage universe. One timely stock per month is highlighted in our Live Monthly Forum Virtual Events and added to the Focus Model Portfolio, with expectations that a short-term 50% to 100% upside is possible. All Open Forums are archived on our premium portal. upside is possible.

Andrew Sather, co-host of the Investing for Beginners (IFB) Podcast, joined the Second MS Microcaps Starting Five Virtual Conference to share his investment journey, methodology, and insights into building wealth through the stock market. Coming from a non-financial background, Andrew detailed how his passion for investing led him to create educational resources that resonate with beginner investors. His journey from self-education to managing a real-money portfolio underscores his focus on practical, approachable investing.

Andrew’s Investment Philosophy

Andrew outlined his guiding principles for investing:

- Avoiding High-Risk Speculation: Andrew prioritizes companies with predictable performance and avoids chasing moonshot opportunities or highly speculative plays.

- Fairly Priced Quality Businesses: He seeks companies that are either fairly priced or trading at a discount, placing less emphasis on deep undervaluation in favor of sustainable, long-term growth.

- Long-Term Mindset: Andrew emphasized a commitment to holding investments for five to ten years, focusing on consistent compounding over time rather than short-term gains.

He also introduced the Pivot Framework, an analytical tool designed to help investors evaluate businesses systematically. This framework has become a cornerstone of his Value Spotlight service, which combines portfolio tracking with educational insights.

Andrew shared his approach to discovering investment opportunities, blending quantitative tools like screens with qualitative observations and “light bulb moments.” He illustrated this with his decision to invest in Starbucks after realizing the company generates most of its revenue from cold beverages, reframing his understanding of the business. His contrarian nature allows him to comfortably invest in areas overlooked or misunderstood by the broader market, as evidenced by his success in the homebuilding sector during a time of widespread skepticism.

What is The Starting Five?

The ‘Starting Five Virtual Conference’ is an event series hosted by MS Microcaps, featuring presentations and stock pitches from various investors and industry experts. These conferences provide a platform for sharing investment strategies and insights into specific stock opportunities.

If you Are Not a Premium Member, You can Subscribe Here for full access to all our video events

About The Weekly Wrap Up

This is a comprehensive weekly premium email newsletter that encapsulates all the significant updates and insights from the week, just in case you were not unable to catch up with our coverage from daily Morning Emails during the week, as well research content we save for the weekend. Each issue begins with a topical introduction, followed by a recap of our mail summaries.

- New research coverage on our research pipeline.

- Reaffirming commentary on our high conviction stocks.

- Microcap stock education

- Case studies.

- Featured videos.

About Our Daily Premium Emails

These emails provide you with essential updates to start your day, relating to our over 1,500 microcap company coverage universe. Updates include:

- Calls To Actions, letting you know what stocks we are adding or removing from our Model Portfolios that our premium subscribers can choose to mimic.

- Tables and analysis of the best microcap earnings reports.

- Top Stock Pitches from investors we respect.

- GeoInvesting special event notifications.

