GeoWire Monthly, Vol. 4, Issue No. 9, September 2024 Review

In This Month’s GeoWire

While the 3rd quarter 2024 earnings flow took a bit of a break in September, we ramped up our events and were able to hold 6 (7 if you include the 9/5/2024 Open Forum) that featured 4 microcap management executive Skull Sessions and 2 talks with investing peers.

- 9/4/2024 Fireside Chat with Dr. Abinand Rangesh, CEO of Tecogen, Inc. (TGEN) – 09/04/2024

- 9/7/2024 Investor Insights with Dakota Quint from Left Field Investing: ClearPoint Neuro (CLPT) Discussed – 09/09/2024

- 9/17/2024 Investor Insights Skull Session with Founder of Deep Sail Capital – 09/17/2024

- 9/19/2024 Fireside Chat with Covalon Technologies (CVALF) (COV.V) CEO Brent Ashton – 09/19/2024

- 9/20/2024 Fireside Chat with TSS Inc. (TSSI) CEO Darryll Dewan and CFO Daniel Chism – 09/20/2024

- 9/24/2024 Skull Session Management Morning Briefing with Craig Mull, CEO of Cipher Pharmaceuticals (CPHRF) (CPH.TO) – 09/24/2024

Aside from these, we published 5 GeoWire Weekly issues and I participated in a few Twitter Spaces, the most notable being the Woodstock of Small- and Microcap Investing, Part IV. In this event, I along with several peers introduced myself to an expanded audience of investors. I pitched a stock (previously talked about here) that didn’t fit into all the criteria that I usually stress when selecting microcap stocks to include in my coverage universe, but certainly appealed to me on a “special situations” level.

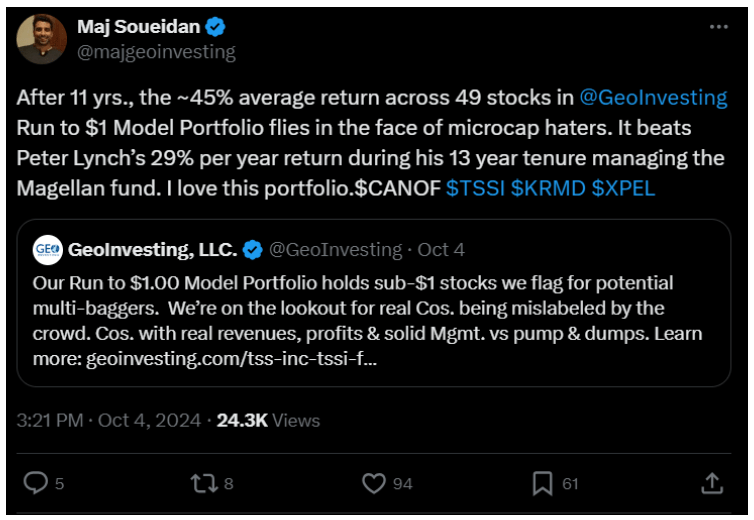

But, what I really want to address today is a comment made by a personality on X with a large following and a subscription service of his own, albeit not in investing. I like to give credence to the fact that investing in high-quality microcaps can produce outsized returns, and in doing so I often cite some statistics that support my suppositions

His comment was in response to my own stat-based tweet that did just that. A popular Model Portfolio that we make available on our premium site, the Run To $1 Model Portfolio (R21), has caught some attention lately due to one of our long-covered stocks, $TSSI, comfortably surpassing the one dollar mark (with plenty of volume, I might add). SInce the stocks addition to the portfolio, it is up over 2800% as of close on Friday.

In visiting the performance of the portfolio, I thought it a suitable time to put out what I surmised might be a well-received tweet for those that agree with my assessment that even though sub $1 stocks can catch some flack, if you pick the right ones, you can certainly win out in the long run.

Plus, it’s tough to argue against Peter lynch, no matter your beliefs when it comes to smaller capitalized stocks. He literally ran a fund comprised of microcaps, and boasted returns of 29% per year over the course of 13 years.

Whether or not you want to shrug off or appreciate R21’s average return of 45% over an 11-year span is up to you. You either subscribe to the concept of making smart money or you don’t, but the reply that caught my attention was little non sequitur, and frankly a little short-sighted given the nature of how this individual makes money. A little more on that later. Here was his response:

…let’s not ignore the bits of the confirmation bias that followed from a few people that also likely gave little thought as to why we do what we do.

