Walmart Beats, Lifts Outlook For 3rd Time As Increasingly More Wealthy Americans Trade Down To Big Box Retailer

At a time when the US consumer is cracking under the weight of record credit card debt as personal savings slide to all time lows (at least until the Biden admin revises them higher just because) in a futile scramble to keep up with rising prices, Walmart can seemingly do no wrong and this morning the company unofficially ended Q3 earnings season when it not only reported earnings that beat across the board, but also raised its guidance for the third time in a row.

- Adjusted EPS 58c, beating estimate 53c, but the lowest since Q3 2023

- Revenue $169.59 billion, +5.5% y/y, beating estimates of $167.49 billion, and net of $1.2 billion negative FX impact

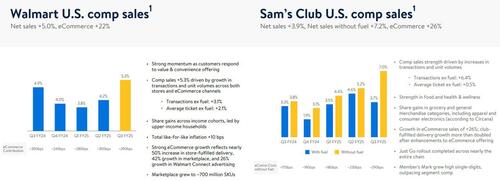

- Total US comparable sales ex-gas +5.5%, beating estimates of +3.8%

- Walmart-only US stores comparable sales ex-gas +5.3%, beating estimates of +3.73%

- Sam’s Club US comparable sales ex-gas +7%, beating estimates of +4.22%

- Operating income %5.4 billion, up 9.1%, and “reflects gross margin expansion, improved eCommerce losses and higher Walmart+ membership income, partially offset by expense deleverage”

- Gross profit 24.2%, down from 24.4%, and reflects “improved inventory management, continuing to manage pricing aligned to competitive price gaps and improved eCommerce margins”

- Operating cash flow $22.9BN, up $3.9BN YoY “due an increase in cash provided by operating income and lapping the payment of accrued opioid legal charges in the prior period, partially offset by increased inventory purchases”

- Free cash flow was $6.2BN, up 1.9%BN YoY “due to the increase in operating cash flow, partially offset by an increase of $2.0 billion in capital expenditures to support strategic investments“

In Q3, the company returned $2.7BN to shareholders: of this $1.7BN was dividends and $1.0 billion was stock repurchases representing 12.6 million shares, at an average price of $77.57 per share and leaving $13.5BN remaining under the share repurchase authorization.

The quarter in charts:

Remarkably, the gross profit rate at Walmart US rose 42bps. This was due to:

- Strong inventory management and lower markdowns as well as managing pricing to maintain competitive price gaps to the retail market

- Advertising and data analytics & insights businesses benefited business mix

- Net delivery cost per order decreased ~40%, the third consecutive quarter of 40% improvement; benefited eCommerce margins

- Offset by product mix headwinds as grocery and health & wellness sales outgrew gen merch

Also notable that WMT’s inventory declined in the quarter, dropping 0.6%, thanks to “disciplined inventory management while sustaining strong in-stock levels.”

While average transaction growth slowed, customers are buying more at each visit, driving ticket sizes. A lot of that growth was driven by upper-income households making $100,000 a year or more as increasingly more affluent households trade down. That cohort made up roughly 75% of share gains for the quarter.

Across the board, shoppers are being selective, but Chief Financial Officer John David Rainey said they’re continuing to spend money at a consistent clip.

“In these seasonal moments when people want to celebrate, they are spending into that,” Rainey said in an interview with Bloomberg on Tuesday. And yes, people now “celebrate” by shopping at Walmart.

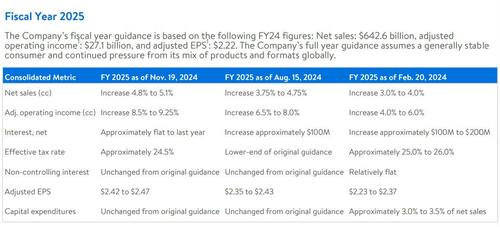

Even more remarkable than the solid quarter, was the company’s latest guidance boost. This is what WMT now sees for FY 2025:

- Adjusted EPS $2.42 to $2.47, up from $2.35 to $2.43 on Aug 15, in line with the consensus estimate of $2.45, and up from $2.23 to $2.37 on Feb 2024

- Net sales +4.8% to +5.1%, up from +3.75% to +4.75% on Aug 15, and up from 3.0% to 4.0% on Feb 2024.

- Company sees year adj. operating income growing 8.5%-9.25%, up from 6.5% to 8.0% on Aug 15 and up from 4.0% to 6.0% on Feb 20

Rainey said Walmart’s higher full-year guidance primarily reflects strong third-quarter performance and that he expects a slight uptick in the ongoing quarter.

The company’s investments in e-commerce are also lifting sales. Walmart began selling pre-owned watches and collectible sneakers online in recent months, and added a new benefit for Walmart+ loyalty members: discounts on Burger King meals. Walmart’s online sales now represent about 18% of the company’s business.

Walmart is among the first big retailers to report earnings ahead of the all-important holiday period, which is shorter this year due to Thanksgiving falling later in November. The retailer moved up Thanksgiving deals by a few weeks, in hopes of luring consumers feeling pinched by high inflation and distracted by a turbulent election season.

So far, CFO Rainey said items like AirPods, televisions and tires are selling well.

In recent quarters, most retailers have pointed to a US consumer who remains cautious about macroeconomic uncertainties. Indeed, most shoppers have pulled back following years of inflation and high interest rates, especially walking away from appliances, clothes and other non-essential items. In fact, if it wasn’t for rich consumers trading down to Walmart, the picture would have been far uglier.

One potential red flag for Walmart is the thread of sharply higher prices from China. Donald Trump has promised to impose a 60% tariff on goods imported from China and as much as 20% on items from other countries, which could lead to possible price hikes. That said, Walmart’s price changes were roughly flat for the quarter. Grocery prices are slightly higher than they were last year, though other consumer products are cheaper. Rainey said clothing sales have been softer partly because of warm weather.

The company’s shares are up nearly 60% year-to-date, far outpacing the S&P 500 Index. But investors’ bar is getting higher for Walmart, which has beat Wall Street forecasts for comparable sales all year.

WMT stock gained 3% in early trading, trading at a new all time high.

Here is the full Q3 investor presentation

Tyler Durden Tue, 11/19/2024 – 09:33

Source: https://freedombunker.com/2024/11/19/walmart-beats-lifts-outlook-for-3rd-time-as-increasingly-more-wealthy-americans-trade-down-to-big-box-retailer/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.