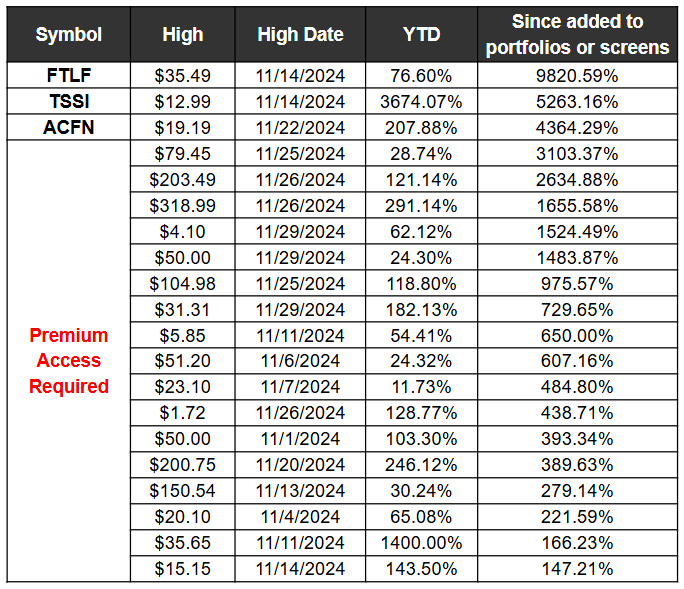

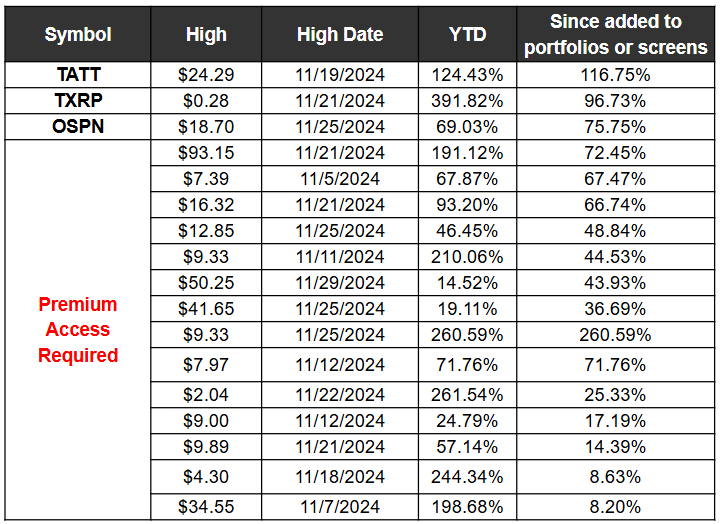

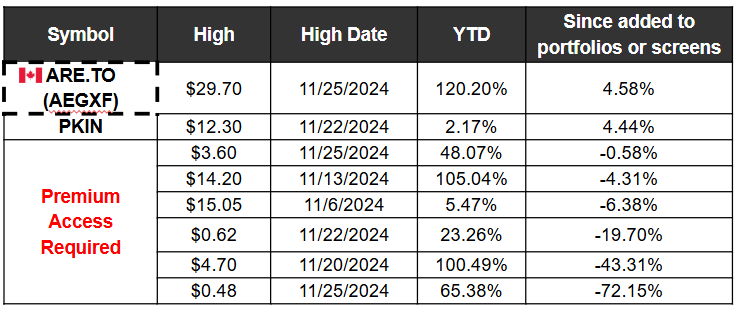

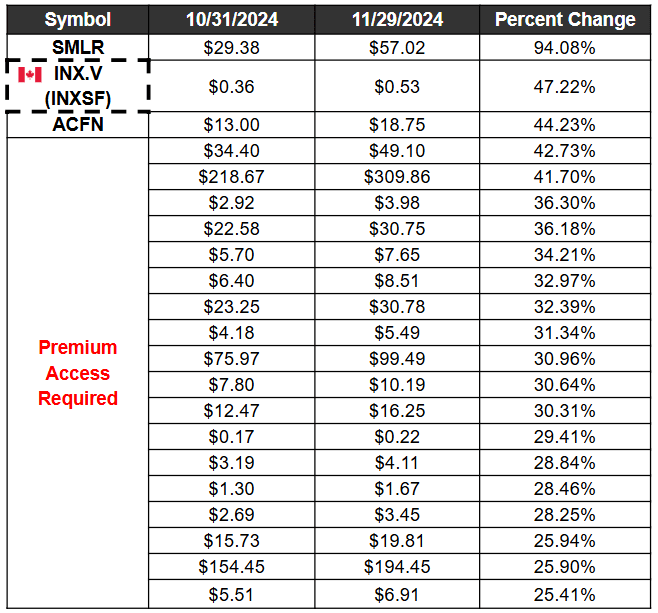

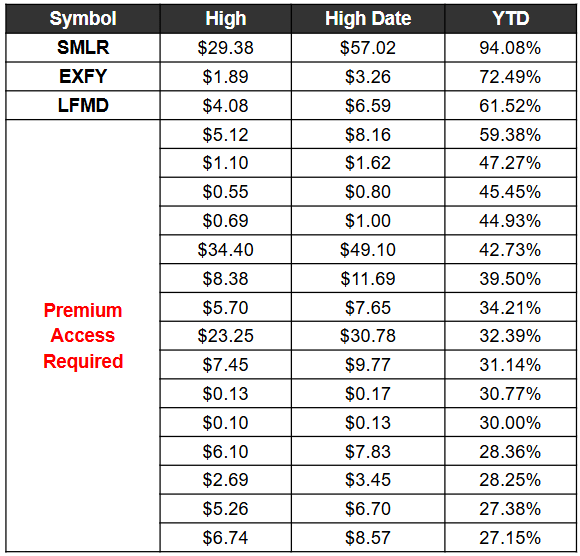

