Buffett To Step Down As Berkshire CEO At Year-End As Cash Hoard Hits Record $348 BIllion

It’s the end of an era at America’s largest hedge fund/private equity/insurance float-cum-rollup conglomerate, whatever you want to call it: Warren Buffett just announced during the Berkshire annual pilgrimage to Omaha that he is stepping down as CEO of Berkshire at the end of the year, and that Greg Abel, the vice chairman for non-insurance operations who has been groomed over the past decade for just this moment, will take over the conglomerate. The news was greeted with a standing ovation by the thousands of Berkshire shareholders who were present at Omaha’s Convention Center.

I’m not crying; you’re crying.

No standing ovation has ever been more well-earned… pic.twitter.com/9xfgoLezKZ

— Compound248

(@compound248) May 3, 2025

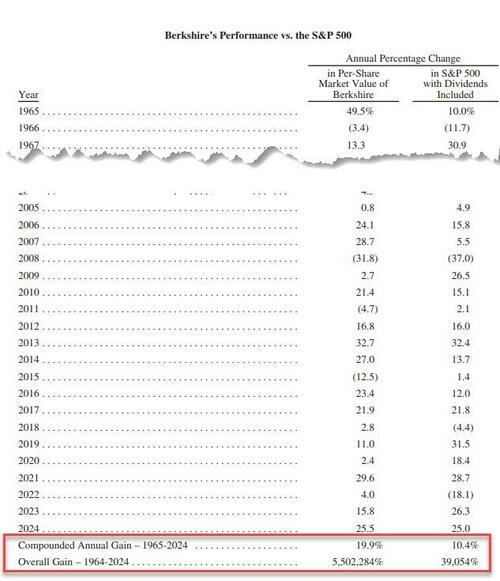

Buffett – whose track record cemented him, along his long-time sidesick Charlie Munger, into a celebrity billionaire renowned for his investing acumen and witticisms – built Berkshire Hathaway into a business valued at more than $1.16 trillion, generating compounded annual returns to shareholders at double the rate of the S&P (19.9% vs 10.4%), since 1965, and a staggering 5,502,482% overall gain on BRK stocks since 1964, vs “only” 39,054% for the S&P. His investing success gave him the power to move stocks and helped him strike lucrative deals with Goldman Sachs and General Electric during times of crisis.

The announcement stunned the board and even Abel, who, while long signaled as Buffett’s successor, was unaware that the news was coming as the annual meeting drew to a close.

“That’s the news hook for the day,” Buffett said. “Thanks for coming.”

Berkshire grew aggressively over the decades with Buffett as chairman and CEO, as he chose acquisitions and stocks for the company portfolio alongside trusted adviser and vice chairman, Charlie Munger, who died in 2023 at 99. As Bloomberg notes, “the conglomerate acquired a bewildering assortment of businesses, which Buffett often said mirrored the US economy as a whole. A bet on Berkshire, he said, was a bet on America.”

Buffett started managing money when he was young, a disciple of Benjamin Graham’s investing style. He moved more into the corporate world when his Buffett Partnership Ltd. bought shares of Berkshire. In 1965, he took control of the rest of the business.

Composed mostly of struggling textile operations that would eventually fade away, Berkshire became the foundation for Buffett’s modern-day giant. Piece by piece, he built and acquired operations into a varied set of industries, including insurance — which gave him cash, or “float” — to help his investing strategy.

Now, Berkshire owns businesses ranging from railroad BNSF to auto insurer Geico, sprawling energy operations, and even retailers such as Dairy Queen and See’s Candies. Its collection of companies generated $47.4 billion of annual operating earnings in 2024. Buffett also built up the stock portfolio — populating it with giant bets on the likes of Apple Inc. and American Express — and offering Berkshire another way to participate in the gains of businesses that it didn’t fully own.

* * *

Ahead of today’s annual meeting with Berkshire’s faithful, the company reported Q1 results that showed a steep drop in operating earnings from the year-earlier period: operating earnings, which include the conglomerate’s fully owned insurance and railroad businesses, fell 14% to $9.64 billion during the first three months of the year. In the first quarter of 2024, they totaled $11.22 billion. On per share basis, operating earnings were $4.47 last quarter, down from $5.20 a year ago, and below the $4.72 consensus forecast.

Much of the company’s decline was driven by a 48.6% plunge in insurance-underwriting profit, which came in at $1.34 billion for the first quarter, down from $2.60 billion a year prior, and was mostly due to the Southern California wildfires which led to a $1.1 billion loss in Q1.

Berkshire’s bottom line also took a hit from the dollar losing value in the first quarter. The company said it suffered an approximate $713 million loss related to foreign exchange. This time last year, it benefited from a $597 million forex gain. The dollar index fell nearly 4% in the first quarter. Against the Japanese yen, it lost 4.6%.

The company’s overall earnings plunged nearly 64% year over year, as Buffett’s portfolio of publicly traded names took a hit to start the year. As is well-known, Berkshire always advises investors to look past these quarterly changes: “The amount of investment gains (losses) in any given quarter is usually meaningless and delivers figures for net earnings per share that can be extremely misleading to investors who have little or no knowledge of accounting rules,” Berkshire’s release said.

Berkshire said Donald Trump’s tariffs and other geopolitical risks created an uncertain environment for the conglomerate, owner of BNSF railway, Brooks Running and Geico insurance. While the firm said it’s not able to predict any potential impact from tariffs at this time, it warned that tariffs may further hit profits.

