Silver: So Much Bigger Than 2011

This post Silver: So Much Bigger Than 2011 appeared first on Daily Reckoning.

I remember the 2011 silver bull market like it was yesterday.

We had already experienced two rounds of money printing (QE) by then, and the bank bailouts were still fresh on everyone’s mind.

Silver prices shot up from $9.40 per ounce in October 2008 to over $49 in April 2011.

It was a beautiful run, but ended much too quickly for my liking. Silver stayed above $30 for almost two more years, but as the economy improved, investors lost interest for a time.

Looking back, I can see now why the 2011 rally faded. First, the Chicago Mercantile Exchange (CME) hiked margin requirements, punishing long speculators. Moreover, the U.S. was still in relatively good economic shape then. The Fed’s drastic actions hadn’t yet caused major inflation. We were “saved”, for a while.

Investment demand for silver petered out and the supply deficit never got too serious, as we’ll see below.

In today’s bull market, I see none of these issues. Silver’s current move is set to be far more durable and stronger than in 2011. And today is the perfect time to explore why.

Shrinking Supply, Soaring Demand

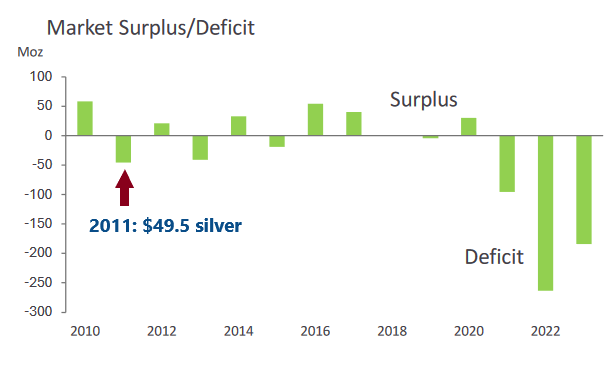

The remarkable chart below is from a Silver Institute presentation. It shows the annual surplus or deficit of silver.

Sources: Silver Institute, Metals Focus

I’ve marked how small the deficit was in 2011. That was when silver reached nearly $50. Now note how much larger the deficits were from 2021 to 2023. And 2024 is projected to be another big deficit year for the metal.

Demand for silver is absolutely BOOMING, and mine production was down about 1% in 2023. Recycling of the metal is up slightly, but that only accounts for about 20% of annual supply.

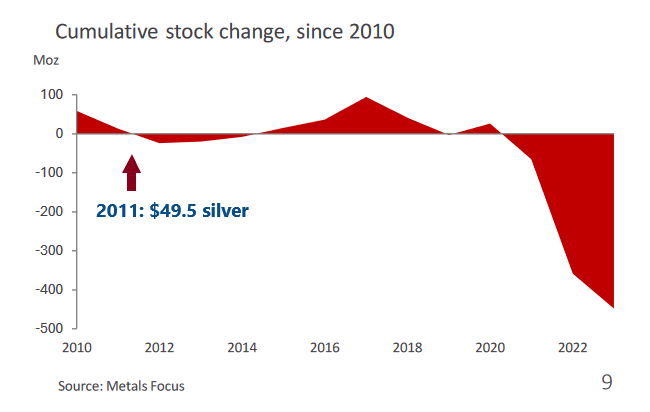

Here’s another fascinating chart from the Silver Institute presentation, showing how silver stockpiles are dwindling.

Sources: Silver Institute, Metals Focus

Once again, I’ve marked 2011 with a red arrow so it’s clear how different the fundamental picture is today. The size and scale of what we’re seeing today is so much larger than 2011.

Industrial + Store-of-Value

One major driver of today’s increased silver demand is solar panels. Each new gigawatt of solar power requires approximately 12 tonnes (~26,000 pounds) of silver, according to BloombergNEF. China alone installed approximately 216 gigawatts of solar capacity in 2023, increasing capacity by a whopping 53%.

The newest generation of solar panels is more efficient than past models, and it achieves much of this gain through increased use of silver. So it looks like this trend isn’t going away anytime soon.

Demand for silver as an investment and hedge is also significant, and I expect this area to grow dramatically over the coming years.

- Another wave (or two) of inflation seems certain

- More bank woes likely

- Conflicts escalating

- QE around the corner

- Silver supply getting thin

I expect demand for silver coins, bars, and ETFs to rocket higher in the ensuing calamity.

Eventually, I expect significant outflows from bonds and stocks into gold and silver. Bonds in the U.S. alone are a roughly $53 trillion market. US stocks are another $55 trillion or so.

Meanwhile, all the silver ever mined is reportedly only worth $1.8 trillion. And a chunk of that is lost at the bottom of the sea in Spanish galleons, or rotting away in landfills as improperly disposed electronics.

If just a fraction of traditional assets shift into silver, we’ll see incredible price action. With industrial demand growing steadily, additional investment demand could upset the market’s equilibrium.

During precious metal bull markets, silver tends to significantly outperform gold (and vice versa in bear markets).

Once metal mania begins, silver could easily see $130/oz over the next 4 years. If we get a big bank crisis, who knows how high the price could go? Bullion would become ultra-scarce in such a scenario.

In 2011, we reached a gold/silver price ratio of 31:1 ($49 to $1,500).

The gold/silver ratio is currently 84:1 ($31.40 to $2,661) as I write this on October 1, 2024. So one ounce of gold buys 84 ounces of silver. This tells me that silver still has a ton of gas in the tank.

Industrial demand is growing incredibly fast. And with central banks shifting back into easing mode, the future for silver is bright indeed.

The post Silver: So Much Bigger Than 2011 appeared first on Daily Reckoning.

This story originally appeared in the Daily Reckoning

Source: https://dailyreckoning.com/silver-so-much-bigger-than-2011/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.