Believe it or not, there is a bit to unpack from this small exchange. But I’ll try to keep my rebuttal bite-sized. All in all, I’m glad this was brought up since it tends to be an elephant in the room, and I hope it reinforces the decision that our premium subscribers made to join GeoInvesting, and helps to clarify our purpose for those still considering the platform for the go-to place for microcap research.

200+ Multibaggers And Counting

Sharing Knowledge and Helping People Achieve Goals

Just like you, our mission goes beyond personal gain. We get immense satisfaction from helping others achieve their financial goals. Through our service, we aim to provide opportunities that many might not have discovered on their own. It’s about giving back to a community of like-minded individuals. Helping others grow is part of what drives us.

We Do Own the Stocks, But Can’t Own Them All

The assumption that we don’t “eat our own cooking” is misguided. We do own many of the stocks we cover, but it’s not feasible to own every single one, especially when you have limited fund. On the flip side, running a subscription service helps sustain the research we do, which benefits both our subscribers and ourselves.

Building a Collaborative Community

Building a community means we’re part of something bigger. Through collaboration, some of our best stock ideas have come from our subscribers. Investing isn’t just a one-way street—it’s about contributing, learning, and getting feedback from a premium group of people who share a passion for the same thing.

Reputation Gains Access to Management

Being visible, reputable, and influential in the microcap space gets us (and in turn, our subscribers) access to CEOs, management teams, and other insiders that others can’t reach. This information flow is invaluable. If we didn’t run this service, those doors might not open as easily.

Capitalism and Charging for Expertise

Why do investment institutions charge fees? Why do financial planners? Are you suggesting there shouldn’t be a monetary exchange for expertise? Charging for a service doesn’t undermine the value of what we’re offering; it supports and justifies the time, energy, and skill that go into making well-researched, data-driven stock picks.

Engaging with Followers and Building Dialogue

You’ve engaged with other professionals in your field; so do we. The assumption that we don’t connect with people or provide value beyond subscriptions is inaccurate. We often have conversations with both subscribers and non-subscribers, free of charge, just to help people. If you want, let’s have a phone or Zoom call. I’m open to having that dialogue.

Education as Part of the Service

We don’t just pick stocks; we educate. Education is vital in the investment world, and we’re proud to provide insights that empower others to make informed decisions. Do you believe universities or institutions shouldn’t charge for this? Education has value, and charging for it allows us to maintain a high standard of service.

High-Quality Research Takes Time and Resources

When you see the returns we’ve achieved, it’s easy to focus on the numbers, but behind each of those picks is countless hours of work. High-quality research isn’t something you can automate or shortcut. It involves:

- Financial Analysis: Digging into quarterly reports, balance sheets, income statements, and cash flow to assess a company’s financial health.

- Industry Trends: Understanding the broader industry trends that may affect a stock’s future performance.

- Management Interviews: Speaking with executives and insiders to gain deeper insights into the company’s strategy, challenges, and opportunities.

- Monitoring Ongoing Developments: Keeping up with news, regulatory changes, and company updates to ensure our recommendations remain relevant and up-to-date.

- Due Diligence: Vetting companies beyond just the numbers—looking at competitive positioning, potential risks, and even the people behind the company.

All of this takes time, expertise, and often requires access to resources that aren’t readily available to the general public. By charging for the service, we can fund this in-depth research process and deliver it to our subscribers in a way that saves them time and offers a high level of confidence in the information they receive. This isn’t just about “good investors don’t sell investment advice”. Honestly, if you do know anything about GeoInvesting, we clearly say we are not advisors, nor do we give recommendations. We’re also not shy to explain when we’ve erred and taken our lumps.

Now, back to what you do. Can you give me a reason why you wouldn’t just take your own advice and get in shape in a vacuum, without charging people? You are probably good at what you do, but at the end of the day, how much do you really care about your subscribers, and how good does it make you feel to better their quality of life?

Building on my intro, this is a great moment to direct you to exactly how busy we are learning about companies, sharing ideas with fellow investors, as well as doing so much more than it would appear to someone who might not want to learn who we are at our core, and what we’ve done for investors in the past. Or maybe you do.

Continue Reading Rest of Commentary Here.

On August 15, 2024, at the The 4th Annual CEO Networking Event in Chicago, Illinois, Jim Jenkins (CEO) and Roger Shannon (CFO) of Lakeland Industries, Inc. (NASDAQ:LAKE) participated in a fireside chat.