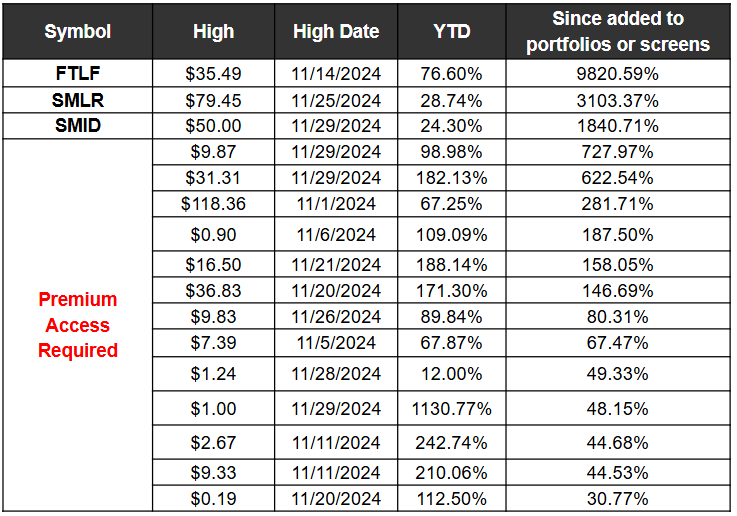

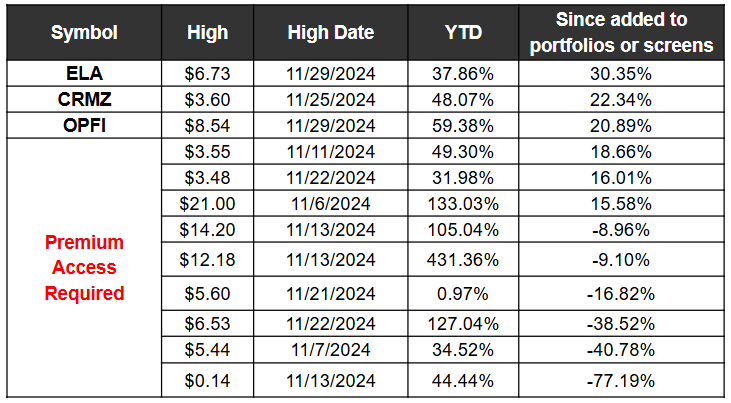

Top Performance Across All GeoInvesting Model Portfolios and Screens (In November 2024)

