Does ESG Investing Deliver Better Returns?

Are publicly-traded companies that incorporate practices favored by social and environmental issue advocates into their business models better for investors? Or rather, can you make more money by investing in these companies than in companies that place less emphasis on these issues?

These are not small questions. Whether it’s your investment portfolion that may have thousands of dollars at stake or the entire global economy that boosts the money at stake up into the trillions, the answers matter.

Over a decade ago, Robert G. Eccles, Ioannis Ioannou, and George Serafeim provided the strongest academic endorsement of what has come to be known as Environmental, Social, Governance management policies, or ESG, for publicly-traded corporations. They claimed their research proved firms that had incorporated policies favored by environmental and social issue advocates into their governance structures, including in their business models and daily operations, financially outperformed firms that had not.

They described their approach and findings in the abstract of their 2014 paper.

We investigate the effect of corporate sustainability on organizational processes and performance. Using a matched sample of 180 US companies, we find that corporations that voluntarily adopted sustainabilitypolicies by 1993 – termed as High Sustainability companies – exhibit by 2009, distinct organizational processes compared to a matched sample of firms that adopted almost none of these policies – termed as Low Sustainability companies. We find that the boards of directors of these companies are more likely to be formally responsible for sustainability and top executive compensation incentives are more likely to be a function of sustainability metrics. Moreover, High Sustainability companies are more likely to have established processes for stakeholder engagement, to be more long-term oriented, and to exhibit higher measurement and disclosure of nonfinancial information. Finally, we provide evidence that High Sustainability companies significantly outperform their counterparts over the long-term, both in terms of stock market as well as accounting performance.

Here are the two figures they put forward to illustrate their claim that ESG-practicing firms had delivered better results for investors from 1992 through 2010:

Here is their discussion of what the two charts show (boldface emphasis ours):

Figure 1 (2) shows the cumulative stock market performance of value-weighted (equal-weighted) portfolios for the two groups. Both figures document that firms in the High Sustainability group significantly outperform firms in the Low Sustainability group. Investing $1 in the beginning of 1993 in a value-weighted (equal-weighted) portfolio of High Sustainability firms would have grown to $22.6 ($14.3) by the end of 2010. In contrast, investing $1 in the beginning of 1993 in a value-weighted (equal-weighted) portfolio of control firms would have only grown to $15.4 ($11.7) by the end of 2010. Table 7 presents estimates from a four-factor model that controls for the market, size, book-to-market, and momentum factors. We find that both portfolios exhibit statistically significant positive abnormal performance relative to the market. However, we note that this might be because for both samples we have chosen companies that survived and operated throughout the early 1990s and until the late 2000s.

The better performance of the firms in both samples compared to the rest of the market may be attributed, to a considerable extent, to this survivorship bias. However, the relative performance difference between the two groups is not affected by this bias since both groups are equally likely to have survived, by construction of our sample. Accordingly, we find that the annual abnormal performance is higher for the High Sustainability group compared to the Low Sustainability group by 4.8% (significant at less than 5% level) on a value-weighted base and by 2.3% (significant at less than 10% level) on an equal-weighted base.

Those are pretty impressive results. And given the stakes, it’s no wonder why the paper has received considerable attention on both Wall Street and Capitol Hill, where its findings have influenced both investing strategies and public policy.

There is just one problem. When another economist finally got around to attempting to replicate Eccles, Ioannou, and Serafeim results, they found those results and their methods came up short on multiple levels.

In a newly published paper, Andrew King found he could not duplicate Eccles, Ioannou, and Serareim’s findings with the information they published. King also found he could not obtain similar results by replicating their methods in a new study.

