Three Unusual Inflation Hedges

This post Three Unusual Inflation Hedges appeared first on Daily Reckoning.

As we float in the trough following the first wave of inflation, bracing for the next, it seems an excellent time to review a few alternative inflation hedges.

Today we’ll examine the benefits of owning firearms, farmland, and fixed-rate mortgages during inflationary periods. Let’s get started.

Inflation Hedge No. 1: Firearms

I’ve honed my “firearms as a hedge” pitch to perfection. I’ve found that it works fairly well on skeptical wives when one needs to justify certain purchases.

But it’s also real. High-quality firearms tend to hold their value remarkably over time. As long as they are properly stored and maintained, firearms tend to keep pace with inflation.

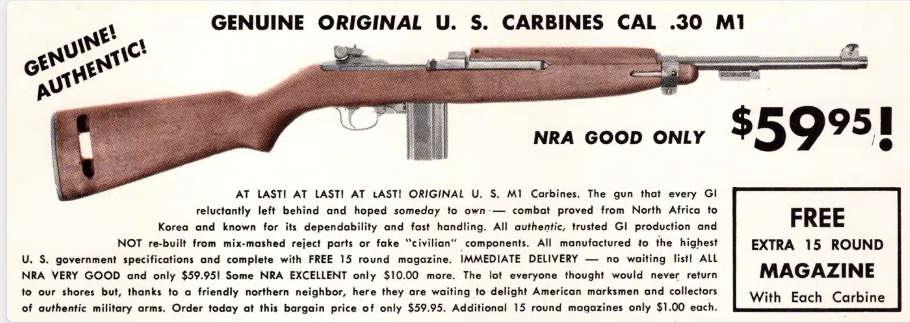

Source: The Armory Life

The drool-inducing ad above, from 1965, offered surplus US M1 carbines for just $59.95. Today, similar weapons in great condition can cost upwards of $4,000.

Despite this impressive example, firearms shouldn’t be classified as investments per se. Over time they will almost certainly be outperformed by quality stocks. But they shouldn’t lose much, if any value either.

Plus, there are intangible benefits to owning firearms. First, shooting and collecting guns is an enjoyable hobby.

They also provide excellent personal defense value and peace of mind.

Firearms can be viewed as inflation-resistant assets with additional benefits. A sort of insurance policy that holds its value extremely well.

The bottom line: if you ever truly need them, firearms will provide a world-beating ROI.

Inflation Hedge No. 2: Farmland

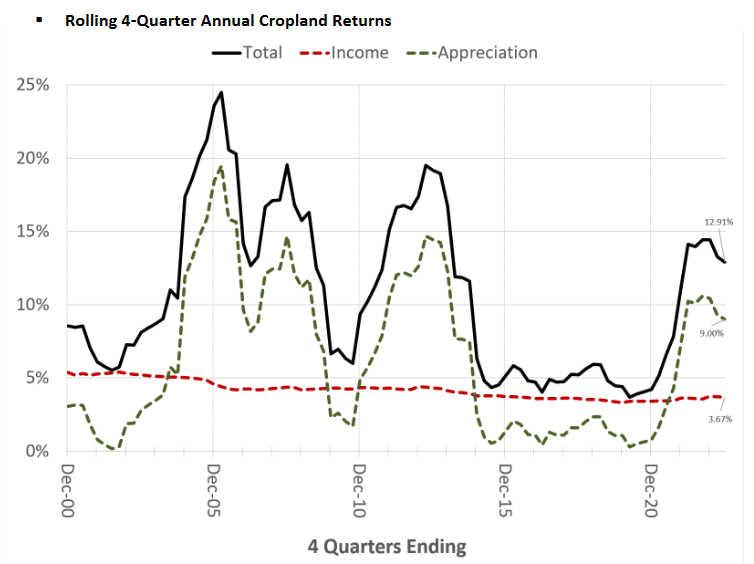

The National Council of Real Estate Investment Fiduciaries (NCREIF) publishes fascinating data on farmland investment returns. Here’s one chart from a recent report.

Source: NCREIF

The chart shows annual returns from 2000 through Q3 of 2023. They break down the returns into income and land appreciation. It’s a fascinating report, and I recommend taking a look if this area interests you.

Annual returns on farmland can range from 3-20% annually. On average the income tends to be steady at around 4-5% a year. Still, real estate value appreciation is where you can make major returns during inflationary periods (as shown in the chart above by the dotted line).

Of course, you could just buy a farm. But that is far from a passive investment. Fortunately, there are also several publicly traded farmland investments.

One that looks interesting is Farmland Partners Inc. (NYSE: FPI). It’s a REIT that owns farms and makes loans to farmers (note: I don’t own FPI and haven’t done diligence on it – just using it as an example).

Inflation Hedge No. 3: Fixed-Rate Mortgages

Everybody knows real estate makes a great inflation hedge. But one of the primary reasons why is the way in which mortgage loans are structured and treated for tax purposes (in the US at least).

A fixed-rate mortgage is an excellent inflation hedge. Anyone with a low-interest loan on residential real estate is set to benefit massively when inflation rears its ugly head again.

Needless to say, you need to be able to service the payments comfortably. Getting over-leveraged in the real estate market is a risky endeavor indeed. As we learned in 2007, prices do crash every so often.

But responsible use of cheap debt in inflationary times is almost a cheat code. And when you add in the benefit of writing off interest expenses, it’s no wonder that mortgages are so popular.

So if you’re thinking about paying off a house with a low-rate mortgage, there are probably better investment options (gold and silver, for example).

Unfortunately, this really only applies to existing low-rate loans. In today’s environment, with high prices and 7%+ mortgage rates, the math doesn’t work so well going forward.

However, if the Fed is forced to start buying mortgage bonds again in the future, we could see another opportunity to lock in cheap debt and refinance. That would be quite the opportunity if we get it.

I’ll keep an eye out.

The post Three Unusual Inflation Hedges appeared first on Daily Reckoning.

This story originally appeared in the Daily Reckoning

Source: https://dailyreckoning.com/three-unusual-inflation-hedges/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.