New Highs Across All GeoInvesting Model Portfolios/Screens

>25% Gainers Across All GeoInvesting Model Portfolios/Screens

>25% Gainers Across Contributor Index

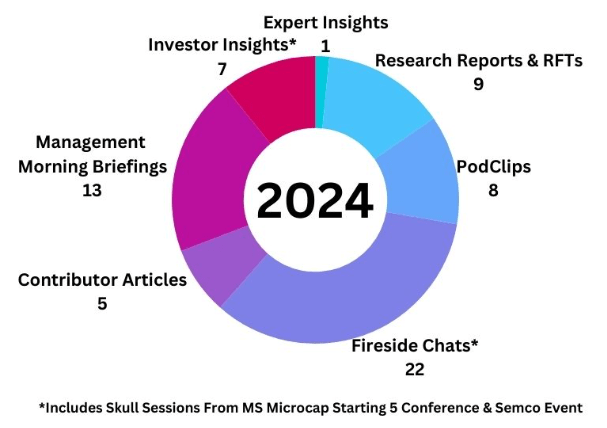

Please also note that year to date, we’ve published 251 video clips parsed from Investor Insights, Fireside Chats, Management Morning Briefings and Expert Insights.

So far in 2024, apart from daily emails and weekly GeoWire Content, we have published a combined 323 pieces of Premium content (including video clips) across the segments detailed in the appendix, versus 329 pieces of Premium content in 2023

To see more details on 2023 and 2024 year to date earnings, please go here.

Earnings Processed, YTD to November 2024

Earnings season picked up a bit in November as we began preparing for Q3 reports. We processed 51 reports in November 2024, bringing our full year total to 326.

Content Distribution Key

Written

9 Research Report & “Reasons For Tracking” (RFT) pieces: Articles are in-depth stock analysis columns focusing on qualitative and quantitative aspects of stocks, while RFTs are shorter, concise research on stock ideas. Learn more about our services.

5 Contributor Articles – Investors we invite to publish their analyses on microcap stocks as well as market forces and industry trends that impact the world of microcap investing.

Audio

8 PodClips – Audio clips consisting of quick “hot take” follow-ups to management interviews, brainstorms on a new stock idea and updates on current ideas.

1 Skull Session Expert Insights (via Twitter Spaces) (NEW) – Recorded and live podcasts that feature conversations with industry experts.

Video

22 Skull Session Fireside Chats – Live/archived video events with management to discuss a company’s entire business plan, growth initiatives and risk factors.

13 Skull Session Management Morning Briefings (MMBs) – Live/archived update video events with management to discuss key developments.

7 Skull Session Investor Insights (picking up the pace here) – Recorded and live podcasts that feature conversations with Investors we invite to provide a look at their stock picking research process, market commentary and their favorite stock pitches.

2 Skull Session Expert Insights (via Video) – Recorded and live podcasts that feature conversations with industry experts.

258 Video Clips across all Live Events (Not represented in Chart) – Catch a quick glimpse of some of the more notable clips/key takeaways that are extracted from our Skull Sessions (Fireside Chats, Management Briefings, Twitter Spaces, Expert & Investor Insights, & Forums), then highlighted on our Weekly/Monthly GeoWire Newsletters. We archive all of this material on the video menu section of our Pro Portal.

GeoInvesting is a premier research platform for microcap investors, dedicated to uncovering high-potential stock ideas in undervalued companies across various sectors. With over 30 years of investing experience, GeoInvesting has covered more than 1,500 equities, providing often actionable proprietary research. The platform has been instrumental in identifying 200+ multibagger stocks, and offers investors exclusive access to over 600 management interview clips, allowing for deeper due diligence and understanding of the microcap stocks, many of which make it to market-beating premium Model Portfolios. Join the GeoInvesting community for the best stock research and microcap insights to help you stay ahead in the market. To learn more about our Premium Services, go here.. (https://geoinvesting.com/premium-research/)

The post GeoWire Monthly, Vol. 4, Issue No. 11, November 2024 Review appeared first on GeoInvesting.

Source: https://geoinvesting.com/geowire-monthly-vol-4-issue-no-11-november-2024-review/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.

![Dilution Isn’t An Option For This Profitable Under-Followed Penny Stock With Share Repurchase In Place [GeoWire Weekly No. 160]](https://geoinvesting.com/wp-content/uploads/2024/11/One-Dollar-This-Way-282x300.png)