For our purposes, we’ll focus on the findings that so-called “High Sustainability” (HS) firms delivered better investment returns than “Low Sustainability” (LS) firms. King ran 1,600 scenarios with 400 pairs of HS and LS portfolios to compare their returns. Here are those findings and charts (boldface emphasis ours):

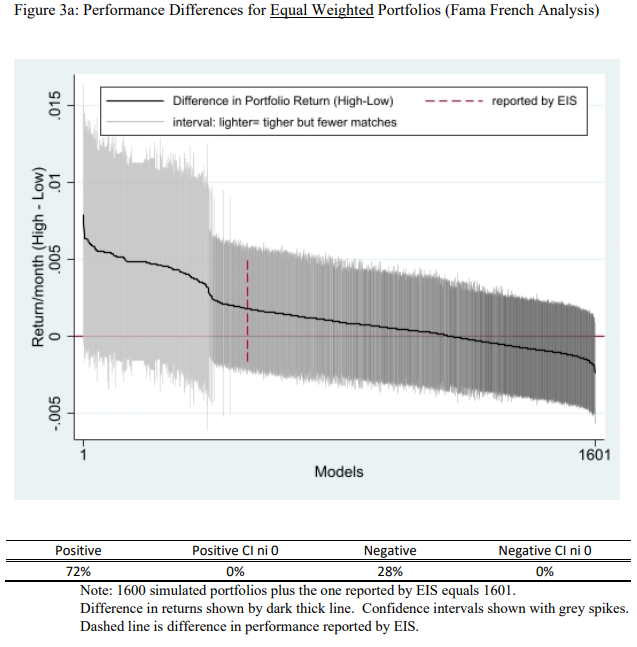

For each of 1600 cases (400 draws X 4 caliper settings), I compared the difference in stock returns for the HS and LS portfolios using the same Fama French model employed by EIS. Figure 3a shows a graph of the performance difference of the two portfolios for each modeled case, sorted by the difference in portfolio performance – from largest positive difference to largest negative difference. The black line is the estimated difference in portfolio returns, and the grey spikes show the 95% confidence interval. Darker spikes indicate portfolios using less stringent matching criteria but including more firms (thus they also have smaller confidence intervals). The bold dashed line shows the estimate reported by EIS. The overlap of its confidence interval with zero demonstrates again that it does not meet traditional requirements for significance.

Across the 1600 runs, 72% estimate a higher return for the High Sustainability Portfolio, but the high variance in all of these estimates mean that all confidence intervals include zero. This means that had any researcher chosen to evaluate one of these 400 pairs of portfolios, they would not have been able to report a “significant” estimate of performance difference.

EIS report that they also compared returns from value-weighted portfolios. They do not disclose their process, but such weighting usually means that investments in the portfolio are rebalanced at the beginning of each year to be proportional to the market capitalization of the firms. I recalculated portfolios for all 1600 cases using this value-weighting method and reran the Fama French analysis.

As shown in Figure 3b, 78.5% of my models result in an estimate where the High Sustainability portfolio has higher returns. However, none of these estimates can be confidently differentiated from zero. Moreover, portfolios with a smaller number of matched firms (lighter interval lines) dominate the extremes of the estimates. This is unsurprising given the higher variance caused by smaller portfolio size.

EIS’s reported estimate is near the extreme. Only five of my portfolios result in return differences larger than the one reported by EIS, and these portfolios have 9 or 10 treated firms not 90. For none of the 5 is the difference in portfolio performance “statistically significant.” Thus, EIS’s one report of significant superior performance for HS firms is an extreme outlier in my replication.

The ball is now back in Robert G. Eccles’, Ioannis Ioannou’s, and George Serafeim’s court to back up their claim of financial outpeformance for firms that follow the ESG playbook in their business practices. As it stands, the failure of their results to be successfully replicated raises serious questions about both those results and their methods.

References

Eccles, Robert G. and Ioannou, Ioannis and Serafeim, George, The Impact of Corporate Sustainability on Organizational Processes and Performance (December 23, 2014). Management Science, Volume 60, Issue 11, pp. 2835-2857. February 2014. DOI: 10.2139/ssrn.1964011.

King, Andrew A., Comment and Replication: The Impact of Corporate Sustainability on Organizational Processes and Performance (November 29, 2023). DOI: 10.2139/ssrn.4648438Z.

Image Credit: Microsoft Bing Image Generator. Prompt: “Environment Social Governance for a corporation”.

Source: https://politicalcalculations.blogspot.com/2024/02/does-esg-investing-deliver-better.html

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).