“Our periodic operating results may be affected in future periods by impacts of ongoing macroeconomic and geopolitical events, as well as changes in industry or company-specific factors or events,” Berkshire said in the earnings report. “The pace of changes in these events, including international trade policies and tariffs, has accelerated in 2025. Considerable uncertainty remains as to the ultimate outcome of these events. We are currently unable to reliably predict the potential impact on our businesses, whether through changes in product costs, supply chain costs and efficiency, and customer demand for our products and services” it said.

During the annual meeting, Buffett also addressed Trump’s tariff policies at the company’s annual meeting in Omaha, saying trade “should not be a weapon.”

“You can make some very good arguments for the fact that balanced trade is good for the world,” Buffett said in response to a question about trade barriers. “There is no question that trade can be an act of war.” He added that the US “should be looking to trade with the rest of the world.” Which, obviously is what Trump is trying to do, just on far better terms than effete US leadership had accepted gradually over the past few decades.

“Balanced trade is good for the world. And the more balanced that trade is, the better.”

– Warren Buffett…

…distinguishing between his idea for Import Certificates vs standard Tariffs, which he believes can be destabilizing and war-like antagonism. pic.twitter.com/DFWPPGoORz

— Compound248

(@compound248) May 3, 2025

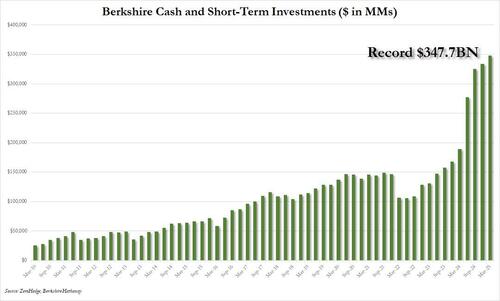

Continuing a familiar trend, in the first quarter, Berkshire’s cash hoard ballooned to a fresh record, rising to more than $347 billion from around $334 billion at the end of 2024, as the company now holds a record $305.5 billion in Treasury Bills, which to CNBC showed “that Buffett did not use the first-quarter drop in the stock market to deploy the money.” Which, of course, was to be expected since the stock market dropped sharply only at the start of the second quarter.

Buffett on markets, cash, portfolio management, and opportunism.

“ I wouldn’t do anything nearly so noble as to withhold investing myself just so Greg can look good later on.”

– Warren Buffett…

…on the conspiracy that he’s built $330 billion of cash to give a blank sheet… pic.twitter.com/Bty6OdP5Qs

— Compound248

(@compound248) May 3, 2025

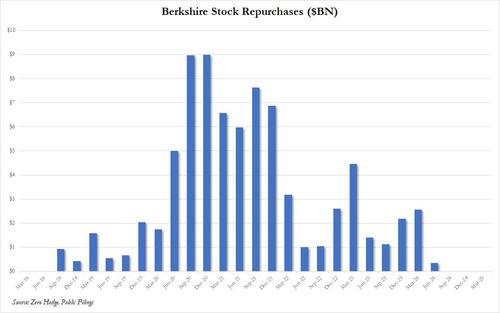

During the pandemic, Buffett was stymied on the dealmaking front due to high valuations for good businesses, leaving a swollen cash pile and few attractive opportunities to put money to work. Instead of deals, Buffett aggressively leaned into share buybacks to deploy capital, though he broke with that trend by completing a $11.6 billion acquisition of Alleghany Corp. in 2022.

Last year, he decried a lack of meaningful deals that would give the firm a shot at “eye-popping performance” as Berkshire’s cash pile hit yet another record. The few US companies capable of moving the needle at Berkshire had already been “endlessly picked over by us and by others,” he said. Since then, as the billionaire cut his stakes in Apple and Bank of America while refraining from making major deals, Berkshire’s cash pile kept piling up, reaching $347.7 billion as of March 31.

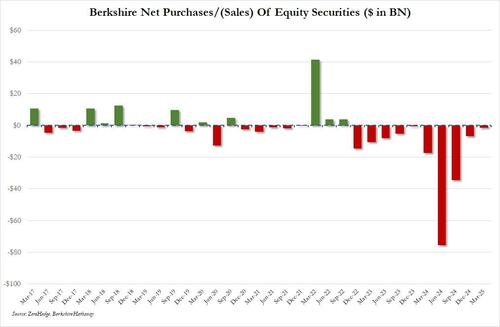

Meanwhile, Berkshire continued to be a net seller of stocks for a 10th quarter in a row, although at a far slower pace, selling just a net $1.5BN in stocks, down sharply from the $6.7BN in Q4 and from the record $75.5BN in Q2 2024.

The report comes as Berkshire enjoys a stellar year-to-date performance, while the broader market languishes. In 2025, Class A shares of Berkshire are up nearly 19%, while the S&P 500 is down 3.3% as uncertainty from tariffs pressures tech and other sectors. Not surprisingly, with the stock surging to a new all time high, for the third quarter in a row, Berkshire did not repurchase any of its own stock.

Despite Buffett’s large following, his day-to-day management of Berkshire was simple. He long favored a decentralized management approach, allowing the heads of Berkshire’s various businesses to run the operations how they deemed fit and checking in on the operations every now and then.

Buffett considered one of his more important roles to be a capital allocator for Berkshire, figuring out where the money should go, and reportedly spent a lot of time reading in his corporate office in Omaha. That office had just 27 employees as of last year.

“Buffett’s decision to limit his activities to a few kinds and to maximize his attention to them, and to keep doing so for 50 years, was a lollapalooza,” Munger said in an annual letter. “Buffett succeeded for the same reason Roger Federer became good at tennis.”

Tyler Durden Sat, 05/03/2025 – 15:45

Source: https://freedombunker.com/2025/05/03/buffett-to-step-down-as-berkshire-ceo-at-year-end-as-cash-hoard-hits-record-348-billion/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.