Maj Soueidan, the co-founder of GeoInvesting, conducted interviews with both executives, where they discussed the company’s recent developments, including its acquisition strategy. Jenkins highlighted the company’s transition from a traditional personal protective equipment (PPE) provider to a more aggressive growth-oriented firm, partly inspired by his previous success at Transcat, Inc. (NASDAQ:TRNS). They focused on their “small, strategic, and quick” acquisition approach, emphasizing recent deals like the LHD acquisition, which has expanded their fire fighting turnout product line and market presence in key regions like Australia and Germany. The discussion also covered their goal to boost EBITDA margins, the importance of recurring revenue from new services like laundry and software for firefighting gear, and the ongoing efforts to optimize operations in Europe and Asia. The conversation concluded with an optimistic outlook on achieving their long-term revenue and margin targets, despite the challenges ahead.

This Chicago Networking Event was designed to give the opportunity for microcap management teams handpicked by Geoinvesting Subscriber Scott Weis of Semco Capital to present their stories to about 30 investors, allowing the companies to showcase their business models and growth strategies.

The gathering is a significant opportunity for investors to engage directly with management teams, gaining insights that might not be accessible through regular market channels.

This event, organized by Scott Weis of Semco Capital, continues to be an important forum for microcap companies to connect with microcap investors. This is Scott’s 4th Chicago microcap conference event.

If you Are Not a Premium Member, You can Subscribe Here for full access to all our video events

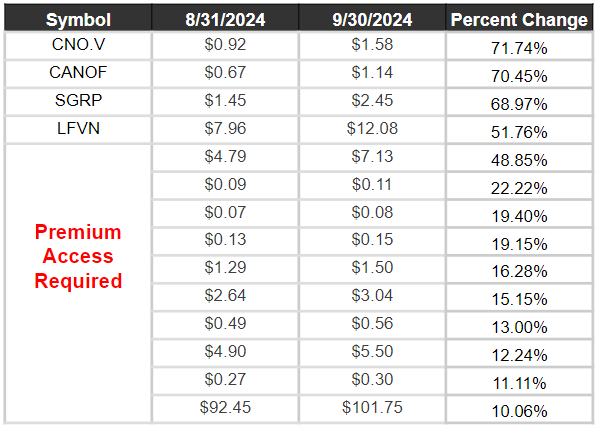

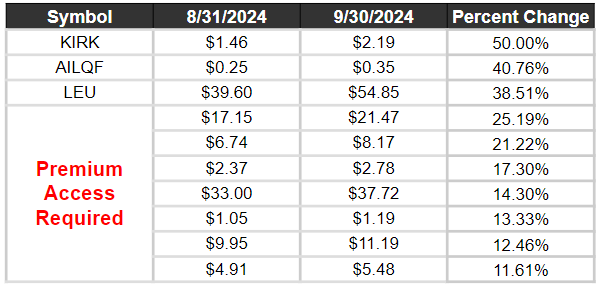

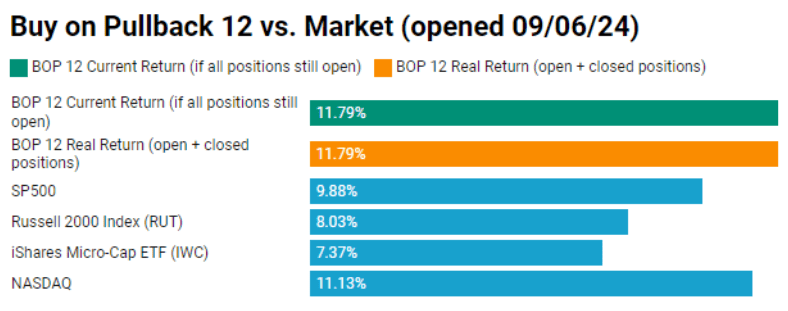

Top Performance Across All GeoInvesting Model Portfolios and Screens (In September 2024)

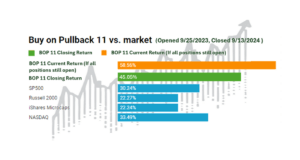

Buy on Pullback Model Portfolios are aimed at swiftly capitalizing on mispriced opportunities in the market, identifying stocks experiencing negative or muted reactions to positive news or downside overreactions to negative news that we see as temporary.

Misunderstood company developments, emotions, or negative market sentiment can often be at the core of the mispricing, so the pullbacks often stem from investor overreactions and may not necessarily reflect the underlying fundamentals of the business.

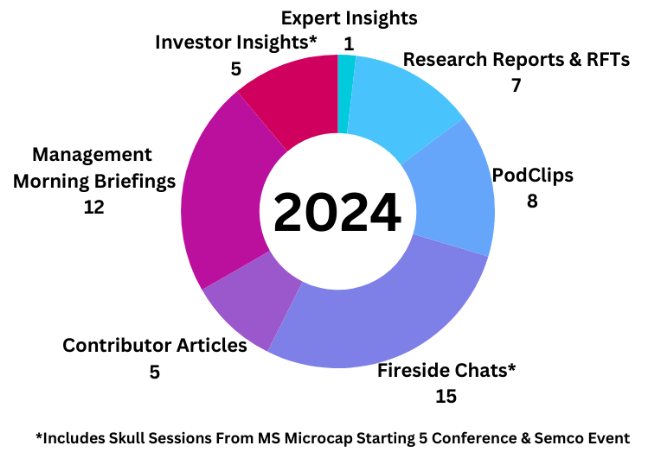

Please also note that year to date, we’ve published 205 video clips parsed from Investor Insights, Fireside Chats, Management Morning Briefings and Expert Insights.

So far in 2024, apart from daily emails and weekly GeoWire Content, we have published a combined 258 pieces of Premium content (including video clips) across the segments detailed in the appendix.

As a reminder, in 2023 we published a combined 329 pieces of Premium content across GeoInvesting’s platform.

To see more details on 2023 and 2024 year to date earnings, please go here.

Earnings Processed, YTD to September 2024

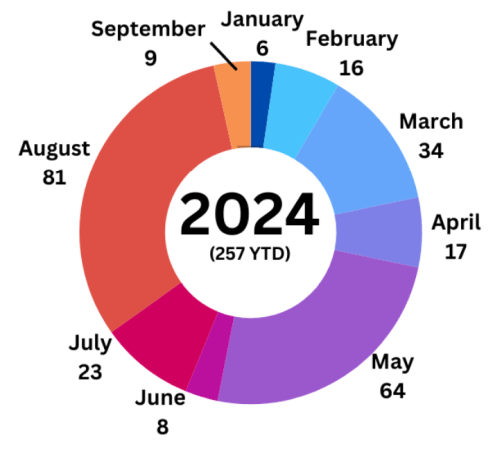

Earnings season took a respite in September as we began preparing for Q3 reports. We processed 9 reports in September 2024, bringing our full year total to 257.

Content Distribution Key

Written

5 Research Report & “Reasons For Tracking” (RFT) pieces: Articles are in-depth stock analysis columns focusing on qualitative and quantitative aspects of stocks, while RFTs are shorter, concise research on stock ideas. Learn more about our services.

5 Contributor Articles – Investors we invite to publish their analyses on microcap stocks as well as market forces and industry trends that impact the world of microcap investing.

Audio

7 PodClips – Audio clips consisting of quick “hot take” follow-ups to management interviews, brainstorms on a new stock idea and updates on current ideas.

2 Skull Session Expert Insights (via Twitter Spaces) (NEW) – Recorded and live podcasts that feature conversations with industry experts.

Video

7 Skull Session Fireside Chats – Live/archived video events with management to discuss a company’s entire business plan, growth initiatives and risk factors.

5 Skull Session Management Morning Briefings (MMBs) – Live/archived update video events with management to discuss key developments.

3 Skull Session Investor Insights (picking up the pace here) – Recorded and live podcasts that feature conversations with Investors we invite to provide a look at their stock picking research process, market commentary and their favorite stock pitches.

2 Skull Session Expert Insights (via Video) – Recorded and live podcasts that feature conversations with industry experts.

104 Video Clips across all Live Events (Not represented in Chart) – Catch a quick glimpse of some of the more notable clips/key takeaways that are extracted from our Skull Sessions (Fireside Chats, Management Briefings, Twitter Spaces, Expert & Investor Insights, & Forums), then highlighted on our Weekly/Monthly GeoWire Newsletters. We archive all of this material on the video menu section of our Pro Portal.

The post GeoWire Monthly, Vol. 4, Issue No. 9, September 2024 Review appeared first on GeoInvesting.

Source: https://geoinvesting.com/geowire-monthly-vol-4-issue-no-9-september-2024-review/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.